For Cable Operators, Wireless Gets Real

Q4 performance shows product becoming legitimate revenue, profit center

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Cable wireless service, initially believed to be a retention tool for broadband, is quickly becoming a revenue and profit center in its own right. Some analysts see it as an important part of the overall cable revenue mix, especially as traffic from telco partners is unloaded onto the network.

Since launching their respective wireless offerings in 2017 and 2018, both Comcast and Charter Communications have amassed a collective 7.6 million wireless customers, and growth rates keep rising. In Q4, both Comcast and Charter reported their best quarterly subscriber growth ever. As expansion continues into more rural areas through edge-outs, fiber extensions and federal programs, that pace isn’t expected to slow anytime soon. This should come as good news for investors, who have seen the companies’ respective stock prices slip amid fears of slowing broadband growth.

In a research report, MoffettNathanson senior analyst Craig Moffett wrote that wireless is quickly becoming a profitable business for cable operators and before long the business will be a meaningful profit center.

According to Charter, the mobile business had negative earnings before interest, taxes, depreciation and amortization (EBITDA) of $92 million in Q4. For the year, EBITDA was negative $311 million. The deficits are getting better, though — EBITDA was negative $401 million in 2020 and negative $520 million in 2019. According to Moffett, Charter could reach EBITDA break-even this year.

That would be on a profitability path akin to its mobile virtual network operator (MVNO) partner and the largest cable operator in the country, Comcast, which already has reported four straight quarters of positive wireless EBITDA growth.

Moffett doesn’t expect wireless to replace broadband in investors’ hearts: high-speed internet remains a better business. But he does believe that investors have to stop thinking of cable as “only” a broadband provider.

A Second Stream

“Cable isn’t a broadband-only business,” Moffett wrote. “It is, as we have repeated so often over the past two decades, an infrastructure business with multiple revenue streams — residential and commercial, wired and, yes, wireless — riding on that infrastructure.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

All this is happening as the Big Three wireless companies — AT&T, Verizon Communications and T-Mobile — aggressively price their offerings to drive subscriber growth. Cable, which has avoided pricing wars in the past, has been equally aggressive, with $30 per month, per line promotions from both Comcast and Charter (for a minimum of four lines and two lines, respectively) plus device discounts.

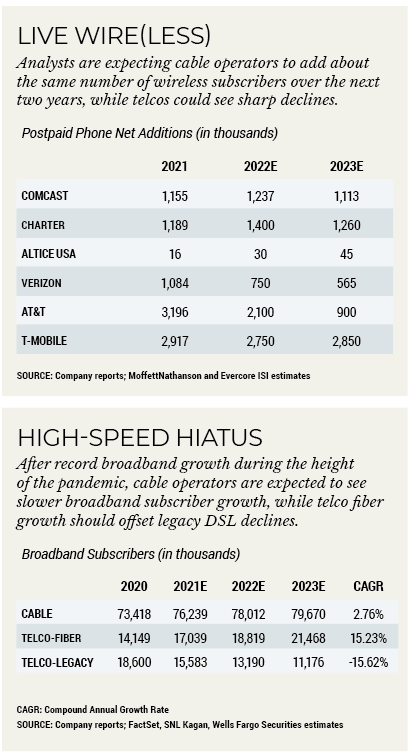

But as cable is looking toward growth, AT&T and Verizon are anticipating a slowdown in what has been a strong past two years. AT&T said in January that it expects wireless revenue to grow about 3% in 2022, down from 5% last year. Wireless EBITDA is expected to be in the low single digits in 2022, compared to 3.2% in 2021.

For Verizon, the forecast is for postpaid phone additions to slow to 1.585 million in 2022 (down 25% from 2021 additions of 2.115 million) and 1.46 million in 2023, according to Evercore ISI Group media and telecom analyst Vijay Jayant.

“While the company continues to execute well, pressure from 5G leader T-Mobile, combined with increasingly aggressive cable wireless pricing, keep us on the sidelines,” Jayant wrote.

T-Mobile postpaid phone net additions will be down about 6% in 2022 at 2.75 million, Jayant estimated, rising by 4% to 2.85 million in 2023.

While Comcast and Charter have experienced explosive growth on the wireless front, one major publicly traded operator, Altice USA, has had worse luck with mobile. But that could change soon.

Altice USA added just 5,000 wireless customers in Q4, and ended the year with about 186,000 mobile subscribers.

Altice introduced its wireless product — now branded Optimum Mobile — in 2019 at a very low price point ($20 per month) and it has lagged well behind its peers in terms of subscriber growth, revenue and profitability. After several attempts to right the ship, which stumbled in part because of its original mobile virtual network operator (MVNO) agreement with Sprint (now T-Mobile), Altice says it is back on track with wireless.

On a February 16 conference call with analysts to discuss Q4 results, Altice USA CEO Dexter Goei said churn rates have leveled off to the 30% range from previous highs of 60% to 70% and are declining monthly. And the company is close to forging a new MVNO agreement with T-Mobile, which should also help the service.

“I think we’ve been clear that wireless is very important to our strategy,” Goei said.

Altice is currently concentrating on building out its fiber network: It expects to pass about 6.5 million homes, or 60% of its footprint, with its fiber-to-the-home platform by 2025. Though broadband expansion is inherently a catalyst for mobile growth — mobile customers need to subscribe to broadband in order to get wireless service — the fiber buildout could mean Altice continues to lag behind its peers for the foreseeable future.

In a February 18 research note, Moffett reversed his outlook on Altice, downgrading the stock to “neutral” and slashing his 12-month price target on shares by more than half to $15 from $33. The primary reason for the downgrade was Moffett’s belief that Altice’s broadband turnaround is going to take at least three years. He predicted Altice would add just 9,000 subscribers in 2022 and 34,000 in 2023 and wouldn’t approach 2019 levels until 2025.

While Altice moves to turn around its broadband business, other cable operators are focusing on expanding the service into more rural areas.

Rural Opportunities

At Comcast, which has about 4 million mobile customers and nearly 32 million broadband subscribers, rural expansion is ongoing. During its fourth-quarter earnings call with analysts, Comcast Cable CEO Dave Watson said mobile and broadband growth go hand in hand.

“Our mobile is key for us, and in and of itself is a great growth opportunity, but it’s also very important to broadband,” Watson said. “We talked a lot about broadband churn benefits. That continues, but we want to bring mobile value to every segment in every offer.”

As Comcast builds out more homes to broadband, there are more opportunities to sell mobile service. “The way we look at it, every single broadband home is an opportunity,” Watson said. “And every single broadband home should have at least a couple of lines.”

Charter was one of the big winners in the federal Rural Digital Opportunity Fund (RDOF) auction, snagging about $1.2 billion in funding to help bring broadband to underserved and unserved markets. That funding will be part of the $5 billion commitment the company has made to bring broadband service to more than 1 million customer locations in unserved areas of the country over the next five years. Charter has already earmarked some early markets for the expansion. In the past two months it has launched service to nearly 3,000 unserved homes and businesses in areas of rural Kentucky, South Carolina, Michigan, Missouri and Texas. And more are to come.

Broadband expansion can only help mobile growth as customers need high-speed data service to be mobile customers. At least for now, as the pandemic has caused more and more consumers to stay put and stick with existing providers, much of Charter’s mobile growth is coming from existing broadband customers upgrading to mobile service and existing mobile customers adding lines.

Offloading Key to Growth

Charter chairman and CEO Tom Rutledge said the MSO is also making inroads at offloading mobile traffic from the MVNO to its own WiFi network, making the operation more cost-efficient. Charter also has a large block of CBRS spectrum which Rutledge said could be used to transfer as much as 30% of its mobile traffic.

“We also are already offloading enormous amounts of traffic on WiFi,” Rutledge said. “And I think that we have the ability to take that up significantly, too.”

That could be key. According to Moffett, the biggest goal for both Comcast and Charter in cable wireless is to offload as much traffic as they can onto their own networks to become both a mobile network operator (MNO) and an MVNO.

“A hybrid MNO/MVNO combines the best of all outcomes,” Moffett wrote. “They will be facilities-based where the returns are high and an MVNO in the places where the returns on building would be low. Margins will likely grow over time, but the real appeal of the strategy isn’t EBITDA margin but instead return on invested capital.” ■

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.