Xfinity Mobile to Generate $266M in EBITDA By 2023: Cowen

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Count Cowen as being particularly bullish about Comcast and Charter’s respective and fledgling consumer wireless services.

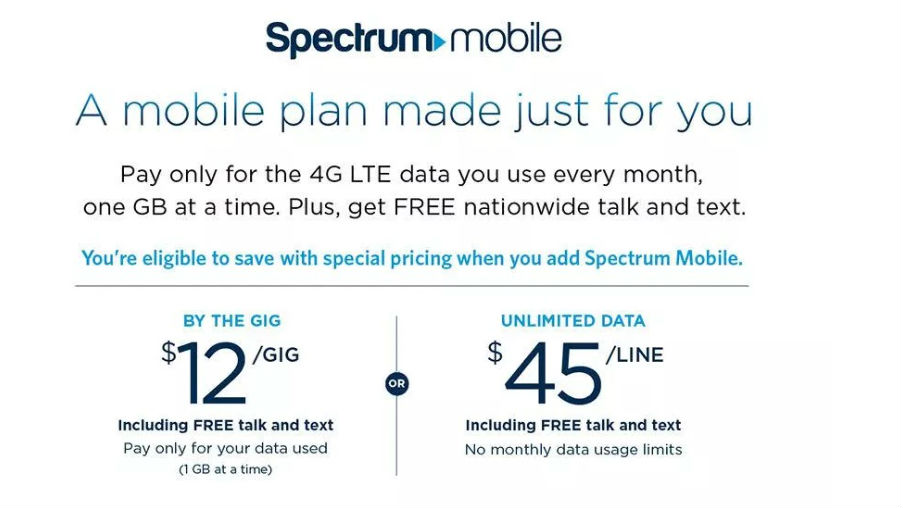

Declaring cable-wireless convergence a “‘when' and not ‘if’ story,” the equity research firm sketched out in a note to investors this morning all the different approaches the two companies could take to slowly build out their wireless infrastructure, as they continue to steadily grow the respective Xfinity Mobile and Spectrum Mobile leveraging the continuing economics of their Verizon MVNO wholesale network lease deals.

Cowen’s modeling, based on a variety of data sources, yielded some interesting snapshots and projections of the two mobile businesses.

> Comcast’s Xfinity Mobile, which currently has 1.6 million subscribers, will control around 6% of the U.S. wireless market by 2023 and generate $266 million in earnings before interest, taxes, depreciation and amortization (EBITDA), Cowen predicted.

> Charter’s Spectrum Mobile will generated $201 million in EBITDA by 2023.

> Xfinity Mobile Unlimited subscribers use, on average, 8.75 gigabytes of cellular data each month

> Comcast is currently paying $3.09 per GB of cellular data used on Verizon’s network, Cowen said.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

> Around 80% of data used on Xfinity Mobile comes over Wi-Fi.

“We believe that there is a distinct possibility that the MVNO model could be a springboard for cable to build out their own in-footprint networks,” reads the Cowen report, which was lead authored by analyst Gregory Williams. “Cable can lean on the MVNO agreement and build out at a more measured pace, deploying pockets of network, starting with the denser/urban markets with an ‘inside out’ strategy, migrating to a hybrid roaming/facilities-based model (somewhat similar to what Dish could do with New T-Mobile).

“Furthermore, cable could build an SDN/cloud-native network and leverage plant rooftops or MDU’s to deploy cheaply,” the reported added. “We especially find the Comcast set-up as compelling, acquiring 5x5 600 MHz spectrum in 72 markets. We envision Comcast cheaply deploying the 600 on head-end/plant/MDU rooftops for coverage, then add CBRS and Wi-Fi access points on poles and strand mounts for capacity, all backhauled on DOCSIS 3.1 cable plant. If Comcast links networks with Charter at some point, and/or brings Dish into the mix (depending on the T-Mobile/Sprint outcome), even better.”

Williams pointed to Altice USA, which has been steadily building out wireless network infrastructure as it launches Altice Mobile.

“We believe Comcast and Charter are looking at the Altice model, and if proven successful, could also look to migrate to an infrastructure-based strategy and lower their roaming costs,” the report said.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!