FAST Channels Quickly Find Favor With African-American Viewers

Familiar content, lean-back experience proving popular with Black adults

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Black viewers have always been at the forefront of new media consumption, and the emerging free ad-supported streaming television (FAST) environment is no exception.

As more Black viewers tune into FAST channels, though, industry observers are concerned the platform won’t keep up with an increasing demand for content that reflects the images and stories of that audience segment across all platforms. That’s because big media companies are gobbling up bandwidth by launching multiple channels based on their owned-and-operated networks and popular shows. A perception holds that independently-owned multicultural programmers might get stuck on the outside looking in.

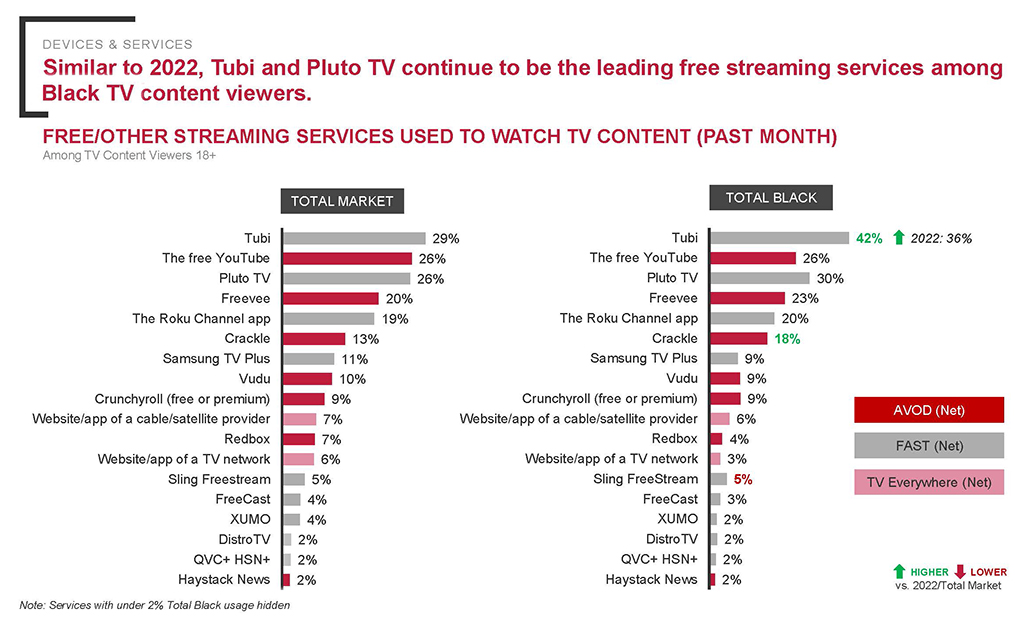

Much as Black viewers have traditionally consumed more content on linear and streaming platforms than the total viewing audience — Black viewers watched TV an averaged of 44.32 hours a week compared to 32.18 hours for the general population during Q2 2023, according to Nielsen — but they’re also more likely to watch content from FAST services than viewers overall. Some 52% of Black viewers tune into a FAST service every month, compared to 45% of total market users, according to the 2023 Horowitz Research study “FOCUS Black: State of Media, Entertainment & Tech: Viewing Behaviors.”

Only subscription video-on-demand services like Netflix and Hulu topped FAST usage among Black consumers, Horowitz reported.

“Black viewers are among the most valuable for media brands because historically they are much more likely to spend more time with media and entertainment,” Horowitz Research executive VP of insights and strategy Adrianna Waterston said. “We’re seeing a continued pattern of how valuable Black consumers are to this space. That continues to be true even in this new ecosystem that now includes FAST.”

The survey of 643 Black TV viewers 18 years and older, conducted last February, also reports that older and younger Black adults use FAST platforms almost equally. Fifty-one percent of Black adults 18-34 viewed a FAST channel at least once a month, compared to 59% of adults 25-54 and 48% of adults older than 50. Comparatively, 88% of Black adults 18-34 used a streaming service, compared to only 65% of adults over 50.

The uniqueness of FAST channels, which offer a myriad of programming choices, similar to SVOD, but provide the lean-back viewing experience of traditional cable or broadcast TV, is quickly capturing the attention of African Americans.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Television has always been about being live and ad-supported, but when streaming came it changed behaviors,” Waterston said. “But at the end of the day, we forget that television isn’t supposed to be work. It’s supposed to be entertainment, and people are getting very frustrated with the cost of streaming services.”

With streamers such as Netflix continuing to raise monthly subscription fees, the relatively inexpensive cost of accessing FAST content — free, aside from the price of a smart TV and a high-speed internet connection — makes such services appealing to Black viewers, observers said.

“You can get many FAST channels and [streaming content] apps without having to have a cable subscription,” Douglas Holloway, a cable-industry veteran and longtime senior executive at NBCUniversal, said. “In this recessionary time, you can get a relatively inexpensive smart TV with, in most cases, hundreds of FAST channels already embedded in the operating system of those sets.”

Paramount senior VP, global streaming research and insights Christian Kurz also said Pluto TV’s lean-back viewing experience — synonymous with traditional linear TV — appeals to Black audiences. “What we’re seeing is that for the Black audience, the comfort and ease of watching television is more important than for everyone else,” he said. “You don’t need to register, you don’t need to pick any show and it’s very easy to navigate.”

Pluto TV and Tubi are the two FAST services Black viewers watch most, with use within the demographic overindexing against the general market, according to Horowitz’s survey. The two services succeed by effectively curating content targeted to Black audiences, Waterston said.

Kurz pointed to the programming offered by Paramount-owned Pluto TV, with channels featuring familiar and entertaining content such as classic Black-focused movies and TV shows and branded channels from such cable networks as BET, Bounce and Aspire TV.

“We believe that our overall content mix is absolutely leaning into that familiar nature and into that easy viewing and positive content that Black audiences are looking for and craving,” Kurz said. “We are trying to engage with audiences of all forms, shapes and sizes, and this audience is certainly one that we’ve been working on.”

Even as FAST services grow in popularity among Black audiences, there’s still a paucity of services targeted specifically to the demographic. FAST channels targeted to Black audiences make up just 2% of all such channels in the U.S. at a time when Blacks represent 14% of the U.S. population, according to Ebony TV, a FAST channel venture between Ebony Media Group and Lionsgate that launched this past October and is available on Fox Corp.-owned Tubi.

Other independent Black-targeted entertainment brands, such as Revolt TV and TV One, are also featured on Tubi’s live FAST TV lineup. TV One’s move into the FAST space in 2023 with the launch of its Crime & Justice channel reaches the target audience where they are.

“We have some franchises that are extremely popular with the TV One audience, and luckily, we’re now at a point where we can make that available to people who are outside the pay ecosystem without cannibalizing the [linear] business,” Rori Peters, senior VP of content distribution & marketing at TV One & Cleo TV, said.

Shelf-Space Worries

As media companies turn to FAST channels to generate additional streaming revenue from their existing linear networks and shows, Horowitz’s Waterston is concerned that bandwidth issues will eventually shut independent, multicultural content out of the platform.

“I think the strategy that media brands are using to try to use FAST to drive engagement with their premium services is a smart one because then at least you’re keeping the viewers in your ecosystem,” Waterston said. “What remains to be seen is whether the FAST space will have room for independent, new emerging media companies trying to make a name for themselves and build an audience, or whether they’re going to get edged out by the big media conglomerates that have discovered this space.”

Another looming issue in the development of diverse FAST channels is access to bandwidth. Former NBCU executive Holloway runs a pair of ad-supported streamers in UKW Media and Urbn-TV.

“Ultimately it comes down to bandwidth allocation and the cost of developing a FAST channel, which is fairly expensive,” Holloway said.

While Pluto’s Kurz acknowledges that there is an “upper limit” of live, linear content that the distributor is keeping an eye on, it is still being aggressive in launching content that will bring in a broad cross-section of viewers.

“We’re always on the lookout for the right opportunities to broaden the appeal of the overall service,” he said. “It’s not just all content, but it’s about content that we also think is going to work for our viewers.”

R. Thomas Umstead serves as senior content producer, programming for Multichannel News, Broadcasting + Cable and Next TV. During his more than 30-year career as a print and online journalist, Umstead has written articles on a variety of subjects ranging from TV technology, marketing and sports production to content distribution and development. He has provided expert commentary on television issues and trends for such TV, print, radio and streaming outlets as Fox News, CNBC, the Today show, USA Today, The New York Times and National Public Radio. Umstead has also filmed, produced and edited more than 100 original video interviews, profiles and news reports featuring key cable television executives as well as entertainers and celebrity personalities.