Dish Wireless: Strong Stomachs Required

Analysts caution that despite AT&T deal, satellite TV provider’s wireless ambitions are still risky

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With the launch of its first wireless market — Las Vegas — fast approaching, Dish Network has made some big moves, including its recent mobile virtual network operator agreement with AT&T Wireless.

Analysts, though, are still skeptical as to how the satellite-TV provider will be able to carve out a big enough niche as the fourth player in an already crowded market.

Dish plans to launch its wireless service in Las Vegas in the fourth quarter (later than the Q3 launch originally planned) but has been preparing for this day for nearly a decade. Dish purchased its first swath of wireless spectrum, from bankrupt DBSD North America and TerreStar, for a combined $2.8 billion in 2012 and has been accumulating spectrum and striking deals ever since to lay the groundwork for what it says will be a state-of-the-art 5G offering. At a cost of about $10 billion — a figure some analysts believe is painfully low — Dish has said it expects its wireless offering to be the “5G Network of the Future.” But even as the launch date approaches, the company has been reluctant to offer too many details.

During its Q2 conference call with analysts, Dish executive VP of network development Dave Mayo, who is responsible for the wireless buildout, said that construction has begun on about 30 geographies within 36 markets in which Dish will initially offer service. The company expects to have finished construction activities in Las Vegas, the first wireless market, by the end of the third quarter, and will begin beta testing customers in Q4.

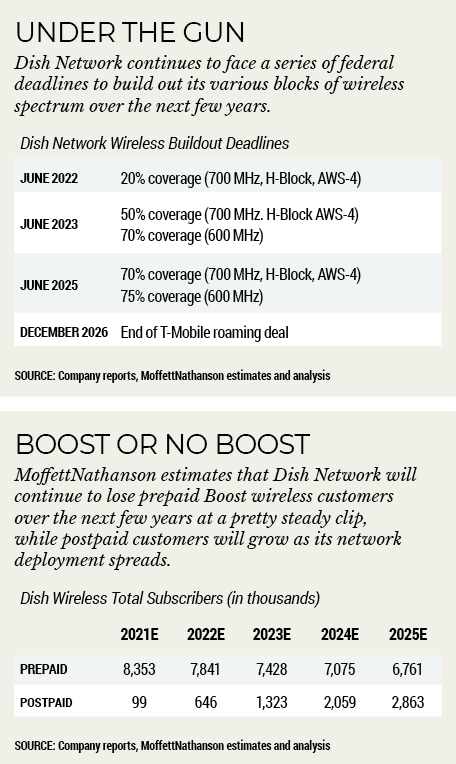

Dish is under the gun to meet several federal mandates around its wireless spectrum, and needs its network to reach 20% of the population by next June, a deadline Mayo said it is on schedule to meet. But there are other deadlines ahead.

Prepaid Biz Has Problems

Barclays media analyst Kannan Venkateshwar said in a research note that Dish “investors will need a strong stomach.” Because while Dish is gearing up for a big splash in Sin City, it continues to shed prepaid wireless subscribers (acquired through deals with T-Mobile) at an alarming rate and other recent deals don’t appear to alleviate its biggest pressures, namely federal buildout deadlines and the shutdown of T-Mobile’s 3G network in January.

Dish acquired about 9 million prepaid Boost wireless customers from T-Mobile last year, but Venkateshwar wrote that Dish has lost more than 10% of that base in the past four quarters, a slide that is expected to continue. And while its recent 10-year MVNO deal with AT&T answers the question of what Dish will do once its similar arrangement with T-Mobile expires in 2026, that won’t help Dish meet its 2023 buildout commitments.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Therefore, there doesn’t appear to be any change in Dish’s capex or opex trajectory on wireless,” Venkateshwar wrote.

And it is going to take plenty of capital to get where it wants to go.

According to Moffett, Dish’s Q2 5G network deployment capex was $200.5 million, about 4 times what it spent in the prior quarter, but that’s “just a warm-up” to what will be needed to meet FCC buildout requirements. The analyst estimated that Dish needs to spend another $1.2 billion in 2021 alone and another $1.5 billion between 2022 and 2025. While the AT&T MVNO agreement eases some of the pressure on Dish — Moffett wrote that it can now focus strictly on meeting its FCC deadlines instead of worrying about what comes after — there is still substantial spending to be done. According to Moffett’s report, Dish has commitments to spend about $6.6 billion after 2005, bringing the total to $8.8 billion on minimum payments for tower leases, network deployment and other obligations. Moffett said the figure is particularly close to the $10 billion Dish said it would spend in total on building out its wireless offering, “and they have barely started spending on the network yet.”

As far as the prepaid Boost business, most analysts expected that segment to decline over time, as customers migrated to the postpaid offering. But the decline is happening faster than expected. By 2025, Moffett expects the prepaid business to lose nearly 2 million customers, dipping from 8.4 million in 2021 to 6.7 million in 2025. Postpaid customers, which include customers acquired through the AT&T MVNO agreement and Dish’s own phone network, should grow from an estimated 99,000 in 2021 to 2.8 million in 2025, the analyst predicted.

“There was a time when most observers imagined Boost to be a bridge from an MVNO to an MNO business; Dish would build the base of subscribers as a reseller and then transition those subscribers to Dish’s own network, using the prepaid MVNO as both a source of cash but also, more importantly, as a source of subscribers with which to load the network,” Moffett wrote. “It isn’t working out that way.”

T-Mobile Shutdown Looms

Dish also has to solve another problem: T-Mobile’s plan to shut down its 3G CDMA wireless network in January. Most of Dish’s prepaid customers receive service over that network, and Dish faces substantial costs to transition those customers, including new handsets, if it can’t find a replacement. The AT&T deal won’t solve that particular issue because AT&T doesn’t have a CDMA network.

Dish has complained to the DOJ about T-Mobile’s plans to shutter the network and the agency said in July that any shutdown would be “unreasonable,” giving some hope that the 3G network will stay live. Dish still has to prepare for the worst.

“Even the possibility of a 3G shutdown by T-Mobile suggests a challenging second half,” Moffett wrote.

On the Q2 conference call, Dish chairman Charlie Ergen said T-Mobile, which received what he said was billions of dollars in synergies from its Sprint purchase last year, is acting like a “sore winner.”

“You’ve all met that guy in grade school who wants to brag about himself and brag [about] how good he was and spike the ball in front of you,” he said. “Sometimes it takes a bit of maturity to be a good winner, and they’re kind of — they’re a sore winner.”

The T-Mobile 3G situation notwithstanding, Dish also will have to deal with some macro issues as it enters the deployment stage of its wireless business. In an Aug. 24 report, Moffett noted that wireless subscriber growth, off the charts in the past 12 months, was 5 times the U.S. annual population growth rate in Q2, fueled by promotional offerings that gave new customers free equipment if they added an additional line, whether they needed it or not. Those aggressive promotions have led to big gains for all players: AT&T had its fastest subscriber additions in years, Verizon swung from customer losses to gains, T-Mobile beat and raised its guidance and cable operators have taken 30% of net additions, seemingly without affecting the competition. But Moffett wondered: what will happen when that growth fades?

Cable has made huge strides in attracting wireless customers. Comcast, Charter and Altice USA accounted for about 6.5 million lines in Q2, up from nearly 6 million in Q1 — and a big leap from just a few years ago, when the three launched wireless mainly as a broadband retention tool.

Cable’s lower prices — Comcast and Charter initially charged about $45 per month for unlimited service, compared to the $60 or more the incumbents charged — and more flexible service plans resonated with customers.

Incumbents like AT&T and T-Mobile took notice, but as they dropped their prices to gain share, Comcast followed suit, reducing unlimited Xfinity Wireless service to $30 per month, per line (for four or more lines) in May, not including taxes and fees. As the bigger players have sweetened the promotional pot with free handset deals and streaming video products like HBO Max and Netflix (a practice cable has so far avoided), the gap continues to shrink.

Now Moffett says offerings like T-Mobile’s mid-tier Magenta service, which includes three lines (the fourth line is free), a free Netflix basic standard-definition subscription and all taxes and fees for $40 per line per month, is much more competitive. AT&T’s unlimited wireless service is priced at $50 per month for four lines, but includes HBO Max (a$14.95 monthly value) and 4K streaming.

T-Mobile also is aggressively discounting on the prepaid side of the business, with promotions for Metro 5G prepaid service that include a free Samsung Galaxy A32 handset and unlimited 5G service for $25 per month, said to be half what Boost and AT&T’s Cricket prepaid service charge.

Addicted to Promos

Verizon said in July that it would stop the more aggressive discounting, but has indicated it will be as promotional as needed to maintain parity, according to Moffett. The big question is whether AT&T and T-Mobile will turn off the promotional spigot and risk losing price conscious customers, or keep them going and suffer the likely financial pain.

Moffett believes the latter scenario will prevail. “Cheap lines and free phones inevitably promote low-quality phone net additions,” Moffett wrote. “To keep those lines from churning, or to replace them when they do, the companies now dependent on promotions to bolster growth will need them even more to maintain it.”

Dish has already seen some of that happening already. In Q2, it lost about 201,000 prepaid Boost wireless phone customers, rising to 400,000 if its Q2 purchase of Republic Wireless is taken out of the mix, despite 2.3% growth for other providers in the prepaid wireless sector.

For its part, Dish hasn’t yet fully shown its hand regarding wireless. Moffett wrote after the Q2 earnings call there is still some uncertainty whether the service will be wholesale or retail, national or regional or a combination of all four. One thing is certain: Incumbents and cable operators will continue, at least for the short term, their ultra-aggressive approach to the business.

The big question is whether Dish Wireless can keep up.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.