Broadband Slowdown Will Have to Wait Another Day

Comcast, Charter report strong Q2 high-speed internet growth as analysts brace for declines

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

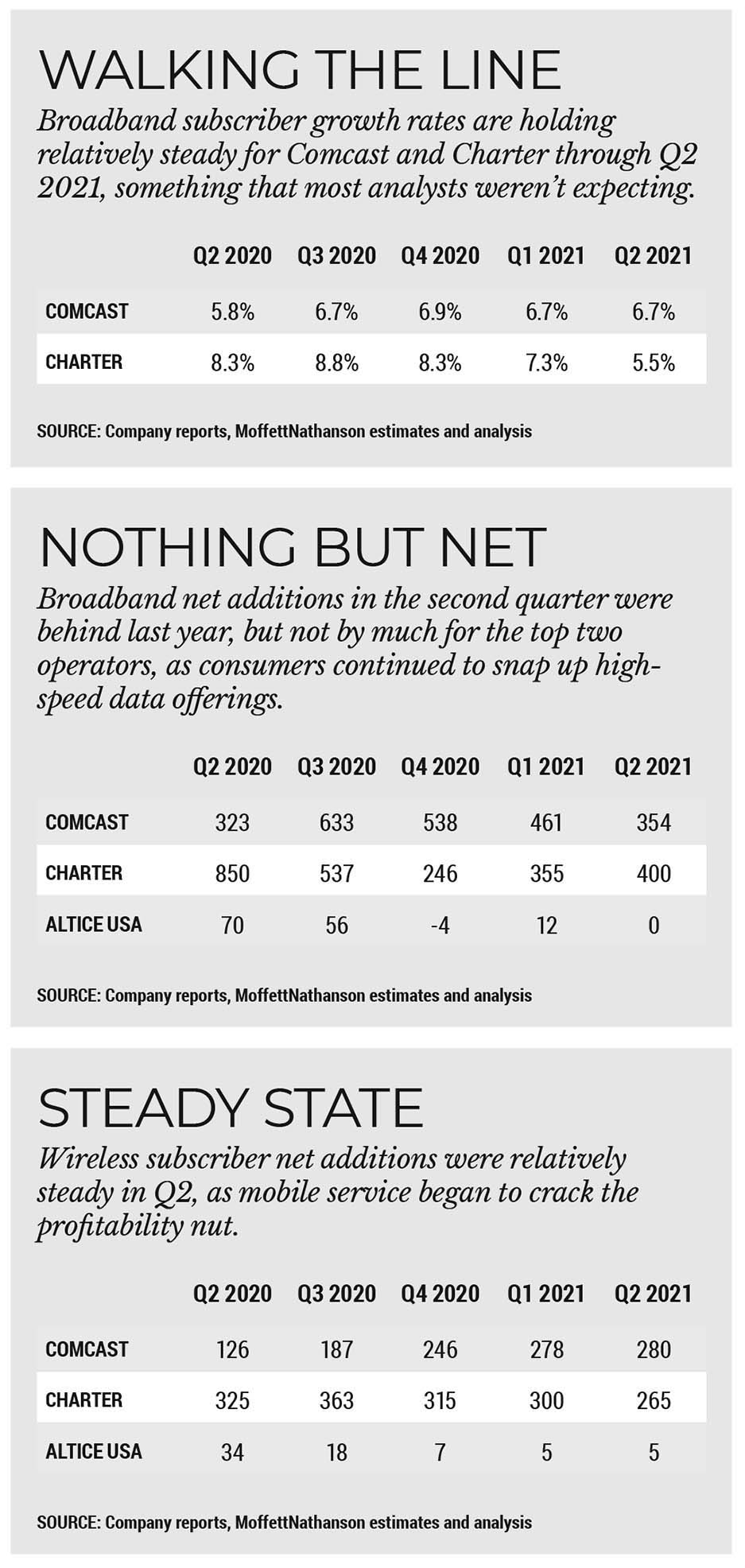

Comcast and Charter Communications once again defied the general logic, reporting stronger-than-expected Q2 broadband growth despite signs the segment was headed for an extended period of sluggishness.

That slowdown will have to wait for another day, though, as Comcast reported its strongest second quarter ever in terms of broadband growth, adding 354,000 high-speed internet customers in the period and soundly beating analysts’ consensus estimates of 270,000 additions.

Charter, which reported its Q2 results on July 30, one day after Comcast, said it added about 400,000 total broadband customers (365,000 residential and 35,000 business) in the period, outpacing consensus estimates of 275,000 total additions by 46%.

Most analysts had expected the pace of broadband additions to slow down after the industry reported its best growth ever in 2020, fueled by the pandemic and stay-at-home orders for work and school for most Americans. The cable industry added 5.6 million broadband customers in 2020, according to Wells Fargo Securities media analyst Steven Cahall, and most analysts expected that growth to slow to about 2.5 million additions in 2021.

But while the pace of the slowdown was expected to accelerate after the huge gains in 2020 and many Americans beginning to return to offices and schools, that will have to wait at least a little while longer. Most analysts still expect broadband additions will be lower in 2021 than 2020, but the gap will be narrower. Expectations that 2021 growth will be behind 2019 results are no longer being considered, at least for Comcast, according to MoffettNathanson principal and senior analyst Craig Moffett.

Keeping Up the Pace

“Growth remains torrid,” Moffett said of Comcast. “Broadband is doing better than even we had expected — full-year 2021 is now expected to be much better than full-year 2019, something that seemed aspirational, at best, at the start of the year — and wireless is gaining some serious momentum. With rising margins and still-low capital intensity, the cash generation of the business is nothing short of incredible.”

Comcast’s broadband growth helped drive even better increases in revenue and cash flow for its cable unit. Revenue at Comcast Cable rose 11% to $16 billion (ahead of analysts’ consensus estimates of $15.7 billion) and cash flow rose 14.5% to $7.1 billion, beating consensus predictions of $6.8 billion. Even video customer losses, at 399,000 in the quarter, beat expectations of a 430,000 customer loss. Comcast also added about 280,000 wireless customers, ending the period with about 3.4 million Xfinity Mobile subscribers.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Moffett wondered aloud how the results, and the huge amount of cash Comcast is expected to generate, will be used. In the past, the analyst said Comcast could spend as much as $20 billion on buybacks by 2023. Comcast has $9.5 billion remaining on its repurchase authorization, but didn’t say how much of that it intends to spend this year. Moffett opined that they could use the money to acquire scale.

“What they do about that issue is anyone’s guess,” Moffett wrote. While the cable segment is doing well and buybacks would probably be the best use of cash, he added, “the debate is about Peacock and whether Comcast needs to (or will) buy ViacomCBS (God forbid) or a not-yet formed Discovery-WarnerMedia.”

Comcast chairman and CEO Brian Roberts tried to squash the M&A speculation on a conference call with analysts, but left the door open to international partnerships. Reports have said Roberts met informally with ViacomCBS chair Shari Redstone and CEO Bob Bakish to discuss streaming partnerships outside of the U.S.

“We have a majority broadband-centric company and we like the mix,” Roberts said, adding that a partnership that could enhance its international streaming position would be “something you might talk to others and consider.”

But as far as making another big acquisition to gain scale, he added, “We have all the parts.”

Charter’s performance in the period comes after Bernstein analyst Peter Supino downgraded the stock to “market perform” in July, partly because of an expected slowdown in broadband growth. While most analysts see broadband customer gains waning in the next few years, the intensity of that deceleration may not be as dramatic as first expected.

Supino ticked up his estimates slightly for Comcast. He now thinks Comcast will add 375,000 broadband customers in Q3 (from previous estimates of 350,000 additions) and hit 1.6 million additions for the full year, up from his previous mark of 1.4 million adds. That’s in line with Comcast raising its year-end estimate for mid-teens percentage broadband additions, from the previous prediction of a mid-single digit increase.

Charter did not change its full-year guidance, expecting broadband additions to be at or above the pace they were in 2019.

The additional growth spurred increased optimism from some analysts.

“A solid beat by Charter, and after Comcast’s bullish internet outlook yesterday (July 29) we expect optimism around lower churn and stronger net additions in broadband,” Cahall wrote in a note to clients.

Ample Runway for Charter

Charter chairman and CEO Tom Rutledge said on a conference call to discuss Q2 results that he sees ample runway ahead for high-speed data services, adding that as the population rises and housing demand increases, so will adoption of broadband services.

“The big issue in general adoption is more of a digital literacy issue than it is a cost issue,” Rutledge said. “And it’s continuing to improve in terms of market adoption because of the way people can use the tools on the internet today, at any level and at any age. And so I think you have a continuous march of broadband adoption right up to occupied housing over the next five years.”

About 100,000 of Charter’s broadband additions came as a result of federal and state Emergency Broadband Benefit (EBB) subsidiary programs, and could churn off in the future. Lower-than-expected non-pay churn also added to the growth.

Barclays Research media analyst Kannan Venkateshwar saw some potential hidden meaning in Charter’s decision to keep guidance as is, adding it could be normal conservatism, or driven by the company’s assessment of the quality of the pool of available subscribers and management’s view that churn could return to normal levels. “However, visibility around these trends seems to be limited based on call commentary, which means that the unwind of some of these tailwinds could be a surprise, not just for Charter but for the industry as a whole,” he said.

For Altice, a Less Rosy Picture

Whatever the reason, Charter and Comcast’s results were in sharp contrast to Altice USA, which kicked off the earnings season July 28 by showing a decline (12,000 customers) in broadband subscribers.

Altice USA has the highest broadband penetration in the industry at 48.4% and faces the stiffest competition from telcos (Verizon Fios) in its footprint. Thus it could serve as a canary in the coal mine for the rest of the industry.

Altice USA’s recent acquisition of a regional fiber-optic broadband service provider helped offset organic customer losses in the second quarter, as revenue rose 1.7% to $2.52 billion and cash flow growth was flat at $1.1 billion in Q2.

Altice said unique customer relationships were down by 12,000 in the period, but showed a gain of 23,000 unique customers with 35,000 subscribers from its most recent acquisition, Morris Broadband, included. Altice USA purchased Morris in April in a deal that valued the North Carolina company at $310 million.

Organic broadband subscriber growth was flat in the period, but increased to a gain of 30,000 customers with Morris Broadband data included. That compares to a gain of 70,000 broadband subscribers in the prior year.

The same holds true for video customer losses, down 48,000 organically in Q2, or 36,000 when Morris Broadband’s 12,000 video customers are considered. Altice USA lost 35,000 video subscribers in Q2 2020.

Residential revenue growth of 1.5% was spurred by a 7.8% rise in broadband sales and a 36.4% spike in news & advertising revenue, supported by a strong recovery in local, regional and national advertising plus additional political advertising revenue from the New York mayoral and New Jersey gubernatorial races.

Altice USA CEO Dexter Goei said he expects broadband subscriber growth to improve next year — a departure from Q1 guidance that edge-outs would help spur growth in the second half of 2021. On the call, he said that most of the edge-out build activity occurs in the summer months, which would push out the impact of those extensions into 2022. “[W]e’ve signaled going into this year that [in] 2022 and onward we expect to see much more elevated levels of broadband net adds,” he said.

Supino, along with other analysts, reduced his 2021 broadband growth expectations for Altice USA as a result.

“Investors need some volume growth to be comfortable with the narrative,” Supino wrote. “Zero broadband net adds does nothing to help their case.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.