Streaming: The Winning Play

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The past decade’s promise of digital convergence is manifesting in live streaming of major sports events attracting record audiences via smartphones, tablets, game consoles and PCs.

Consumers are taking advantage of TV everywhere and OTT streaming services that sports leagues and networks offer in increasing numbers, with mobile views augmenting the longer established out-of-market pay TV offerings.

“League Pass continues to grow, even as we introduced new packages,” David Denenberg, the National Basketball Association’s senior vice president of global media distribution, business affairs, told Multichannel News. “We’re focused on serving our fans no matter what platform they have with them.”

Full-season subscription-TV packages like NBA League Pass, Major League Baseball’s MLB.TV and the National Hockey League’s NHL GameCenter Live serve transplanted sports enthusiasts in out-of-market locations who want to keep following their hometown teams.

Digital extensions from the leagues have bolstered those services, leagues said. The NBA this season even added single-game pay streams. (The leagues won’t divulge the number of digital subscriptions, other than they’ve increased steadily.)

League and network officials don’t seem especially concerned about business-model-busting moves such as the live-streaming deal Twitter reached with the National Football League to stream 10 free games from its Thursday Night Football package.

“I have a hard time thinking that the best way to stream content to the masses is digital-only product,” said Rick Cordella, NBC Sports Group senior vice president and general manager, digital media. “There’s no power like broadcast television. We’re not going to make our content freely available.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

When NBC streamed in 2008 for the first time the Olympic Games, in Beijing, “We took a very cautious approach,” Cordella said. “The biggest fear initially was cannibalization: instead of people watching on a big screen TV on the wall, they would then watch on an iPhone or a desktop computer. Really that’s never the case.”

For NBC, the key to streaming live is authentication; users must prove they’re either a cable or satellite subscriber. “We’re part of the ecosystem, a larger machine. We think it’s the right model,” Cordella said.

That goes for anything that NBC broadcasts over the air, as well as NBCSN, the Golf Channel and regional sports networks, such as local NBA games, and NBC’s partnership with Telemundo’s Deportes, totalling 7,000-8,000 hours of content a year, not including the Olympics, which is another 4,500 hours. In mid-April, the first week of the National Hockey League’s Stanley Cup Playoffs scored for NBC Sports an 84% bigger digital audience than last year, Cordella said.

“Digital streaming attracts young affluent males who are tech-savvy and forward leaning: an attractive demographic to reach for advertisers,” Cordella said, adding that digital has its own ad load often with different creative even though they might be some of the same advertisers on-air. “In some case [advertisers] pay a premium to reach it.”

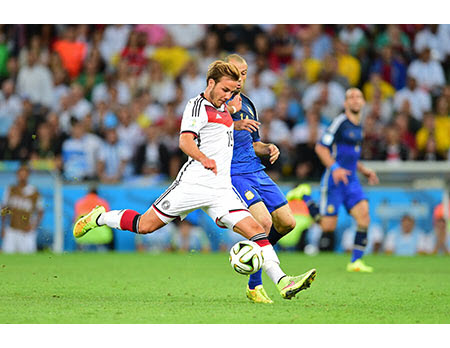

Livestream growth also is evident in other sports, such as soccer, golf and tennis.

The NeuLion-powered Major League Soccer service, MLS Live, grew its subscription base by 60% in 2015, according to Chris Wagner, executive vice president and co-founder of NeuLion.

NeuLion overall delivered OTT 63,000 live sports streams in 2015 and 30% higher video traffic than the previous year, Wagner said.

The new OTT product Univision Now, directed at 57 million Spanish U.S.-based speakers, expects digital traffic this June for the 32-match Copa America Centenario soccer tournament, involving national teams from North America and South America to be a bigger streaming deal than the 2014 FIFA World Cup was for Univision, he said.

“TV is still going to have the majority of [all sports] audiences,” Wagner said.

But digital is making inroads.

SIDEBAR: Sports Streaming Milestones

• Viewers of CBS Sports’s live stream of Super Bowl 50 consumed more than 402 million total minutes of coverage across laptops, desktops, tablets, connected TV devices and mobile phones, watching for more than 101 minutes each on average. During the game window, viewers consumed more than 315 million minutes of coverage, with an average minute audience of 1.4 million.

• NBA League Pass, the NBA’s live out-of-market subscription package, delivered a record 27 million video views and 1.2 billion total minutes viewed during the 2015-16 regular season. Globally, NBA.com and the NBA app netted a record 9.1 billion video views this season, up 160% over last year, and 3 billion visits, for a 27% year-over-year increase.

• This year’s NCAA March Madness Live, managed by Turner, garnered 73.5 million live streams and 18.1 million hours of live video consumption. When comparing this year with 2010, live streaming is up 84% and hours of live video consumption are up 54%.

• MLB Advanced Media’s At Bat app in 2015 established record levels of engagement including 13.1 million downloads (+21% YOY), 1.7 billion app starts (+40% YOY) and 8.4 billion minutes.

• WrestleMania 32-related content garnered more than 250 million video views across WWE.com, the WWE app and social media, (+122% YOY), setting a data traffic record of 8.6 TB on the AT&T network.

• Golf Channel Digital achieved its best week ever with The Masters from April 7–10, 2016 for total video starts (3.2 million) and total unique users (4 million). Additionally, Golf Live Extra saw a 23% increase in streaming coverage over 2015 for Golf Central Live From The Masters coverage, the best ever for Masters Week.

•CSN Bay Area Digital set a network record with 3.19 million minutes streamed for the historic 73rd regular-season Golden State Warriors win over the Memphis Grizzlies, surpassing the previous high, last Sunday’s Warriors-San Antonio Spurs game (3.15 million minutes streamed). For the full season, fans consumed 96.1 million minutes on CSNBayArea.com and via NBC Sports Live Extra (through 70 games), up 443% compared to the 2014-15 championship season.

• The NBC Sports section of Yahoo Sports delivered 3.5 million minutes in March, up 30% over March 2015, according to multiplatform data released by comScore.

Larry Jaffee was a Multichannel News senior editor and Washington bureau chief in the late 1980s and then managing editor of rival CableVision magazIne. Focusing on other aspects of the media business, Larry was the editor-in-chief of Mediacentral.com, Medialine magazine and Promo magazine. A widely published freelance writer and adjunct college professor, Larry is the author of the new book, Record Store Day: The Most Improbable Comeback of the 21st Century. Larry lives in Washington Heights, Manhattan.