Over-the-Top Rises to the Top

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Renewing distribution deals with major programmers remains a focal point for the National Cable Television Cooperative, but the group’s priorities are shifting as its members — primarily small and midsized independent cable operators — continue to face rising programming costs and blossoming consumer demand for over-the-top content.

“We are accelerating our efforts around creating OTT deals for our members,” said Rich Fickle, the CEO and president of the NCTC, which inks programming and equipment deals for nearly 1,000 U.S. operators, a number that will likely rise as the co-op looks to add Canadian pay TV firms.

The OTT part of the plan is to “seek alternative content models for video” that can also lower costs for set-top boxes and other types of consumer premises equipment, Fickle said.

The general plan is to find new sources of content, accelerate the enabling of video-on-demand services (many NCTC members didn’t invest in VOD or don’t have a strong offering today), establish more flexible packaging and, lastly, to ensure all content is delivered in a “super bandwidth-efficient” manner.

The co-op is open to working with existing programmers on the initiative, but is also looking for new content sources, Fickle said.

“It’s not a toe-in-the-water thing,” he said. “It will take a lot to get all of this organized, but it’s one of two major initiatives for us in 2015.” The other is getting those aforementioned big carriage renewals salted away, Fickle added.

TIGHTENING TIVO TIES

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

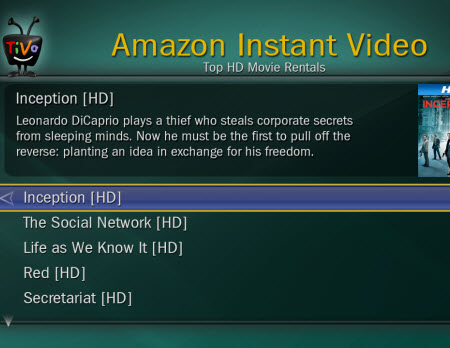

Separate, but connected to the initiative, is the NCTC’s recently struck agreement with TiVo, which has built an operator-optimized platform that weaves a provider’s traditional video services with OTT fare from such companies as Hulu and Netflix.

TiVo has been successful at notching deals with midsized MSOs such as RCN, Mediacom Communications, Suddenlink Communications, GCI and Grande Communications. The NCTC deal will make TiVo more economically attractive to a broader range of co-op members, Fickle said.

“They’ve built over time a pretty good product,” Fickle said of TiVo. “But the problem with any of those advanced platforms that are trying to service the traditional QAM worlds is that it’s pretty expensive.”

The TiVo-NCTC plan is to provide a standardized, more templated technology approach with shared integration costs. Additionally, they’ll offer a back-office and interface solution that will hook into multiple billing systems, reducing some of those integration costs.

“[The agreement] was driven around an initiative to drive a much lower cost structure for NCTC members to get into TiVo,” Fickle said.

Video-cost pressures have taken a toll on cable providers, especially the co-op’s smaller members. Last month, the American Cable Association, citing NCTC figures, told the Federal Communications Commission that content costs were a major factor in the shutdown since 2008 of 1,169 small cable systems serving more than 55,000 customers (including 91 system closures last year).

As smaller pay TV operators focus more heavily on lucrative broadband services, some might exit video altogether, or perhaps offload the management of their TV business, to keep costs in check for a product with shrinking margins.

Fickle said he believes that his members plan to stay in the video business for the long term, though.

VIDEO STILL MATTERS

“Video is important even if your primary focus is on broadband,” he said. “Video still is an essential offering in their quiver of services.”

Besides, given the rising popularity of OTT, “you’re in the video business even if you’re just a broadband provider.”

The NCTC has been meeting with companies that could provide co-op members with a national video platform that could help to subsidize the costs, Fickle said, though he won’t identify potential partners at this point.

“We’re acting as a catalyst and will continue to act as a catalyst to bring partnering options to our members,” Fickle said.