Netflix and Sony Pictures: A Look at Their Social Video Strategy

With insights from Tubular Labs, including how Netflix may help promote Sony content

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Sony Pictures Entertainment and Netflix recently agreed to a groundbreaking licensing deal that will give Netflix an exclusive window on Sony theatrical releases. This is clearly a boon for both parties, with Netflix scoring more of the latest entertainment titles and Sony locking in access to the massive Netflix subscriber base. And there are likely to be promotional synergies too.

Social video has helped SVOD companies excel in the streaming wars, engaging current audiences and accelerating subscriber growth. According to a recent report from social video analytics firm Tubular Labs, U.S. viewers spent 116% more time watching SVOD content on social video in January 2021 compared to January 2020. Tubular’s analysis shows that of the SVODs’ U.S. audiences, 67% are 13-34 years old, a coveted demographic. (A note about methodology: This data is based on the U.S. viewing audience, including YouTube and Facebook. The minutes-watched data is based on views of at least 30 seconds.)

Also Read: Netflix Ups the Ante with Latest Deals

Of the SVOD platforms Tubular measured, Netflix dominated for U.S. cross-platform unique viewers in January of this year, with 93.2 million. That bodes well for Sony, given that Netflix will surely use its social video muscle to promote new Sony titles as they become available to stream.

That said, Sony also already has a strong social video strategy.

Sony Pictures utilizes multiple social video platforms to promote its content, but according to Tubular, YouTube is a primary driver of views for the company, netting 796 million from over 1,100 video uploads across various Sony Pictures-owned accounts (that includes Sony Pictures’ global creators and other owned properties such as Sony Pictures Classics).

The top YouTube video for Sony Pictures’ U.S. accounts across the last year is the official trailer for Monster Hunt, which was posted in October and has generated 11.8 million views, 5.5 million of which occurred within the first 30 days, according to Tubular’s analysis. Meanwhile, the most-watched Netflix video hasn’t even been up for a full month yet: The official trailer for The Mitchells vs. The Machines, posted on March 31, has racked up over 18.9 million views so far.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Trailers are the bread and butter of Sony Pictures’ social video strategy: Of its top 15 YouTube U.S.-focused videos by views in the last year, only two aren’t teasers or trailers: “Puppy! A Hotel Transylvania Short Film,” from Sony Pictures Animation with over 3 million views, and “The New Spider-Man Title is…” reveal with 2.4 million views.

This brings us to one specific area where Sony might take cues from Netflix: the diversification of content types in its social video mix. Although both companies focus heavily on teasers and trailers for their YouTube presences, Netflix in particular tends to offer more full-fledged content: While many of Netflix’s top 15 YouTube videos by views are trailers, it's also posted full episodes of Our Planet, which have generated top view counts.

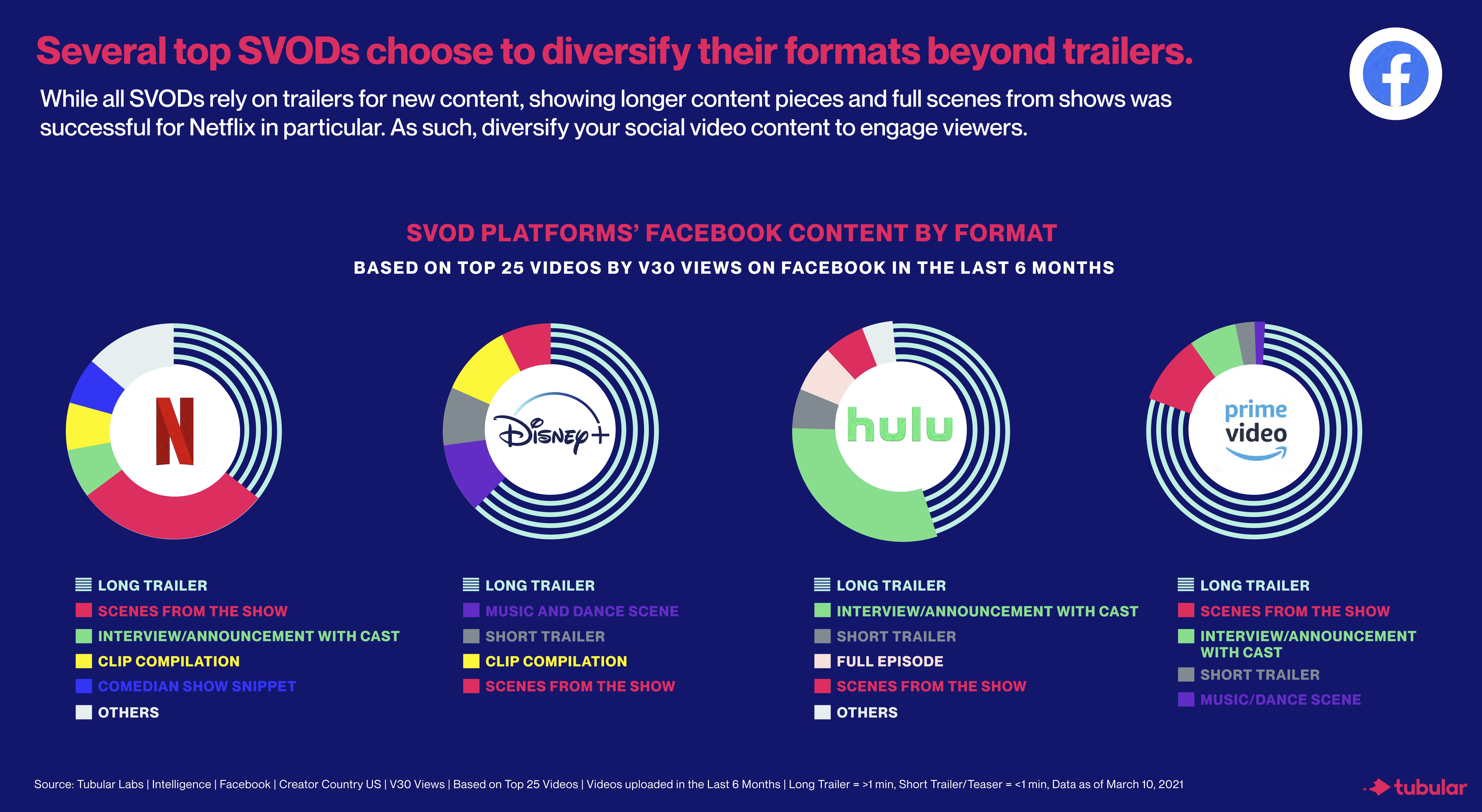

Also, of the top SVOD platforms that Tubular examined, Netflix has the most format diversity across types of content posted to Facebook.

For example, on Facebook, Netflix shares short clips from shows and movies, such as a 17 Again clip that was posted in early January and is the No. 1 Facebook video by views (55.6 million) for Netflix in the last year, 19 million of which occurred in the first week. Another top video is a collection of “Floor Is Lava Falls,” with 29.7 million views, and this interview with Goldie Hawn and Kurt Russell, which has generated 8.8 million views. Meanwhile, Sony Pictures’ most-watched Facebook videos are all trailers and teasers.

As Sony Pictures content comes to Netflix under the new licensing deal, it’s easy to envision how the streaming giant can push forward with increasingly engaging ways to promote Sony fare.