Lost And Found

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The TV industry’s fixation with “TV Everywhere” is a wonderful thing, as it would give viewers the ability to find any show at any time on any screen. All of this programming ubiquity has a downside, though: How do you find a show you want to watch?

Media consumers have said their “No. 1 need” is for “a universal listing to find shows across all TV sources,” including the vast array of over-the-top and online video content, according to “Conquering Content,” a December, 2014 study of some 1,250 U.S. television viewers with broadband service by Boston-based Hub Entertainment Research.

Sixty-one percent of respondents cited a need for “a universal listing that lets them find shows across all TV resources,” the Hub study said.

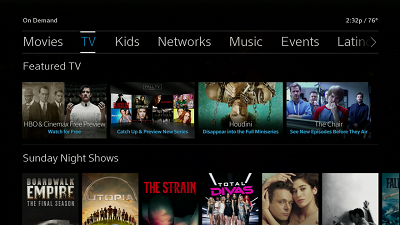

For the most part, though, the best cable operators can do is offer is a roster of programs available from conventional sources: linear networks, video-on-demand and shows saved to digital video recorders. Some still offer a frustratingly slow scroll of TV listings, while others merely provide an up-down and left-right grid as part of their DVR and VOD functions, with limited descriptions.

While such established players such as DVR manufacturer TiVo and over-the-top video provider Netflix have honed their suggestion-based services, a small group of companies — mostly third-party vendors such as Jinni and CanIStream.it — have stepped in with new image-based and keyword discovery systems. These systems are far more accurate and interactive than the text listings found in standard on-screen cable guides, and cover art and show clips are de rigueur.

NO ONE-STOP SHOPPING

Whether a viewer hankers to put together a personalized viewing session of Iggy Azalea, Taylor Swift and Nicki Minaj performances or a Doris Day film festival, it’s frustrating to know that the titles are out there somewhere but not attainable. Where’s a single, easy-to-use search tool to find them?

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Cable operators have very little incentive to offer any such universal program-search capability. Aside from complexity that is often beyond the capability of today’s standard set-top boxes, any such searches could drive viewers to OTT content that operators cannot monetize.

Neither cable operators nor over-the-top providers such as Netflix or Amazon have a compelling motivation to provide comprehensive listings of everything available everywhere in a user-friendly, searchable format.

MSOs contend that their VOD libraries offer anything viewers would want to see, while OTT providers only want to list the programs that are actually available from their libraries. As with many factors in the brave new digital world, those deliberate limitations may soon be breached in a manner beyond operators’ control.

“The discovery process plays a big role in the success of TV content, both online and linear,” Jon Giegengack, a principal at Hub and co-author “Conquering Content,” said.

The idea of a universal source for cross-platform search has been viewers’ “No. 1 interest” for several years, Giegengack said. Three-quarters of viewers who have broadband access watch some online video, he said, often from two or more online sources, such as Netflix, Vudu or Hulu.

Comcast, with its evolving cloud-based X1 platform, believes it has part of the cross-platform solution. Viewers, for example, can create a customized dashboard that unites multiplatform content “with improved redability and intuitive navigation,” according to Comcast. It is eyeing — but not yet implementing — truly universal program discovery and navigation.

“X1 makes it easier for our customers to access all the programming available to them as part of their subscription through integration of live, on-demand and saved programming and also through intuitive search and discovery,” Matt Strauss, senior vice president and general manager of video services at Comcast Cable, said. “It also opens the door to make new content, such as Web-based content and experiences, available directly on the TV.”

During the 2014 Sochi Winter Olympics, Comcast experimented with Web-video content, making NBCUniversal’s NBC Sports Live Extra app available via the X1 platform, according to Strauss. Comcast is “exploring the ways in which we might expand our collection of apps on X1 over time and continue to work with third parties on the integration of new content and experiences into the platform in a way that’s seamless, intuitive and complementary to the comprehensive X1 experience,” he said.

But as far as over-the-top revenue streams go? “It’s too early to discuss how we’d monetize Web-based programming on X1,” Strauss said.

Cox Communications is focused on the search capabilities in its Contour set-top boxes, which can seek programs across linear and on-demand lineups as well as DVRs, vice president of marketing for video Jonathan Freedland said.

“It’s not going out to Netflix or Hulu or anything; there’s not an access path for the consumer to get to it,” Freeldand said. “We’re serving content that we have the capability to deliver.”

Cox does have a Contour app and Contour-powered set-tops can serve default recommendations, but the Atlanta-based MSO is focusing on content from the channels it carries, Freedland said. Since Contour debuted in 2013, he said, there has been a 20% average viewing increase on about two dozen networks and a 40% increase in the average number of shows viewed monthly on those channels.

Freedland credited the Contour program guide for driving that viewership growth. Such increases suggest that viewers are finding programs they want to see within the limits of set-top search capabilities.

But like other MSOs, Cox is holding back on any universal search capabilities until “we determine a business case and consumer desire” for such expanded access, Freedland said.

Ultimately, content discovery is not enough. An ideal content-search system should be integrated with a navigation service. Several companies are focusing on the importance of “catch-up” features, which enable a viewer to go back to the start of a show (via VOD technology) even if they “discover” the real-time telecast minutes, hours or even several days after it ran.

The functionality of today’s set-top boxes is one of the biggest stumbling blocks to universal search and discovery.

BLAME IT ON SET-TOPS

“We’d like to deliver all [shows] … but I don’t have an STB that can give them everything yet,” Bob Gessner, president of independent cable operator MCTV in Massillon, Ohio, and chairman of the American Cable Association, a small-operator trade group.

That universal search situation will eventually lead to a delivery dilemma, Gessner added.

“To the extent that content will migrate to (broadband), customers will have to buy more bandwidth,” he said. “If you follow that to the logical conclusion that they’ll want high-definition on multiple screens, they’ll need a lot [of bandwidth]. The 50 Mbps connection would not be sufficient.

“I don’t think it’s really that hard to assemble the metadata for a universal guide,” Gessner said, but you need “to have that infrastructure platform on which you can play it. The STBs [today] cannot do that.”

Viewers want a “wider breadth of content and pricing flexibility,” Patrick Knorr, executive vice president of IP and business services at Wave Broadband in Kirkland, Wash., said.

Wave uses TiVo’s platform, which can offer universal search to deliver the content consumers want via apps within the set-top, he said. “We think it’s the best solution in the marketplace today,” Knorr said.

There is “high demand,” but the TiVo service is “too new to give specific data about usage,” Knorr added.

INTERIM SOLUTIONS

Discriminating viewers are finding other means to look for shows they want to see. New smart TVs with program-guide apps fill some of this demand, either through preinstalled “native guides” or via downloads that access websites linked to the growing multitude of navigable contentsearch tools (see sidebar).

Such online directories are becoming increasingly competitive with cable operators’ limited on-screen program guides. They are especially appealing to curious and demanding millennial viewers.

Smart TV apps are proliferating. For example, at last month’s International CES, Samsung expanded its proprietary “Milk Video” platform with features that let viewers discover, collect and share Web videos. The Milk app curates premium Web video content from growing rosters of 50 sites.

Milk offers a click-and-watch seamless process that is a step beyond most on-screen grids and certainly more responsive than scrolling time listings.

Yosi Glick, co-founder/CEO of Israel-based Jinni, contends that today’s on-demand environment has created “a very challenging process, because the responsibility lies with the viewer” to figure out how to search for titles.

But the antiquated tools in conventional navigation systems can’t handle the current array of choices, Glick said, so viewers need to do a little work to find what they want to watch.

Jinni’s guide, unlike a conventional navigation system, is intended to help viewers make such decisions, Glick said. Jinni’s “Entertainment Genome” software offers viewing recommendations based on seven “tastes” that people identify when they register for the service. Using these preferences, Jinni can search for shows that are “bleak,” “mind bending,” “captivating,” “clever,” “tense,” “offbeat” or “thought-provoking” to fit a viewer’s current mood, according to Glick.

Whether they say it or not, viewers want the on-screen guide “to show me what’s available for the mindset I’m in right now,” Glick said.

Such personalized capabilities augur a new direction for program discovery and navigation. But for now, cable’s business situation tempers the momentum for universal guides.

“There’s not a lot of partnership [collaboration] going on,” Billy Purser, senior director of marketing at TiVo-owned video search-technology company Digitalsmiths said. “You haven’t seen anything ... because they [operators] haven’t figured out how to monetize the OTT relationship. They’re figuring out how to promote the current catalog.”

Cable operators are just starting to implement crossplatform promotion solutions, Purser said, noting that Digitalsmiths is working with seven of the top 10 U.S. pay TV providers (Time Warner Cable, Dish Network, DirecTV, Charter, AT&T, Verizon Communuications and Bright House Networks).

The Digitalsmiths tool — distributed via parent TiVo, which acquired the tech firm last year — allows cable operators to promote content in all formats “to the right audience,” co-founder and CEO Ben Weinberger said.

“They can find anything they want on a single platform,” Weinberger said. “Operators can apply business rules based on the goals they want.”

The uptake among MSOs is still sparse, though, he acknowledged.

Longtime guide developer Rovi’s November acquisition of Fanhattan is also seen as a potential programsearch game-changer. Through its cloud-based Fan TV device and services, Fanhattan has created popular multiplatform program discovery products for linear TV, VOD and OTT content.

Fanhattan’s one-touch wireless device, Fan TV, can plug into a cable settop and the integrate content from linear cable, VOD and OTT into a single interface. Time Warner Cable has been offering Fan TV for a one-time $99 fee on a limited basis since last year.

In 2013, Cox trialed Fanhattan’s technology with a broadband-subscription TV project in Orange County, Calif., branded as flareWatch. Cox ended that trial in September of 2013, at the time saying only that results from the tests could factor into future product offerings.

Fanhattan was originally set up as a video-discovery app for cross-platform searches for movies and TV shows. Creating Fan TV was an attempt to get into more homes, and the company’s founders acknowledge that the sale to Rovi was intended to accelerate cable relationships.

Rovi expects Fan TV to “augment our next-generation guidance and discovery solutions,” Omar Javaid, senior vice president and general manager of Rovi’s Discovery Group, said. Fanhattan’s technologies will be incorporated into a “scalable and modular cloud-based platform supporting IP and hybrid STBs, DVR functionality and personalized interactive user-interfaces,” he added.

A comprehensive cross-platform guide threatens to be “unwieldy and overcomplicated,” Peter Fondulas, Hub’s co-founder and co-author of the “Conquering Content” report, said. “A major consideration should be what the user experience will look like” and how the guide “allows individuals to search according to their preferences,” he said.

Interface decisions must be the result of “negotiations between the OTT provider and the cable operator,” Fondulas added, noting that cable “has newer content” but it is often “more expensive and clunky to find.”

Moreover, the infrastructure for a true, full umbrella video discovery system is haphazard. That’s because neither cable systems nor OTT video providers want to direct viewers away from the content they sell.

DEMAND DRIVES CHANGES

Greg Gudorf, a former Sony and Digeo senior executive, said he expects the momentum for integrated universal search will grow. He was formerly chief operating officer of Technicolor’s MediaNavi MGO technology unit, which focused on integrated digital content delivery.

“Consumers are demanding it more,” Gudorf, now a San Diego-area media technology consultant, said, adding that he believes cable’s TV Everywhere initiatives “are going to evolve to embrace OTT.”

The barriers to truly universal program discovery and navigation — “growing complexity” and the “need for business relationships” between cable and online content providers — will persist for a while, cautioned Gerald Kunkel, a media strategy adviser with Nautics.tv. (Kunkel led Comcast’s “GuideWorks” joint venture with Gemstar-TV Guide International, now Rovi, which was eventually folded into X1; and more recently worked on Microsoft’s “OneGuide” project.)

As Hub Entertainment Research’s Giegengack said, “Almost-unlimited catalogs mean that viewers need, and increasingly expect, tools to make discovering shows they’ll love a manageable task.”

Finding Video Sherpas Online

A throng of companies have popped up offering almost universal onscreen and online (including mobile) program search. Below is a list of a few such Web-based offerings, some of which offer curated video capability. For links to the websites, visit multichannel.com/Feb2.

Jinni: Steers viewers to programs on HBO, Showtime, NBC, CBS, Netflix, Vudu, Amazon and other video sources. The company has been developing its “taste-based” audience recommendation system for seven years.

Rovi: Program-guide maker has expanded capabilities through its November 2014 acquisition of Fanhattan, maker of the Fan TV device and cloud-based software for cross-platform video search.

WhereToWatch.com: These searchable program listings from the Motion Picture Association of America debuted in November.

CanIStream.It: Provides links to videos available via Netflix, Hulu, Xbox 360, Sony Entertainment Network, Google Play, YouTube, Comcast’s Xfinity and many other sources.

GoWatchIt.com: Concentrates on films and documentaries, many of them organized by their appearances at recent film festivals.

Watcheroo: A tune-in guide categorized alphabetically by platform or network.

Frequency Networks: Focuses on “turning the Internet into TV” by gathering videos from CNN, the National Geographic Society, TMZ, Fashion TV, the Associated Press, TechCrunch, Laugh Factory and The New York Times, among others.

Waywire: Curated service that provides tools to enable viewers to develop their own guides to pertinent programming for special interests.

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.