Judiciary Raises Programming, Broadband Control Issues with Comcast/TWC

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The Senate Judiciary Committee held a marathon—three-hour—hearing on the proposed Comcast/TWC deal with both Democrats and Republicans raising issues about the impact of the deal on availability of programming, prices to consumers, and access to broadband.

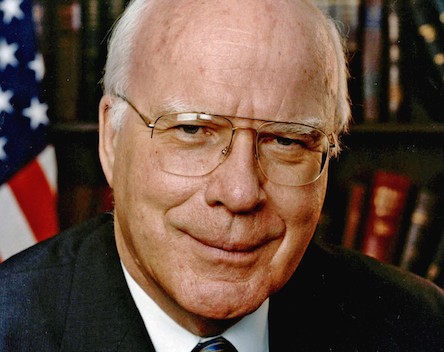

Committee chairman Patrick Leahy (D-Vt., pictured) suggested the combination of the number one and number two cable operators raised issues about market power and network neutrality, seconded by Sen. Amy Klobuchar (D-Minn.), who presided over much of the hearing, and Sen. Mike Lee (R-Utah).

Leahy made it clear he saw potential consumer harms in the deal on both the video and broadband access sides: "In 1996, I voted against the Telecommunications Act in part because of concerns I had about the lack of competition in the cable TV market," he said. "Along with many consumers, I continue to be concerned. Similar questions are now being raised about the broadband industry, where consumers feel like they face large bills and inadequate choices."

He said consumers want to know why their cable bills keep going up, why they don’t have more choice of providers, and why the merger is good for them.

Leahy asked David Cohen, executive VP, Comcast Corp., whether he would be willing to extend Comcast's commitment to network neutrality rules beyond 2018. Cohen would only say that he thought that would happen anyway given the FCC's effort to recraft no-blocking and antidiscrimination rules, an effort Comcast has said it supports.

Sen. Lee said that it was an extremely large transaction affecting cable and broadband and that where the stakes are high, as they are in terms of access to the Internet, any potential anticompetitive effects must be scrutinized “very carefully.”

Lee also raised the issue of whether a combined Comcast/TWC could limit access to conservative voices on their outlets.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Comcast's Cohen said that had been one of the most heavily litigated issues around and that the FCC had concluded that having less than 30% of subs, as the combined company would have, did not represent a threat to access to content.

While Cohen asserted there were no anticompetitive problems with the deal given no geographic overlap between the two companies' systems, numerous legislators, mostly Democrats, but not solely, suggested the size of the combined company in video as well as broadband access—the number one and number three ISPs—represented potential incentive and ability to discriminate against online video competition, or to have too much power over programming prices, access to must-have NBCU content, or equipment prices.

Sen. Al Franken (D-Minn.) took Cohen to task about his prepared testimony in which he said of the 150 conditions in the NBCU deal—many of which Comcast is pledging to extend to the TWC deal—the FCC only looked at one of those, and that was resolved. Comcast and the FCC struck a consent decree in which Comcast paid a fine and agreed to better market the availability of stand-alone broadband.

Franken pointed out that the FCC had also "looked" at the neighborhooding condition, and ultimately found that Comcast had not met that condition with regards to Bloomberg TV. Cohen countered that the neighborhooding condition had been about interpretation of a condition, and when the FCC clarified what a neighborhood meant, Comcast complied and remains the top distributor of Bloomberg TV.

Franken was not assuaged. The senator made it clear he opposed the deal, saying it would mean higher prices and less choice for his constituents.

Cohen could not promise the deal would lower consumer prices, but said nothing in the deal would raise them, either.

Cohen talked up the benefits, faster speeds, more VOD, a more secure network, and even took the opportunity to announce that Comcast was raising its 50 Mbps high-speed broadband service to 105 Mbps, and its 105 Mbps to 150, all for no extra charge.

While Cohen and professor Christopher Yoo of the University of Pennsylvania law school testified the deal would have no anticompetitive impacts on the video or broadband marketplace, and Cohen outlined the benefits, Public Knowledge president Gene Kimmelman saw the deal very differently.

Invoking a Jules Verne-like image, Kimmelman suggested the combined companies would be an octopus-like creature with its arms around nearly 50% of high speed Internet access subs, over 30 percent of MVPD, and almost 60% of cable subscribers.

"The proposed transaction is inconsistent with antitrust policy, the goals of the Communications Act, and the broader public interest. Therefore, it should not be approved," he said. Kimmelman was concerned about access to NBC programming, and what he said was Comcast's incentive and ability to use the combined ISP footprint to find ways to disadvantage online competitors, whether raising their prices for access—Comcast's paid peering deal with Netflix was referenced—or in other ways.

Cohen countered that the peering deal had been Netflix's idea as a way to cut out the middleman for access to the broadband backbone, a market he said remains wildly competitive and on which the Internet was built.

But Kimmelman said his concern was the control of the last mile, which he said was not so competitive.

Speaking for independent golf lifestyle network Back9Network, James Bosworth alleged that its discussions with Time Warner Cable had been productive, but were less so after the announced proposed merger with Comcast, which owns Golf Channel. TWC CFO Arthur Minson said that its programming decisions had nothing to do with the proposed merger, and would be based on the cost/value proposition and bandwidth constraints. Cohen said they had productive meetings with Back9 as recently as this week and, while he was not a part of those, understood it to be a channel they were still considering.

Bosworth countered that the message from Comcast was that it would be keeping an eye on the channel over the next 24 months.

Leahy, whose focus was on the impact of the deal on consumers, asked Minson whether his $27 million golden parachute was consumer friendly. Minson said it was not out of line with the complexity of the transaction.

Contributing editor John Eggerton has been an editor and/or writer on media regulation, legislation and policy for over four decades, including covering the FCC, FTC, Congress, the major media trade associations, and the federal courts. In addition to Multichannel News and Broadcasting + Cable, his work has appeared in Radio World, TV Technology, TV Fax, This Week in Consumer Electronics, Variety and the Encyclopedia Britannica.