Hugh Hewitt Show Suggestion Drives Tax Bill Amendment

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Hugh Hewitt, radio talk show host whose show is syndicated to over 120 cities by the Salem Radio Network, got a shout out on the Senate floor Friday (Dec. 1), with a suggestion for the tax bill that was incorporated into an amendment.

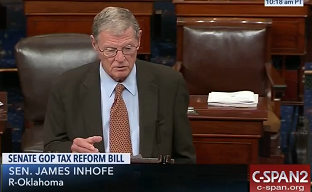

During debate over the Senate version of a tax reform bill, Sen. James Inhofe, (R-Okla.), he said that there is "this idea that somehow there isn't a good idea unless it emanated from this body."

He said that one of the good ideas he had heard from "the outside" was one he heard several weeks ago on the Hugh Hewitt show, and said he had studied it since then, tried to "pick it apart" but could not find fault with it.

Inhofe said he had developed an amendment based on the suggestion. It would allow retirees who defer income tax until the withdrawal date of the funds, say, 59 and a half, to have a one-time early withdrawal opportunity to take out up to a quarter of the funds for a one-time 10% flat fee in lieu of income tax on that sum.

He said that would provide immediate tax revenue from all those ten percenters, which could amount to billions of dollars immediately.

He conceded there could be some long-term negative effects, but said it would be an immediate economic stimulus.

Hewitt said in an interview with Inhofe's fellow Oklahoma Republican Senator, James Lankford, Nov. 28 about allowing the one-time early withdrawals at a flat rate rather than at a penalty and the regular rate, "provided they use it to pay down mortgage interest, mortgages, or to buy residential real estate."

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Hewitt also posted the plan at Hughhewitt.com.

"I am glad the senators are willing to consider a manifestly sensible, moderate approach to both raising revenue to cover the cost of the tax bill while also mitigating the loss of the home mortgage interest deduction for some and stimulating housing market which realtors and home builders will applaud," Hewitt told B&C. "It will also increase disposable income of those who pay down or off mortgage with the withdrawals without endangering retirement assets as real estate, especially owner occupied real estate is a superb retirement savings vehicle. I suspect as well, though would have to check with experts on demographics and aging, that quality of life increases dramatically if people can age in their own homes free of mortgage debt."

Related: DelBene Takes Aim at Tax Break For Sexual Harassment Settlements

Contributing editor John Eggerton has been an editor and/or writer on media regulation, legislation and policy for over four decades, including covering the FCC, FTC, Congress, the major media trade associations, and the federal courts. In addition to Multichannel News and Broadcasting + Cable, his work has appeared in Radio World, TV Technology, TV Fax, This Week in Consumer Electronics, Variety and the Encyclopedia Britannica.