How Does Netflix Remain King As New Competitors Chip Away?

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

It’s been quite a week of high, and often dashed, expectations for Netflix, the one-time streaming revolutionary trying to maintain its thoroughly dominant position in an industry that’s gotten so, so, so much bigger in the past year.

The company saw share prices plunge more than 10% in the hours after it released Q1 earnings Tuesday, which were pretty good except where investors were looking.

And then there were the Oscars on Sunday, a telecast about movies where 17 Netflix streaming projects received a whopping 36 nominations. Netflix ended up with seven statues, including two each for Mank and Ma Rainey's Black Bottom and ones for best live-action short, best animated short and best documentary (for My Octopus Teacher, a win that prompted a thousand social memes). All in, a good night for the streaming service with the most wins.

The week’s earnings offered a fair amount of good news, like reduced churn, a 24% revenue jump year over year, and cash flow headed toward break even, which will obviate the need for more junk bonds. The company even said it will begin $5 billion in share buybacks.

Nonetheless, investors found something to panic about: a big miss on quarterly subscriber adds, short 2 million from a projected 6 million new, paying accounts.

That the industry’s closest watchers remain focused on subscriber adds likely is a source of continuing frustration for the Netflix brain trust (they might suggest looking at average revenue per account, for instance).

But it’s probably collateral damage from the entire sector’s lack of transparency, including haziness about what counts as a new subscriber.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

For instance, AT&T said this week that HBO and HBO Max added a combined 4 million new subscribers in the quarter. But where investors lost it when Netflix added 4 million subs, they celebrated the wireless carrier’s considerably less specific sub counts (HBO and HBO Max? And how many are bundled in with a wireless subscription?). No one said life was fair.

Netflix still has 208 million subs, and HBO/HBO Max less than 50 million. The comps are, as the analysts like to say, difficult.

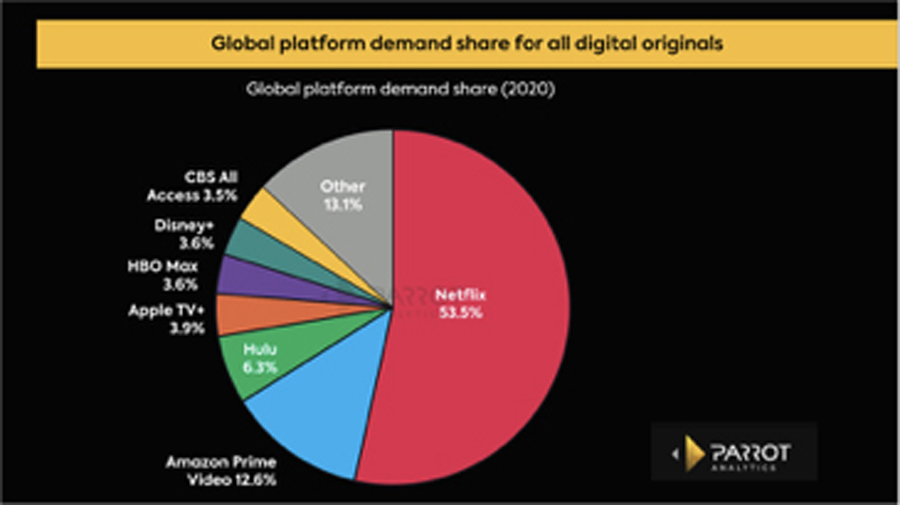

And that’s only going to get more complicated going forward. Parrot Analytics, which tracks what it calls “demand expressions,” said in a new report this week Netflix’s share of that metric declined notably in 2020 as newcomers established beachheads in the attention of video watchers.

Apple TV Plus, Disney Plus and HBO Max each grab less than 4% of the total pie. And that’s with The Mandalorian Season 2 leading all streaming shows for the year (five-year-olds repeatedly watching The Little Mermaid apparently didn’t register in Parrot’s measurements).

Of note, the biggest growth was for those smaller services, including regional operators overseas, lumped into the “other” category, which nearly doubled 15.1% of the pie, from 8.8% the previous year.

But it’s important to note that Netflix still has more than half the overall user demand, and leads in many genre categories too.

Given the dearth of direct viewership data or trusted third parties, efforts like Parrot’s provide a relatively useful stand-in. “Demand expressions” totals the interest in a given show across “video streaming platforms, social-media platforms, photo-sharing platforms, blogging and micro-blogging platforms, fan and critic rating platforms, peer-to-peer protocols and file-sharing platforms.”

It’s good for new shows, but not much use for services with a lot of library viewing (which is probably why Apple TV Plus looks pretty good).

Regardless, there’s lots of good news for Netflix, but not enough to make it a great week. How does it boost signups and make investors happy? Should it even bother? Would shutting down widespread account sharing help, for instance? Given the down sides, maybe not.

“My impression is that [Netflix] is not going to press users too hard,” Edward Jones equities analyst David J. Heger said. “I think that management is afraid that it could damage the goodwill that it has built with subscribers if it plays too much hardball.”

Heger suggested that, by contrast, “expectations have been relatively low for HBO Max,” especially given its slow launch last spring, and mixed in with good news about the parent company’s 5G rollout.

“I think that over time, as the streaming video business matures, investors will start to value the fundamentals of the business rather than just ascribing a per-subscriber value,” Heger said. “That could cause stocks of companies involved in video streaming to lag behind the overall market when that transition occurs.”

That’s a warning for investors piling into other streamers. For Netflix’s part, executives counseled patience. Its competition isn’t the new guys like HBO Max, co-CEO Reed Hastings said; it’s linear TV, and video games, and a bunch of other ways people are entertaining themselves.

Compared to that competition, Hastings said, “We’re somewhere in the middle of the pack,” with maybe 10% of view time, and lots of runaway for future growth.

That could be good news ahead for patient Netflix investors, he and other executives suggested. The pandemic hangovers and disasters should ease by the second half of the year, and the global production pipeline should be back up to its formidable pre-pandemic levels.

Heck, Netflix might even convert some of its next batch of Oscar nominees into hardware was Hollywood awards voters get used to voting for streaming. By then, maybe we’ll even have some better metrics for investors to panic about.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.