Global Viewers Are Flocking to Amazon’s ‘Grand Tour’

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Over-the-top subscription video-on-demand services are a black box in the sense that they don’t release viewership metrics, but new proprietary data analysis from Parrot Analytics attempts to penetrate the sector and peer at what lurks inside.

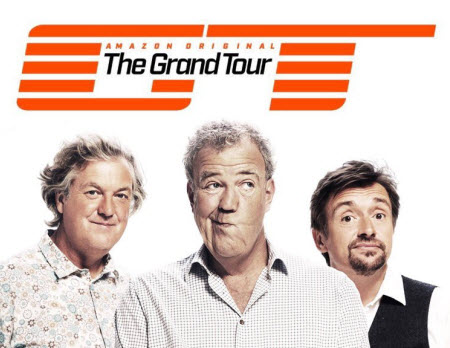

What Parrot found in the first quarter of 2017 is that, for the first time, a non-Netflix show was the most popular digital original series around the globe, as Amazon Video’s The Grand Tour — featuring the former BBC Top Gear trio of Jeremy Clarkson, Richard Hammond and James May — took the top spot in five out of 10 markets, including the United Kingdom.

Netflix’s Stranger Things was the top digital original in the U.S. in that period, but the surprise was that the announcement of the series’ season two release date, set for October 31, caused an average spike in demand of 262% in all ten global markets covered, Parrot Analytics found in latest quarterly Global Demand Report.

In the U.S., other events caused spikes in popularity in certain shows. Amazon’s Goliath, for example, got a lift in January when it won a Golden Globe, and Netflix’s Grace and Frankie ticked up when season three was released on March 24.

Season two of Hulu’s The Path premiered on Jan. 25, with episodes doled out weekly until April 12. Though that strategy didn’t follow digital’s typical binge-viewing model, The Path still saw demand rise under this more linear TV-like release schedule, the research firm said.

Among other regional examples, The Grand Tour, Stranger Things and Amazon’s The Man in the High Castle were the top digital original series during Q1 in the U.K. In France, three Netflix titles — Orange Is the New Black, Black Mirror and Stranger Things — led the way, while The Grand Tour, Stranger Things and Marvel’s Luke Cage were the top trio in Japan.

To determine that popularity, in the absence of hard usage data from each OTT service, Parrot Analytics bases its findings on what it calls Average Demand Expressions, relying on a platform that collects consumer demand data from several sources, including video streaming-media and social-media platforms, photo-sharing platforms, fan and critics’ ratings systems, as well as file-sharing platforms. Once that data is captured, Parrot Analytics combines it using an artificial intelligence system that pumps out a single measure of demand.

Though original titles from Netflix, Amazon Video and Hulu tend to rise to the top of the demand heap, Parrot Analytics also monitors demand for content from other sources, including YouTube Red (YouTube’s SVOD service), Crackle (Sony’s ad-based VOD service), and Seeso (NBCU’s comedy-focused SVOD).

The smarter way to stay on top of the multichannel video marketplace. Sign up below.