Cable Holds the Cards,But D.C. Owns the House

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

jeggerton@nbmedia.com | @eggerton

Like any trend that keeps being resurrected with the times, consolidation has been on the minds and lips of cable operators a great deal lately. But when it comes to such industry buzzwords, Washington remains the arbiter of taste, and no action on that front will happen without their approval.

All of which means the odds of the FCC signing off on a Charter/Time Warner Cable deal will depend on what conditions the stakeholders are willing to accept.

It’s par for the course, given the highs and lows of recent cable history at the FCC. After suffering under the lash of FCC chairman Kevin Martin, who beat up the industry on the à la carte issue, the cable industry fared far better under former recent chairman Julius Genachowski, but that was generally the side benefit of having bet correctly on the future of broadband. To the extent that a cable-friendly decision— basic tier encryption, viewability, tower citing— benefitted the deployment of broadband, the FCC was all smiles (granted, network neutrality was part of the conversation, but those rules have not proven to be a deal-breaker.)

So, while the John Malones (Charter) and Glenn Britts (Time Warner Cable) of the world may be talking about heavying up, it will be the policymakers, not the dealmakers, who get the last word.

Big Deals, Big Players

Comcast is always the elephant in the room, so if a deal creates a stronger competitor to Comcast, that could work in the favor of Washington blessing some cable consolidation. And as distribution continues to fragment over telcos and satellite and the Web, there may be less argument against the horizontal concentration of two distributors outside the top three or four.

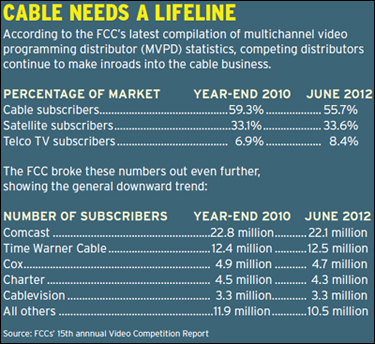

In the FCC’s most recent video competition report, approved two weeks ago, overthe- top video and Direct Broadcast Satellite both showed growth in share of the video market, while cable’s subscriber count and share of the market continued to decline. (See “Cable Needs a Lifeline”).

Brian Wieser, senior research analyst at Pivotal Research Group, says that eventually the FCC is going to need to look at limits on ownership in a broader context, pointing out that those limits date from a world that existed two decades ago.

One veteran cable attorney who asked not to be identified points to the precedent of the FCC allowing phone companies to heavy up—Verizon/ MCI, AT&T/Cingular, or more recently allowing No. 4 wireless carrier T-Mobile to merge with No. 5 MetroPCS—to create, essentially, a Big Four in the industry. And the attorney sees the FCC possibly allowing for a similar evolution in cable through mergaers among or with mid-sized companies, though not among the top three or four.

Give My Regards to Broadband?

One argument that could work in cable’s favor at the FCC and with the administration is needing the economies of scale to deliver more high-speed broadband.

But the attorney suggests that, despite the government’s high-profile push for high-speed, that argument may be losing its steam, with the cable industry the victim of its own success. He says that five years ago, the argument that they needed scale to upgrade to Docsis 3.0 (higher-speed broadband) had legs, but given the current pace of that Docsis build-out, it doesn’t. Still, there are broadband carrots to a deal; specifically, the companies could offer merger conditions similar to Comcast’s on delivering broadband to low-income populations.

Harold Feld, senior VP for Beltway-based public interest group Public Knowledge, which is no fan of big mergers, thinks a horizontal merger between Charter and TWC remains a tough sell to a Tom Wheeler-led commission. He says that is because the combined company isn’t going to start overbuilding, so the only way to get the deal approved would be to load on enough conditions to create a regulated duopoly—or, more conditions than a John Malone would ever take, Feld believes.

Vertical mergers, like a Comcast/NBCU, or a Disney/ ABC, are harder for the FCC and the Department of Justice to say no to. Feld says the government may be uncomfortable with such deals, while having a hard time articulating the traditional antitrust reasons against it. The FCC looks beyond antitrust to public interest concerns, but that is more likely to result in behavioral conditions than putting a kibosh on the deal.

A Wheeler-led FCC might be amenable to a marriage between TWC and CBS, the attorney agrees, which would offer stronger competition to Comcast. It would also provide an opportunity for the commission to apply behavioral conditions, like those on the Comcast/NBCU merger.

Wheeler, in a 2011 blog posting during his time as a venture capitalist, said that the FCC might have put conditions on the AT&T/T-Mobile merger that could then be more generally applied, though he has since referred to that as hypothetical speculation.

At presstime, cable’s consolidation talk was still just that, too. But the more competitive other distribution models become—and it appears only a matter of time for over-the-top—the more likely the FCC will be asked to weigh in with its considerable weight.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Contributing editor John Eggerton has been an editor and/or writer on media regulation, legislation and policy for over four decades, including covering the FCC, FTC, Congress, the major media trade associations, and the federal courts. In addition to Multichannel News and Broadcasting + Cable, his work has appeared in Radio World, TV Technology, TV Fax, This Week in Consumer Electronics, Variety and the Encyclopedia Britannica.