WOW Cable-System Sales Highlight Valuation Disparity

Overbuilder sells five markets for $1.786 billion, or 11 times cash flow

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

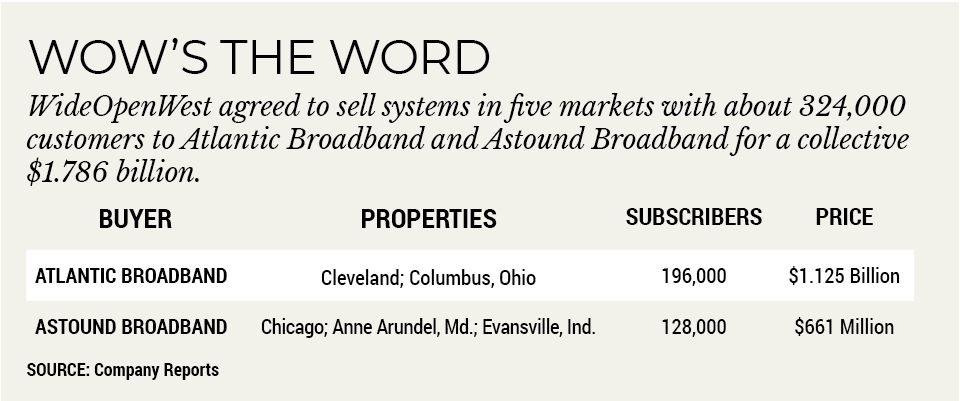

Two weeks after telling a Wall Street audience that rising valuations could help it pay down debt, WideOpenWest reached agreements to sell systems in five markets with a combined 324,000 broadband customers to Astound Broadband and Atlantic Broadband for $1.786 billion, a deal some analysts believe highlights the sometimes glaring gap between private and public market valuations for cable companies.

WOW agreed on June 30 to sell systems in Chicago; Anne Arundel, Maryland; and Evansville, Indiana; to Astound Broadband for $661 million. At the same time, Atlantic Broadband agreed to buy the overbuilder’s systems in Cleveland and Columbus, Ohio for $1.125 billion.

WOW said it would use the proceeds to reduce leverage from its current 5 times forward-looking cash flow to 2.5 times, and fund ongoing expansion of its network through edge-out programs and greenfield construction. The deal is expected to close before the end of the year.

The deal comes after WOW chief financial officer John Rego said at the Credit Suisse Virtual Communication conference on June 15 that the company, if it wanted to pay down debt more quickly, could do so by “selling a market or two.”

The deal multiple works out to about 11 times cash flow, in line with recent private cable transactions that averaged between 12 and 15 times EBITDA.

B. Riley Financial media analyst Daniel Day, who raised his 12-month price target on the stock to $30 per share after the deal, wrote in a research note that WOW was trading at about 8 times cash flow before the sale, further highlighting the disparity between public and private valuations.

He wrote that the gap is even steeper on a broadband subscriber basis, where WOW’s $4,578 enterprise value per broadband customer is 60% less than its peer group.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“In our view, a 30% to 40% ‘overbuilder discount’ is more appropriate,” Day wrote, adding at that level, WOW’s share price would be $35.

The sale helped push WOW stock up more than 17% ($3.09 each) to $21.34 on June 30. The shares were trading at $21.61 each in afternoon trading on July 2.

For Astound, which agreed in November to be purchased by Stonepeak Infrastructure Partners for $8.1 billion, the deal will significantly boost its presence in two of its top markets.

According to the deal, Astound will receive about 128,000 residential and business customers from WOW. The addition of the WOW systems will double Astound’s Chicago homes-passed to about 800,000 residences, while increasing its Washington, D.C. footprint (Anne Arundel is near Baltimore) by about one-third.

In Chicago, Astound competes against Comcast and AT&T, and in Washington, D.C., it goes up against Comcast and Verizon’s Fios. Astound CEO Jim Holanda said the added bulk will give it more of an advantage in what has already been a healthy competition.

Big Boost in Chicago, D.C.

“I like to think we have been a strong competitor in both of those markets, certainly in the 11 years we’ve been operating RCN, and I would expect to continue to be a strong competitor against them in these two markets as we go forward,” Holanda said. Atlantic Broadband will receive about 196,000 internet, 61,000 video and 35,00 telephone customers in Cleveland and Columbus as part of the deal. In a press release, Cogeco Communications president and CEO Philippe Jetté said the deal will add “significant scale” to its U.S. business, raising its total internet customers by about 38%. In addition, the purchase will mean Montreal-based Cogeco will generate more than half of its revenue in the U.S.

Atlantic Broadband has traditionally stuck close to East Coast markets so the WOW deal represents “a major step” in its strategy, ABB president Frank van der Post said in a press release.

“The Ohio broadband systems’ geographic fit with our Pennsylvania operations, combined with our success in winning customer share in competitive markets and our experience integrating acquired properties, will ensure operational efficiencies, a seamless transition for customers, and strong growth in these markets,” van der Post said.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.