The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

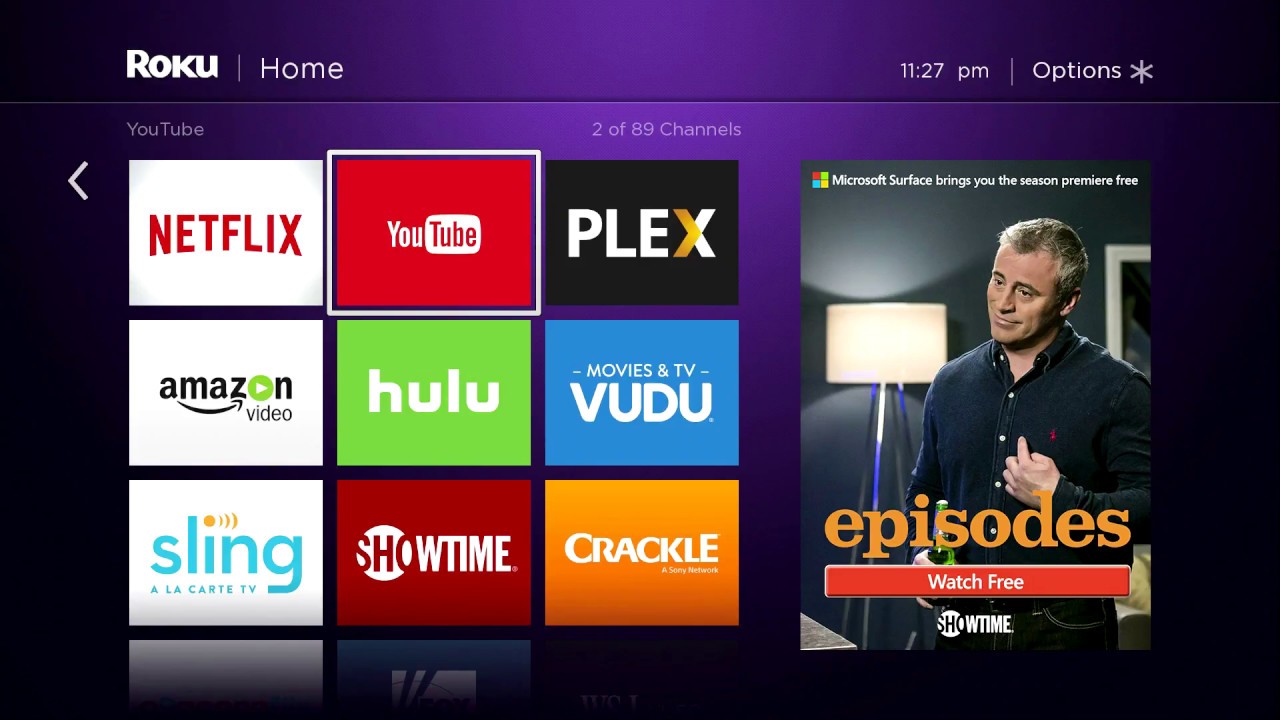

Just when things were starting to settle down in TV land, Roku hit Google up with some serious charges: the internet giant was making “unfair” and “anticompetitive” demands around surfacing YouTube and YouTube TV content in response to user search requests.

Roku claimed that in order to get it to knuckle under, Google was threatening to pull the popular YouTube TV virtual multichannel video programming distributor (vMVPD) from its platform. Google (sort of) denied that move, claiming it was in the middle of normal negotiations, and then — boom! — Roku decided to hit the nuclear button as a negotiating technique.

Ouch.

So what to make of it?

To begin with, it’s not a good time for Google to be accused of anticompetitive anything, given how it is under the microscope in Washington.

It’s anyone’s guess whether Google was indeed getting all Sopranos on Roku or whether Roku was going all Karen on Google, but this is clearly a charge that Google does not want to hear right now. It only serves to reinforce the worst fears of Google critics and, let’s face it, there are far more people who are aware of Google and its potential misdeeds.

In terms of who has the most to lose, that’s an open question.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Consumers who are big fans of YouTube TV will likely just watch it on their smart TV interface: It’s available via Samsung, Vizio, LG and Sharp TVs. Once there, they may be surprised to discover that the original equipment manufacturers (OEMs) have been hard at work on their interfaces. In addition to improving ease of use, they’ve added their own FASTs (free ad-supported streaming TV services) with hundreds of free channels, including all of the popular new Flixes.

So it’s possible Roku loses some customers that way, as is the even-less-likely notion that YouTube TV viewers are so loyal, they’ll go out and buy $29 Amazon Fire TVs or $49 Chromecast 2.0 sticks in order to ensure they’re never without the platform.

Viewers with Roku TVs (TVs with the Roku OS built in) have no such option and are likely to drop YouTube TV (it’s a monthly subscription) and switch over to Hulu Live TV, which offers a markedly similar package. Ditto for users who really like their Rokus, have them set up on multiple TVs and feel no great loyalty towards YouTube TV.

(In fact, if Hulu was smart, they’d even run an offer targeted at Roku users looking to switch from YouTube. Even more clever if they can get Roku to chip in.)

YouTube TV also faces a different kind of potential fallout from this move: Viewers who have been on the fence about why they’re paying more than $50 per month for a service they barely use but hold onto like a security blanket may finally take the plunge and cut the cord. Given that there is more and better programming on streaming these days for considerably less money, I doubt many of them will be disappointed.

There will be some sporting events they can’t watch and they’ll have some trouble finding cable news channels, but I suspect many viewers won’t look back — especially given that vMVPD subscriptions seem to have peaked as of late.

Another point for Roku.

Mostly, though, there’s math: Roku has around 50 million registered users versus around 2 million for YouTube TV. That’s a sizable margin, and while Google does have YouTube itself, few people are likely to be worried that they can’t watch YouTube on their big screen TVs (though to be fair, the number of people doing so is most definitely growing).

Data and Privacy Concerns

The bigger issue here isn’t so much Roku vs Google but rather will OEMs become the industry’s new MVPDs, engaging in frequent and costly carriage battles with programmers that mostly leave consumers frustrated.

That’s a distinct possibility, especially as the lines between programmers and distributors continue to blur.

All of the major OEMs — Roku and Amazon, plus Samsung, Vizio and LG — have their own FASTs, and Roku and Amazon are starting to produce original content for theirs.

They have the advantage now, too, in that few streaming programmers are popular enough at this point to cause real harm by withholding their programming.

The difference though — and it’s an important one — is how consumers will perceive all this.

When satellite TV provider Dish Network engaged in one of its many, many, many carriage wars with the various networks, viewers got that it was about money: The networks wanted more, Dish wanted to pay less and let consumers know that if they had to pay the network more money, then, unfortunately, their viewers would too.

But the current battle is over issues that are less black and white and potentially make both parties look bad.

Talking about who controls viewer data and whether search results can be cooked only serves to remind consumers that “yes, they are tracking all my viewing data and selling it to advertisers” and “yes, those results I see when I search and the recommendations I get may be based on who is paying more, not on what most closely matches my request.”

That messes with viewers' sense of fair play and only serves to underscore all the negative things we’re hearing about the power of Big Tech and its “algorithms,” and all the harm they’re causing.

That’s not a win for anyone in the industry and reason enough to tread lightly, especially as far as consumers are concerned.

Caveat venditor.

Alan Wolk is the co-founder and lead analyst for media consultancy TV[R]EV