Broadcasters Expect Early Voting To Spread Out Political Ads

Typical late deluge could start earlier for expected take of as much as $9B

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With up to 50% or more of American voters casting their ballots well before Election Day on Nov. 3 — either by mail or at local early-voting centers — the traditional political advertising schedule is up for grabs this year. The typical deluge of candidate and referendum commercials during Halloween weekend, especially for local campaigns, is meaningless if most voters have already made their choices weeks earlier.

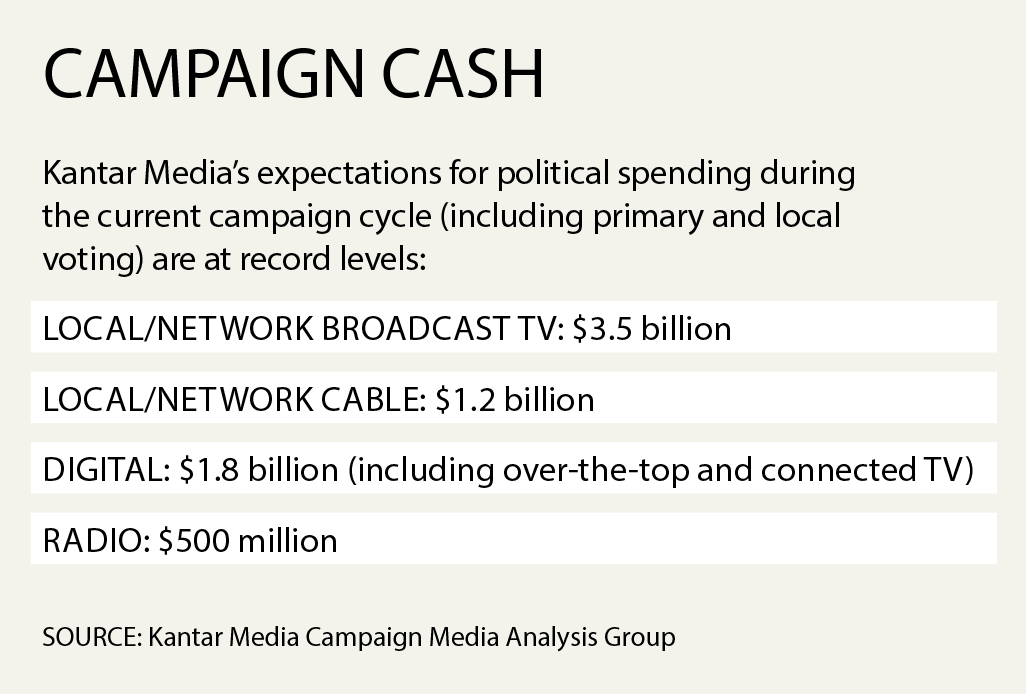

Hence the pre-voting portion of the campaign spending pool estimated at

$9 billion, according to PQ Media, has become a complicated media buy in this unprecedented election year. The growing campaign reliance on online and especially mobile platforms further revises the landscape.

In addition to candidates’ commercials, this year’s political lineup will be overwhelmed by ads from political action committees (PACs), which are not subject to the lowest unit charge (LUC) rates candidates must be offered for broadcast and cable TV buys.

“Early voting [puts] pressure on campaigns to ramp up advertising earlier than October,” Kevin Latek, executive VP and chief legal and development officer at Gray Television, said. “We saw some 2020 Senate candidates start advertising last summer.”

Latek also noted the impact of early political advertising on other commercial placement. “Political advertising displaces traditional advertising to varying degrees,” he said. “Political advertisers tend to advertise in local newscasts more than other types of programming, and that’s where we see the most displacement, and obviously, there is tremendous displacement in local news between Oct. 1 and Election Day in most markets on most stations.”

Starting Earlier, Building Slower

Steve Lanzano, president and CEO of the Television Bureau of Advertising, has observed variants of the early-advertising movement in various states. “It’ll start earlier and ramp up, with slower acceleration,” he said. Lanzano also acknowledged the “agility” of political media buyers, who are buying time very dynamically.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Their money moves on a daily and weekly basis, based on the polls,” he said. “That moves a lot.”

Citing current polling data that indicate about 15 states may be competitive in the presidential race, Lanzano said campaigns have already reserved buys on TV stations in those key markets. “We’re the only megaphone out there,” he said in an S&P Global Market Intelligence interview. “You can’t hold the large in-person political rallies.”

Lanzano said he thinks stations will open up as much inventory as possible for political ads. But there are some hurdles. He cited the comeback of automotive advertising as local car and truck dealers seek to sell vehicles already on their lots, along with 2021 model introductions.

“Inventory management will be important,” he said. One unusual factor this year is that local stations have commercial slots available for tune-in advertising, especially to promote new shows. But since the TV season has been delayed this autumn, Lanzano expects stations will sell that inventory to political campaigns.

Steve Passwaiter, VP and general manager at Kantar Media’s Campaign Media Analysis Group (CMAG), which monitors political advertising, characterized 2020 as “very unfamiliar territory.”

PACs are outspending candidates, he said. A major theme of all political advertisers is to encourage get-out-the-vote efforts. Citing “passion that’s in the mix this year,” he still expects 40% of campaign funds will be spent on ads during October, probably early in the month.

CNN on Labor Day weekend cited separate Kantar CMAG forecasts that the presidential campaigns have already booked heavy TV spending: $171 million for President Donald Trump and $153 million for his Democratic challenger, former Vice President Joe Biden. Those totals are likely to increase, with ad campaigns focused on media in swing states.

Leo Kivijarv, executive VP and research director at PQ Media, a Connecticut firm that has been analyzing election spending since 2004, expects total political advertising to top $9.3 billion this year.

“October will be a bigger month than normal,” he said. “Spending will not be concentrated in the last two weeks before Election Day.”

Money Follows the Polling

Kivijarv said ad-buying decisions would be made dynamically as campaign strategists track voter polls — especially in swing states — in order to throw money toward voters who are still making up their minds. He is especially focused on radio, which over-indexes on African-American and Hispanic voters.

“Everything is happening a little earlier,” said Mark Jablonowski, managing partner and CTO of DSPolitical, a digital advertising company for Democratic candidates and progressive causes.”

“Ad buys are beginning earlier than ever for the more competitive races, but in general, most campaigns will ramp up eight to 10 weeks before the election, which is fairly standard,” Jablonowski said. “We think peak spending will start a bit sooner and last a bit longer than is typical,” although campaigns for down-ballot races may be delayed because of fund-raising problems, he added.

“Early spending for the general election is up by 14% in Effectv markets this cycle compared to 2018 and 20% over 2016,” Dan Sinagoga, head of political sales at Comcast’s Effectv ad-sales unit, said. He expects a continuing commercial flow during September and October, front-loaded more than usual.

“History shows that 63% to 65% of the full year’s spending happens from Labor Day to November Election Day once the General Election window opens,” Sinagoga said. “That [is] holding true in this cycle given the pace of the spending.” (The balance of political spending comes during primaries and for other campaigns.)

Contributor Gary Arlen is known for his insights into the convergence of media, telecom, content and technology. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the longtime “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports. He writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs. Gary has taught media-focused courses on the adjunct faculties at George Mason University and American University and has guest-lectured at MIT, Harvard, UCLA, University of Southern California and Northwestern University and at countless media, marketing and technology industry events. As President of Arlen Communications LLC, he has provided analyses about the development of applications and services for entertainment, marketing and e-commerce.