Sling TV: Everything You Need to Know About the vMVPD as It Fights for Relevance Amid Dish’s Wireless Future

The very first live-streamed pay TV service is now in recession. Does it have a future now that its parent company wants to become the fourth U.S. wireless carrier?

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Sling TV is at a crossroads. Once believed to be the successor to traditional linear TV distribution, offering skinnier programming bundles and lower prices, Sling TV finds itself struggling to grow its customer base, compete with streaming video services and direct-to-consumer offerings from content creators. At the same time, the service is vying for attention within its own parent company -- Dish Network -- which at the moment seems much more focused on the wireless side of the business.

But who can blame Dish? With its satellite TV business slowly disappearing -- it lost about 273,000 subscribers in Q4 and has shed more than 3 million customers over the past five years -- television distribution is becoming less attractive with each passing year. Dish expects to launch its first wireless market -- Las Vegas -- later this year and has revealed more than 25 other cities that are expected to receive service in 2022.

Sling TV lost about 107,000 subscribers in Q4, which Dish CEO Erik Carlson said during the company’s Q4 conference call with analysts was due to the company’s failure to execute, adding that the company is focused on re-engineering its platform and user interface.

Also: Sling TV Takes Center Stage

So far, Sling has managed to outlast at least one of the early OTT competitors -- Sony PlayStation Vue closed its doors in 2020. But the high cost of programming and increased competition with streamers has affected every player in the space. Hulu Plus Live TV has about 4.3 million customers and YouTube TV about 3 million, but are priced at more than double the rate of Sling TV and added to the tough going of the business. In December 2020, Hulu Plus Live TV raised its price to $69.99 per month, but added free access to streamers Disney Plus and ESPN Plus as part of the package. YouTube TV raised its monthly rate to $64.99 in 2020.

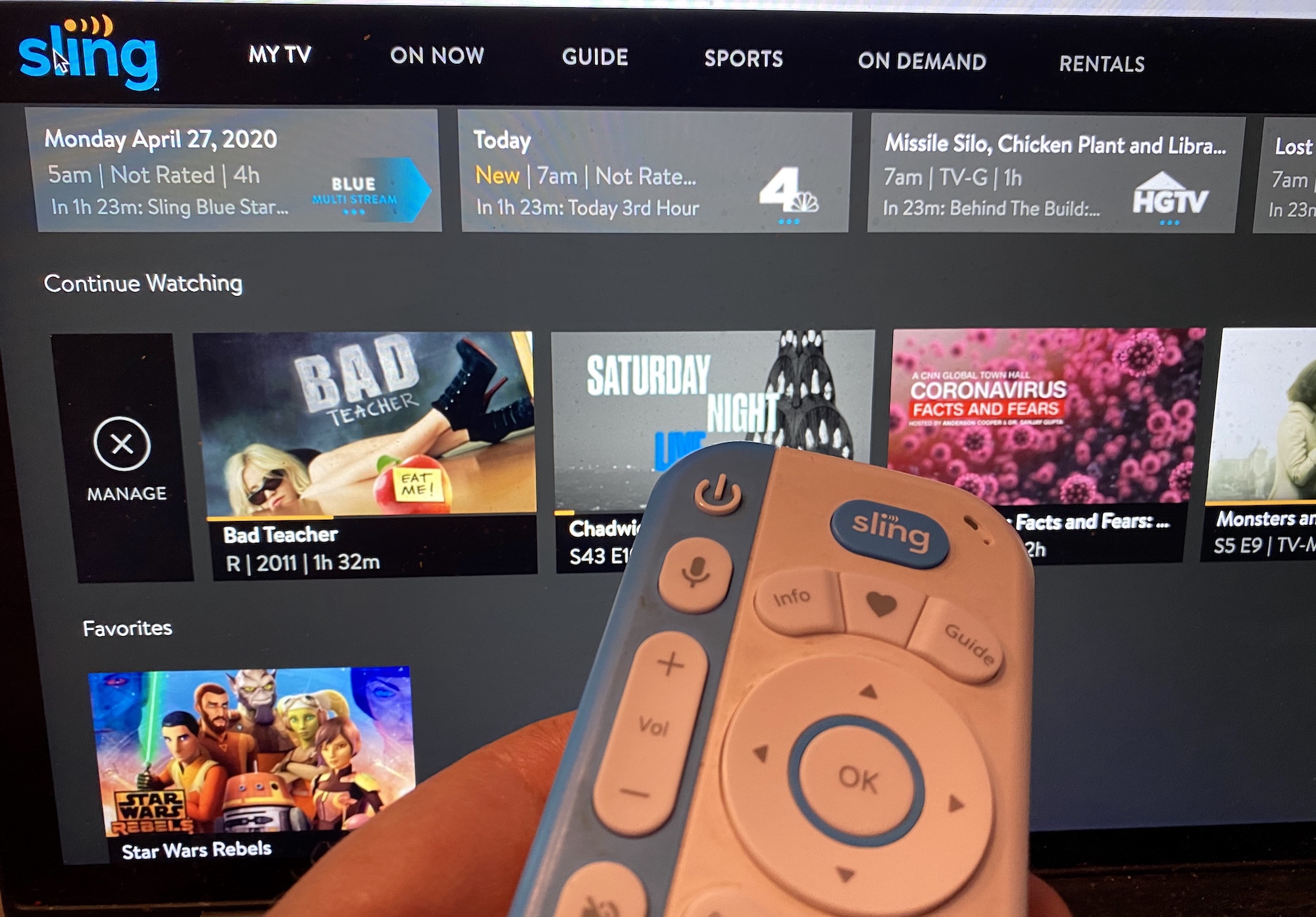

Where Can I Get Sling TV?

The Sling TV app is available through the app stores of most of the major connected TV brands. Basically a broadband connection is all you need to access Sling TV. The service is available through several devices, including: Apple TV, Chromecast, Android TV, Google TV, Roku, and Samsung, Vizio and LG SmartTVs. Broadband-only services like Xfinity Flex and Cox’s Contour Stream also allow access via the Sling TV app.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

How Much Does Sling TV Cost?

Sling TV is separated into two main packages -- Sling Blue and Sling Orange, each which are available for about $35 per month. The company offers a $10 discount for the first month of service. Sling Orange can be streamed on one device and has 32 channels of programming -- mainly entertainment and news offerings like A+E, AMC, BBC America, CNN, Cartoon Network, Discovery Channel, Disney Channel and three sports networks -- ESPN, ESPN 2 and ESPN 3. Sling Blue can be streamed on three devices, offers 42 channels and includes Fox Sports 1, Fox News Channel, TBS, TNT, USA Network and Vice.

For $50 per month, subscribers can stream 50 channels on one-to-three devices, depending on the network.

Each package also includes 50 hours of DVR storage.

What Shows Can You Watch on Sling TV?

Programming from 50 networks is available through the service, with Sling Orange viewers able to watch about 35 channels, including six that aren’t available on Sling Blue like Freeform (which has youth-oriented shows like Single Drunk Female; Good Trouble and The Secret Life of the American Teenager), sports programming and news from ESPN, ESPN 2 and ESPN 3; kids programming from Disney Channel; and automobile-focused shows like Roadkill Garage and Engine Masters from Motor Trend.

Sling Blue subscribers get access to 42 channels including sports network Fox Sports 1; general entertainment networks like Bravo (Top Chef and Real Housewives of New Jersey); E! (The Bradshaw Bunch; Clash of the Cover Bands); Syfy (Resident Alien, The Expanse); USA Network (WWE Raw and Temptation Island); and TruTV (Billy on the Street and The Chris Gethard Show); news channels like Fox News Channel, MSNBC and HLN and education-focused channels like Discovery Channel (Naked and Afraid, Gold Rush), National Geographic (Wicked Tuna, The Incredible Dr. Pol) and TLC (My 600-Lb. Life, Sister Wives); all of which are unavailable on Sling Orange. All 50 networks are available for a $50 monthly subscription to Sling Blue and Orange.

Over-the-air broadcast networks can be accessed via a separate digital antenna the customer purchases on their own (or free via Sling TV after paying for two months of service). For $49, subscribers can get access to OTA channels through an AirTV2 device (regularly priced at $149) and a digital antenna, after paying for three months of service. In select markets like New York, Chicago, Dallas and others, Fox and NBC local stations are available via the Sling Blue service. ■

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.