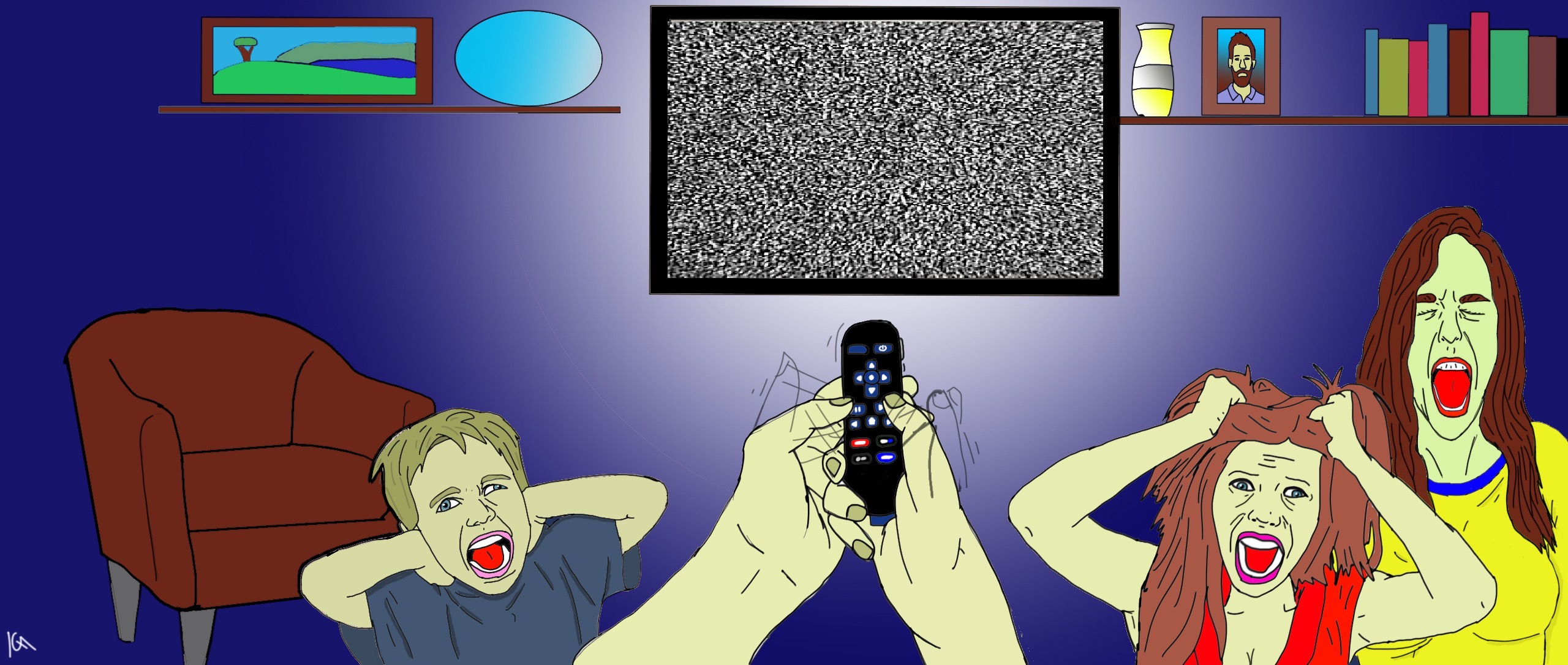

Production Panic: Can the Major SVOD Services Keep Up with Ravenous Audience Demand?

Will pandemic-caused production delays soon make discovering something good to watch harder than finding toilet paper? From Netflix to Disney Plus to Peacock, we break down which streaming services can go the social distance

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

For a platform like Comcast/NBCUniversal’s Peacock, the pandemic represents the best of times and the most challenging of moments, all rolled into one.

Speaking to reporters last week the day before the streaming service conducted its limited launch on Comcast’s X1 and Flex video platforms, Peacock Chairman Matt Strauss lamented the massive disruption the COVID-19 pandemic wrought on NBCU’s original national launch plan for Peacock, which was tied directly to the Tokyo Olympics in mid-July.

Those Olympic Games may have been pushed back to 2021, but quarantined audiences across North America and Europe are consuming record amounts of linear and OTT television. Strauss acknowledged a “historic” opportunity for platforms like Peacock to find audiences that have never been so ready to engage.

Rather than pull back on Peacock’s mid-summer plans, Strauss said his group might launch the streaming service even earlier than July 15.

“Now more than ever,” Strauss declared, describing the urgency and relevance of his video service. Just a few months ago, some wondered if Peacock—along with Apple TV Plus, Disney Plus, HBO Max, Quibi, and all the rest of the “combatants” involved in the so-hyped “streaming wars”—were wading into a business with not nearly enough eye balls to support it all.

Well, these days, eyeballs they got. But with Hollywood’s production studios shut down, and operatives largely confined to post-producing whatever is already shot and in the can, or whatever can be shot from remote home-office locations, SVOD services could soon find themselves facing a pandemic-era dilemma your local grocery store chain is already real familiar with: Sure, the lines are out the door, but there’s no eggs or toilet paper.

Strauss, for example, conceded that many of Peacock’s planned originals now won’t be available until 2021.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

With this mind, we surveyed the SVOD services in an effort to determine which are stocked up and ready to meet the increased audience demand, and which ones might run into trouble. Here, in no particular order, is our service-by-service analysis of how the major SVOD services stack up amid the pandemic production panic.

NETFLIX

Introducing his “Quarterly SVOD Tracker” report last week, MoffettNathanson analyst Michael Nathanson said there’s a reason why Netflix just saw its stock spike to record levels.

“The world is trapped indoors, live sports on TV is non-existent, theaters are closed, unemployment is spiking to terrible levels, and new content is impossible to produce,” Nathanson wrote. “Who wins? The one company with an incredibly cheap price point, a gargantuan library of new and original content to satisfy most demand and broaden distribution.”

Just this past Friday, Netflix introduced complete first seasons of two new series: Kenya Barris sitcom #blackAF and reality/dating show Too Hot to Handle. The service’s Tiger King, which launched in March and seemed to come out of nowhere, is now one of its most-watched series historically. Eight new shows will be available for streaming on Netflix this week. And Ryan Murphy's WWII-era limited series Hollywood is set for a May 1 debut.

Even if it scales back to half that number each week, Netflix should be positioned well.

Netflix’s library is smaller than in year’s past, but its selection still includes more than 2,000 TV shows and nearly 4,000 movie titles, according to a tally published by Reelgood in February.

“Netflix is in a class of its own, and its success did not come overnight,” said Robert Russo, president of consulting company RNR Media. “It was years of planning, a tremendous investment for a wide array of quality content, and a model that set the mold for this new online platform. Whoever has the most programming they have stocked up on, and I do believe that is Netflix, is best positioned to weather this storm.”

AMAZON PRIME VIDEO and HULU

Like Netflix, Amazon Prime Video and Hulu have built their digital brands around a steady flow of original content and library product. Neither spends nearly as much as Netflix and its $17.3 billion content budget for 2020, according to BMO Capital Markets. But each has plenty of originals in the can, and at this point, a more diversified content portfolio.

Amazon Prime Video, for example, is augmented by a transactional video business and services like Amazon Channels. And for now, it has originals like the just-premiered latest season of Bosch to keep viewers hooked.

Hulu, meanwhile, has the benefit of Disney’s myriad content channels. The newly established “FX on Hulu” pipeline, for example, just yielded the Phyllis Schlafly biopic series Mrs. America.

“Overall, I think the ‘rich will stay rich’ among these streaming services during this quarantine. They have enough product available to endure, even if they have to slow down on releasing new product,” noted Robert Russo. “But if this production shutdown lags on, the norm for now will have to be finding new ways to produce content remotely while placing a greater emphasis on the library product.”

PEACOCK

For the national rollout of its $4.99-a-month subscription premium tier ($7.99 without any ads) in mid-July, Peacock is touting 15,000 movies and TV shows, with a flurry of originals highlighting the mix. (As mentioned, the service is already deployed into select Comcast pay TV homes.)

Aldous Huxley adaptation Brave New World is “essentially done,” Strauss said. He added that he’s “optimistic” that reboots Punky Brewster and Saved By the Bell will be done for this year, as well. Beyond those shows, much of Peacock’s plan for scripted originals will likely have to wait until 2021, with production studios shut down.

Also read: Comcast’s Peacock Streaming Service Created From Traditional TV’s Winning Recipe

Given that reality, Peacock has pivoted to promoting its robust library of recent-era sitcom hits—30 Rock, Parks and Recreation, and Two and a Half Men were highlighted in last week’s press release, for example. It’s also plugging late-night shows like Jimmy Fallon and Seth Meyers that can be remotely sustained in their hosts living quarters.

“The advantage for Peacock, among other services with significant libraries, is this evergreen product,” said Robert Russo. “It gives you plenty of content to access. But with fewer original shows at launch, you have to wonder if these shows many people have already seen will be able to carry it.”

Strauss thinks they can, at least for a while.

“We’re really fortunate that we have such a vast library of content that we know is going to resonate,” Strauss said. “Viewers are seeking programming that’s comfortable, that’s familiar and nostalgic. And families are spending a lot more quality time together. This provides a unique opportunity to share common experience, to revisit some of their favorites. It plays to our strengths.

Strauss also noted that Peacock will also exists as a skinnier (7,500 series without originals) free, ad-supported service. Given the new market dynamics, Peacock could actually thrive in that iteration, he said, adding, “Nothing’s more affordable than free.”

HBO MAX

AT&T/WarnerMedia’s $14.99-a-month entry into the streaming wars is still set to launch in May (date still not specified) with an announced 10,000 hours of content, including movies and shows from Warner Bros., New Line, DC Entertainment, TNT, TBS, truTV, and the Cartoon Network.

WarnerMedia kept the original series announcements humming all through the winter and early spring. But even the most anticipated among that flurry—the unscripted Friends reunion special—couldn’t get done before the sudden COVID-19 shutdown.

Again, WarnerMedia has a library to fall back on—notably, the HBO vault.

“Given the caliber of many of its shows, I can see the audiences discovering or revisiting dramas like The Sopranos and The Wire on HBO Max,” noted Russo. “This could be enough to carry them for now.”

Some current HBO shows like Real Time with Bill Maher, meanwhile, are being shot remotely, with the host situated in front of a blue screen at his home.

Appearing on CNBC over the weekend, Jeffrey Hirsch, CEO of HBO rival Starz, said much of his premium network’s content is shot a year in advance. So for now, it’s a matter of remotely conducting aspects of post-production from remote locations, and Starz’s production pipeline is minimally impacted. At least on the HBO side of the business, it’s probably not unreasonable to suspect a similar production workflow is in place.

“The internet is still our lifeline, more so than ever before” said Mike Tankel, partner at marketing and development firm To Be Continued. “But, for now, the challenge is keeping the momentum going at a time when production is at a standstill.”

DISNEY PLUS

Considering the breakout success of recent ABC special The Disney Family Singalong, an early example of a show that can be produced from remote “distanced” locations, viewers at the moment seem hungry for inspirational programming. And that alone can make the content in Disney Plus—which recently surpassed 50-million paid subscribers globally—even more appealing.

“Disney Plus, like Amazon Prime, was smart enough to lock us in to year-long deals, and that can make a huge difference if this quarantine extends indefinitely,” Tankel said. “Then there is its library, which includes the Marvel, Star Wars, Pixar, Nat Geo and Disney brands.”

Also read: Disney Plus: How It Went From Zero to 28.6 Million in Less Than Three Months

Launched in the U.S. in November, Disney Plus touts a library of about 7,500 TV show episodes and 400 films. Those films include Onward, which wasn’t able to finish its U.S. theatrical window before the shutdown.

But there could be trouble ahead. According to Nathanson’s latest “SVOD Tracker,” research firm HarrisX found that while Disney Plus managed to reach 27% of U.S. streaming households by March, there’s been a recent drop of -1,000 basis points among people who use the service on a daily basis.

This, Nathanson concluded, “may signify the need for more original content,” a need that’s emerging at a particularly bad time.

APPLE TV PLUS

Nearly six months after launching, Apple’s big SVOD play is still only used in about 7% of U.S. streaming homes, according to HarrisX data.

This, Nathanson said, “speaks to its very limited content offering and lack of library.”

Apple has offered its $4.99-a-month streaming service for free to purchasers of new Apple devices. At this point, only around 43% of the service’s limited user base is paying for a subscription.

Also read: Is It Already Too Late for Apple TV Plus?

At the end of the year, when Apple starts asking many of those subscribers to pay, will any of them be enticed? With what limited content it already has at its disposal, Apple is trying.

As another sign-up incentive, for example, Apple TV Plus has made some of its original shows free to watch for anyone during the pandemic. New and upcoming shows include Spike Jonze's upcoming Beastie Boys Story and special Oprah Talks on COVID-19. And just last Friday, Apple TV Plus introduced docuseries Home. Drama Defending Jacob, comedy Trying, and animated musical Central Park are expected in May.

So far, only drama The Morning Show has generated early buzz.

“Apple TV Plus still has not hooked me with a show,” Tankel noted.

QUIBI

In its first week, Quibi launched with 50 individual shows, with another 175 shows planned to roll out by year end. But, with productions on host and minus the library content, Quibi is asking producers to shift to programming options that can be produced remotely and turned around quickly.

With the pandemic disrupting production of Quibi’s slate of current events-driven shows, which the mobile-first programming service umbrella-brands under the moniker “Daily Essentials,” producers are finding new, remote ways to tell their stories.

Also read: Can Quibi Build a Brand From Scratch Amid Stiff Streaming Competition?

For example, Tim Kash, who hosts music show Pop5, moved his scaled-down set into his garage. And Jimmy Mondal, host of videogame-themed show Speedrun, is shooting from his living room.

“On the majority of our shows, our partners have been very entrepreneurial," Quibi founder Jeffrey Katzenberg told The Hollywood Reporter just before the service’s April 6 launch. "And, you know, they’re delivering." Katzenberg told THR that he was expecting the premieres of only two shows to be delayed, including Hot Off the Mic, which relies on recent footage of comedy club sets, and the 60 Minutes-inspired 60 in 6, which is on hold after an outbreak inside CBS News.

Various metrics, including app downloads, point to a slow start for Quibi, however. And the pandemic seems to be posing a more existential challenge to Quibi than the toughened task of getting its shows made.

Essentially, consumers are asking, why do I need to watch TV on my phone when my living room TV set is right here?

Marc Berman is editor-in-chief for media-centric The Programming Insider (programminginsider.com), which pioneered the email newsletter format at its inception in 1999. Marc has written for a wide range of publications including Broadcasting + Cable, Next TV, Forbes, Newspro, Campaign US, The Hollywood Reporter and Variety. Known as “Mr. Television” at Mediaweek (now Adweek), Marc has appeared on camera on Entertainment Tonight, Extra, Inside Edition and CNN and MSNBC, among other series and outlets. He is a member of The Television Critics Association and The Broadcast Journalists Television Association. And Marc put his TV historian hat on as author of desk calendar Today in TV History.