New Government Data Shows U.S. Broadband Market Saturated: Analyst

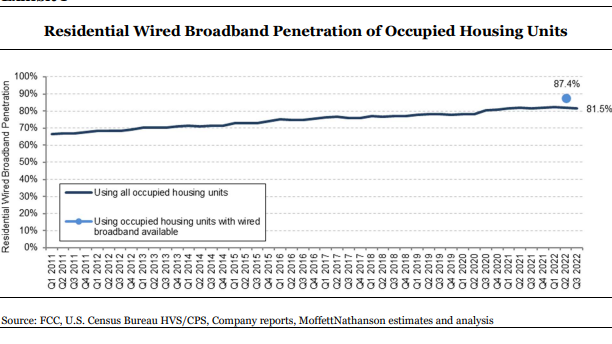

FCC estimates say wired broadband is available to 93.7% of homes, putting penetration at 87.4%, according to MoffetNathanson's Craig Moffett

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Mystery solved. Craig Moffett, the influential principal and senior analyst at MoffettNathanson, said new government figures give him the penetration rate for wired broadband in the U.S.

The rate, which he figures is 87.4% of broadband-available homes, suggests the broadband industry is saturated, a better outcome than finding an industry suffering a share loss to fixed wireless. Moffett’s previous estimate was 81.5% penetration.

As Moffett writes in a new report, which teases its conclusion until the very end: “The single most critical question facing cable investors is what happens to broadband subscriber growth from here. If the problem facing cable broadband today is saturation, then subscriber growth likely flatlines from here. If the problem is market-share loss, it probably goes negative.”

Also: Analyst Asks If Cable Is a Good Business and the Answer Doesn’t Mention TV

Moffett said the latest data from the Federal Communications Commission “strongly supports the ‘saturation’ thesis, in our view. What’s left to penetrate (of what has already been wireline enabled) will have to compete with headwinds that include poverty, illiteracy and, of course, relevance. We’ve seen estimates that suggest that fully half of broadband-enabled but unsubscribed homes don’t own computers. We don’t suggest that 87% penetration of homes is a ceiling … but it is likely not far from one.”

The Federal JOBS Act allocates $43.5 billion to bring broadband to rural areas, Moffett noted. The newest figure shows 7.3% of the country lacks access to a wired internet provider. The program also targets underserved locations, with access to slower than broadband-level service. That raises the target market to 12.8% of the country, or 18.3 million total housing units.

The notion that wired broadband is close to full penetration explains the pivot to rural expansion by Charter Communications, Moffett said.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Charter’s view is that the 12.8% or so of the country that has not yet been wired for robust broadband service, while undeniably quite rural, will be attractive to build to when the government’s subsidies are included … or it won’t,“ he said. “They will make that choice on a location-by-location basis, just like everyone else. Their expectation is that there will be more than enough opportunity to fully and attractively utilize whatever capacity they can find.”

Going forward, Moffett expects cable operators in particular to be major participants in the government’s subsidy programs, “bidding aggressively to bring broadband to unserved census blocks on the periphery of their current franchise areas.“

The Holy Grail number that unlocked Moffett’s calculations was the number of homes that have access to broadband. “We know how many homes in America have broadband, and we know how many homes there are in America,“ he wrote. ”But we’ve never known how many of those homes have access to broadband, and how many are too rural and are therefore unserved.”

Well, this new government report finally fixed that.

Moffett said he continues to rate Comcast “outperform” with a target price of $46 a share. Charter is also rated “outperform” with a target price of $582. Altice USA is rated “market perform,” with a target price of $5, as is Cable One, with a target price of $740. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.