With New Deal, Viacom Steadies VOD Ship

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Viacom's new deal with Amazon has put to rest—at

least for now—concerns that streaming video revenue, which stoked TV companies'

profits for the past year, could dry up.

Worries arose in April, when Netflix said it would allow its

broad deal with Viacom Networks to expire at the end of May. "As we continue to

focus on exclusive and curated content, our willingness to pay for

nonexclusive, bulk content deals declines," Netflix CEO Reed Hastings said in a

letter to shareholders.

Fortunately for content companies hoping to monetize their

libraries, Netflix isn't the only buyer in the stream. That's good news as

online subscription video-on- demand deals expire for companies that are more

reliant on streaming revenue than Viacom, such as CBS and Discovery

Communications.

Amazon last week snapped up what it called hundreds of TV

shows and thousands of TV episodes from Viacom for its Prime Instant Video

service—some of which had been previously available on Netflix—plus fresher

content, some of which will be exclusive. The content includes Nickelodeon kids

shows such as Bubble Guppies and Team Umizoomi, new episodes of Dora

the Explorer and SpongeBob SquarePants, MTV series such as Awkward

and Comedy Central's Tosh.0.

All along, Viacom CEO Philippe Dauman has been assuring

analysts that, even after Netflix said it would not renew its streaming deal,

affiliate revenue would be up 10% this year. "We continue to see the digital

distribution arena as a growing opportunity, and one that will be complementary

to what we do. And it's just growing the pie over time," Dauman said during the

company's second-quarter earnings call in May.

Amazon Deal a Prime Mover

When the Amazon deal was announced, analysts said it

fulfilled Dauman's promise. UBS analyst John Janedis headlined a research note

about the deal "Affiliate Growth Story on Track." Janedis said, "We expect that

it will have a $60 million-$70 million impact in fiscal 2013, allowing Viacom

to meet its 10% affiliate fee growth guidance." He pegged Viacom's affiliate

growth at 9.7%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Marci Ryvicker, analyst at Wells Fargo Securities, said,

"Netflix's loss is Amazon's gain and either way, Viacom still wins." The deal

"reinforces management's comments that there are willing buyers of its

content," she added.

Viacom is also talking to Netflix about a domestic deal for

some programming not included in the agreement with Amazon. The two companies

do business in international markets. But analysts expect any new Netflix deal

to be smaller than the one that expired.

Analyst Todd Juenger of Sanford C. Bernstein is concerned

that Viacom affiliate growth will slow in 2014. "How will Viacom be able to

grow SVOD revenue in the following year(s), considering the Amazon deal is

multi-year and includes exclusive elements?" Juenger asked in a research note.

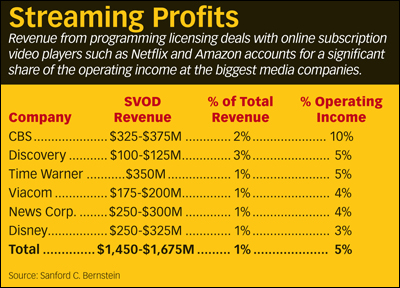

The question is an important one for programmers. Juenger

calls the programmers' need for SVOD revenue "an addiction." He estimates the

big media companies now take in about $1.5 billion a year in streaming

licensing revenue. Because there are very few costs associated with streaming

revenue, nearly all of it falls to the bottom line, making it a big contributor

to media company profits.

For example, Juenger estimates that CBS takes in $325

million-$375 million in SVOD revenue, which accounts for 2% of its total revenue

and 10% of operating income, making it tops in the field. Streaming represents

5% of profits at Discovery, Time Warner and Viacom, 4% of profits at News Corp.

and 3% at Disney.

Juenger said there will be about $4 billion in SVOD content

spending over the next two to three years, but a growing percentage will go

toward original programming, such as Netflix's House of Cards and Arrested

Development. Also, the increase in spending will reflect an uptick in

subscribers and lead to more viewership, which means ratings for the

programmers' core businesses will be cannibalized, particularly in the kids

arena.

Juenger points out that in announcing the deal

with Viacom, Amazon noted that kids' shows are one of the most-watched TV

genres on Prime Instant Video. "This observation is consistent with previous

Netflix comments and supports our view that SVOD will continue to cannibalize

linear kids' viewing, as many kids and their moms prefer to access content via

the SVOD platform regardless of what content is ultimately available," Juenger

said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.