Network Sales Execs Data-Enrich Their Pitches

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

At first glance, the changes resulting from the digital disruption of the television business might not be obvious at this week’s annual round of broadcast primetime programming presentations.

The broadcasters will spend the week at center stage looking to impress advertisers and media buyers with a new crop of dramas and sitcoms. At Radio City Music Hall, Carnegie Hall and other venerable venues, there will be stars galore, singing and dancing, jokes of uneven quality and a heaping helping of “Uptown Funk.” Afterward, the jumbo shrimp will be chilled, the drinks will be strong and the music loud. Upfront week will feel very familiar.

And yet, according to the people in charge of TV’s biggest ad sales operations, this year could actually witness something brand-new: the first data upfront.

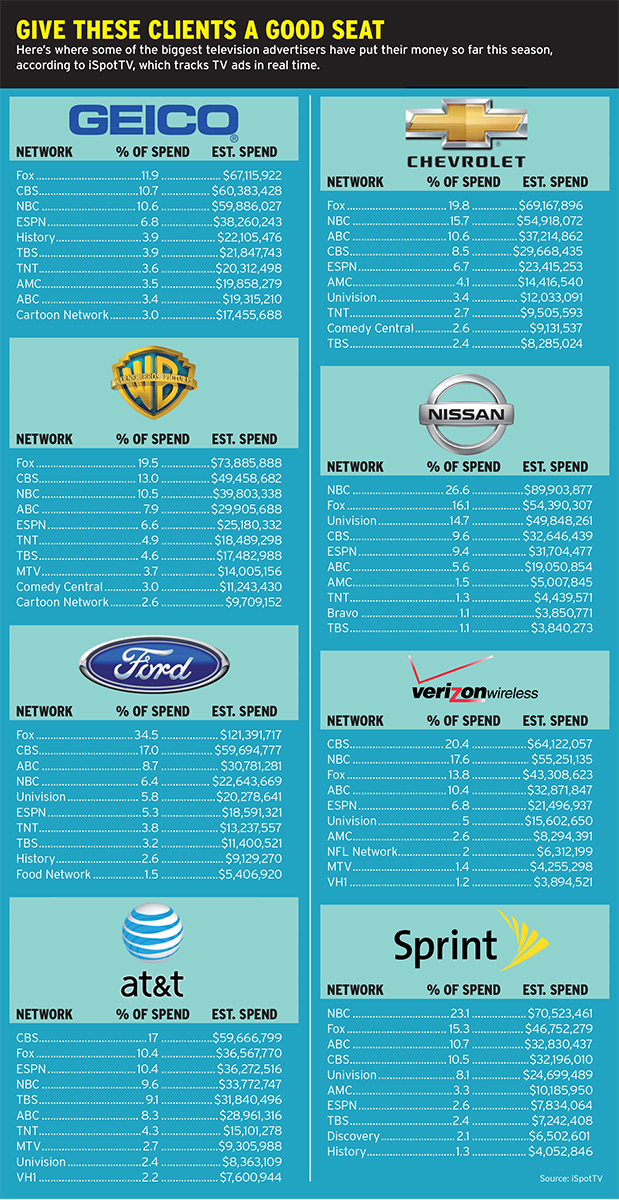

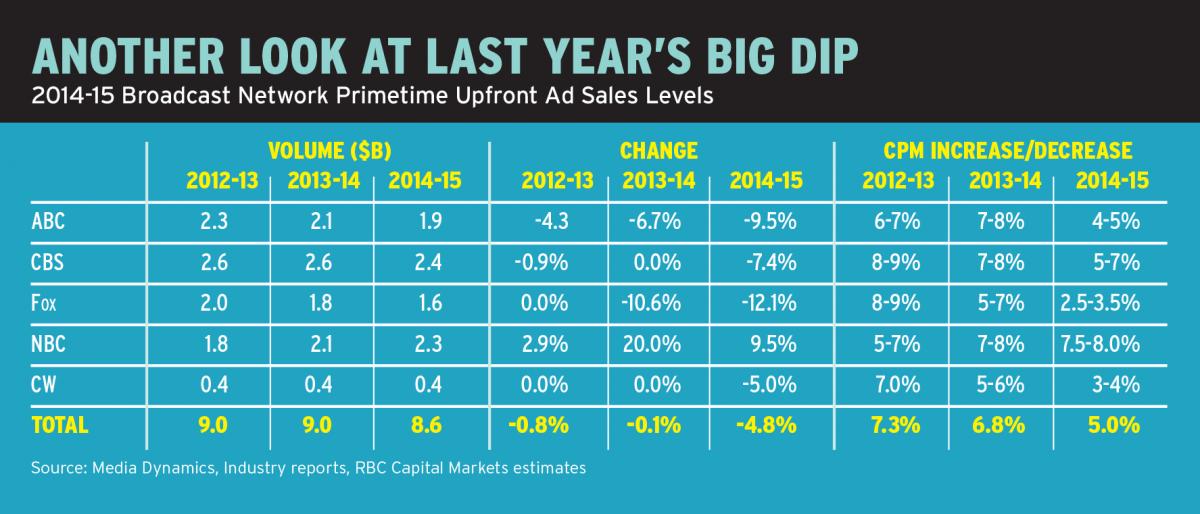

Those prepping pitches say they will contain more references to audience platforms, analytics and even programmatic buying from the networks. Besieged on several fronts, nets are fighting back because upfront volume went down last year and a growing share of ad dollars is flowing into digital. In particular, digital video is gaining, given its promises of more precise targeting, more accountability and clearer return on investment.

While everyone will talk the data talk, some media companies have walked the walk longer and made bigger changes in the way they value and allocate their advertising inventory.

“This will be our second-and-a-half data-driven upfront,” says Linda Yaccarino, who as chairman of ad sales and client partnerships at NBCUniversal oversees a vast portfolio of broadcast, cable and digital assets that generate $10 billion in revenue.

Yaccarino says she’s glad to see the industry embracing the importance of data. “We’re going into this upfront cautious but excited about what we have to offer because the expanse of the offering across our portfolio now fueled by great systems and technology is really incredible.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

NBCU has rolled out several data-based ad products, including NBC Plus Powered by Comcast, programmatic exchange NBCUx and the Advanced Targeting Platform, which isolated the inventory that performs best for advertisers in select categories.

Yaccarino says the products are supported by their ability to work at the program level, and because they offer the flexibility to adjust campaigns in mid-flight. “That’s a big thing,” she says. “It’s another demonstration of the investment by our company to make sure we take the right road toward audience selling to help our clients sell more product.”

Like NBCU, Fox Networks Group last year consolidated its broadcast, cable and digital sales operations under a single executive, president of sales Toby Byrne. “The point was to break down silos so we could do the best business we can with our agency and client partners across our entire portfolio, hopefully leading to an elevated conversation and the opportunity to do bigger and deeper partnerships,” Byrne says.

Byrne is likely to open the May 11 upfront as a representative of the entire Fox Networks Group, acknowledging cable networks like FX and Fox Sports 1. But the programming presentation will focus on broadcast prime as usual. Byrne expects to negotiate broadcast and cable together with most of the big agencies, but “we’re not being heavy-handed about it, and we’re not going to try to force square pegs into round holes.”

Fox is also addressing the d-word. “We’re focused on our data, partnering with the right third-party data companies to further prove the value of our programming both on a linear and non-linear basis,” Byrne says. “We want to continue to innovate with our ad formats and products. That is an area of emphasis for us.”

Building (and Billing) an Empire

After a couple of tough years of falling ratings and lower ad revenue, Fox comes into this upfront with something no algorithm can produce: a big fat hit. Empire, the hip-hop primetime soap opera set at a record company, posted the kind of numbers that help not just Fox but keep all of broadcasting relevant.

“It’s good for the business. Advertisers and networks all are aligned in that we all want to have assets with impact and scale. Empire is one of them,” Byrne says.

But Empire gives Fox in particular a needed boost. “We have better assets to compete this year vs. last year,” says Byrne. “In addition, we’re going to market in a different way with our unified sales structure in place, which gives us the breadth of the Fox Networks portfolio to utilize in the context of our negotiations.”

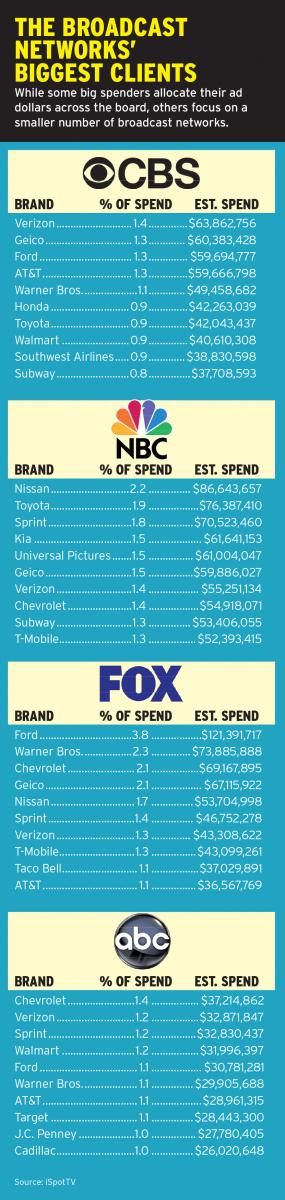

As the top-rated over-the-air network, CBS rakes in the most among the broadcasters during the upfront. CEO Leslie Moonves is on the record telling Wall Street, “I feel very confident that we will once again lead the marketplace in pricing and volume.”

CBS recently released data showing CBS how many consumers it reaches. “We have the most stable and consistent schedule out there and we recently released data showing that our primetime programs deliver more consumers—across every major advertising category— than any other,” says Jo Ann Ross, CBS president of ad sales. “We see this as a very compelling proposition for advertisers. Nina and her team had a very strong development season, plus, we have the power of Thursday Night Football again this year, which brings more original programming throughout the season.”

Research Wizard

CBS is not as tradition-bound as it is sometimes painted. Ross says CBS research wizard David Poltrack has been pumping out consumer purchase data for three years.

“Last year going into the upfront it became an even bigger part of the conversation, and we were prepared because we do have Poltrack and his team out at [Las Vegas research facility] TV City to answer any questions to provide whatever data or analytics the clients need,” Ross says. “During the upfront negotiations, not every client wanted the data or analytics. This year, it’s become more a part of the bigger conversation.”

In March, CBS introduced its Campaign Performance Audit, which uses data-driven analytics to evaluate the effectiveness of their campaign.

“We are in this space, with what we believe is a measurement system and a return on investment analysis that will work if clients want to take advantage of it,” Ross says. “So I think it will come into play as we’re having those broader and deeper con versations and we’ve said that we’re here to offer that to anyone who wants to take a look at it.”

ABC has been talking about data with clients for the past year and a half, says Geri Wang, president of ad sales. “We rolled out the first digital video programmatic trial last May,” she says. “ We continue to engage with our clients about how to better apply their data, third-party data, and potentially our data in unique ways across our inventory. It’s a real opportunity, and you’ll hear more during our upfront presentation.”

During its programmatic test, “we confirmed a lot of assumptions,” says Wang. “First, it’s one thing to ‘talk data,’ it’s another thing to actually ‘do data.’ The plumbing, inventory management, forecasting, pacing and delivery against goal is all really hard to do when you are working with lots of different targeting criteria. More importantly, targeting creates value. We’ve had clients tell us that their campaigns performed better when we applied data.”

Wang says ABC is building its data capability, and it expects to conduct more data-driven business this year across its digital portfolio.

ABC is also working more with its Walt Disney Co. sibling ESPN. “We’ve got a great combined morning story, a fantastic collaboration around college football, the BCS Championship and New Year’s, and a growing Walt Disney Company data capability,” she says.

Wang downplays the importance of whether clients decide to commit money now in the upfront, or buy ads closer to air in the upfront market.

“Our focus is the total marketplace,” she says. “What is most important is talking to clients about what needs they have, where they have challenges, and how we can help them with data, and with great content and advertising offerings,” she says. “When we transact the deal is less important to us than if we create the right solutions, at the right times, and can deliver them seamlessly to drive our clients’ business.”

Improving in a Flash

When The CW launched its new season and The Flash became a hit, executive VP for ad sales Rob Tuck’s phone started ringing off the hook.

“A message has got out that we’re not just a home for young female teens, we are now home for young adults, males included, and we’ve grown up and broadened out and our scatter market has not stopped since our launch,” Tuck says.

Adding male viewers and increasing the network’s age a bit has made The CW attractive to big advertisers in new categories, including financial services, autos and quick serve restaurants.

“This is definitely our best scatter and all-around year in many years,” Tuck says. “Our new season pitch, which hit the streets [in] January, was really well-received.”

The CW was an early mover in selling ads when its shows appeared on digital devices alongside its over-the-air commercials. Now it is also “trying to provide our clients with a more in-depth view of what the consumer is watching,” Tuck says. “As everybody else is looking at the data and trying to provide more information, we certainly are doing the same.”

The CW has also been playing in the programmatic space. Tuck says programmatic is less about buying cheap eyeballs and more about meshing the data to reach the right viewers. “We have played around with a few things with some of the agencies in the programmatic space and we will continue to do so, so we can learn more about our viewer as well,” he says.

By any measure, there are some high-profile items in this year’s upfront. CBS’ Moonves told analysts on the company’s earning call that when it comes to spots in the 2016 Super Bowl, “$5 million to $6 million sounds pretty good to me.” His sales chief Jo Ann Ross wouldn’t say how many spots she’s sold at those prices. “We know where we need to go,” she says. “We have a road map. It’s all moving forward.”

What could be bigger than the Super Bowl? How about the Rio Olympics, held in a friendly time zone?

“To have the virtually live Olympics in 2016 that will be offered on every single platform and every single event available to the consumer, it will undoubtedly be the most viewed event of all time,” says NBCU’s Yaccarino. “I would certainly expect the [ad] revenue to reflect the ratings.”

Not that NBC’s not proud of its regular primetime schedule, led by The Voice, The Blacklist, Chicago Fire and Chicago PD, but Yaccarino’s got other potential goodies in her broadcast bag, like the live telecast of The Wiz.

Meanwhile, NBCU is experimenting by putting shows like USA’s Playing House and NBC’s Aquarius on-demand in new ways and with lighter commercial loads. When you’re competing against a Netflix, “the consumer expectation is very different,” Yaccarino says. “But technology is enabling [us] to take a look at business models in a very different way, and that’s what we’re exploring right now.”

Looking Ahead

How will this market turn out? Most of the sellers say it is still too early to get a good line on volume.

But Yaccarino noted that she sees signs the economy is stronger, putting more money in consumers’ pockets. And the scatter market has strengthened from fourth quarter to second quarter. “It’s always great to go into an upfront where everyone—the buyer and seller—feels better about stuff,” she says.

Looking longer-term, Fox’s Byrne says, “I think as we move forward there could be less emphasis on the upfront. We’ve restructured with the future in mind, and part of that future is doing more business year-round in a really meaningful way.”

Adds ABC’s Wang, “I think the upfront marketplace has been evolving for over a decade but there will always be benefits from a futures-based selling marketplace. Advertisers need to have predictability about access to inventory—especially quality inventory. And as data, automation, and new forms of content reshape our business, I expect we’ll continue to see an evolution of the ‘upfront’ as we know it. That will be a good thing.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.