Job One for Zucker: Reverse CNN's Ad Revenue Woes

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

If Jeff Zucker succeeds in reviving CNN’s primetime programming, its domestic advertising revenues will eventually reverse, improving the network’s financial picture. And at that point, the former NBCUniversal CEO could be looking at a bigger job at his new company.

Zucker, a TV news wunderkind who put the Today show on a remarkable winning streak, was—after numerous reports—named president of CNN Worldwide last week by Turner Broadcasting CEO Phil Kent.

Even before he starts his new job in January, there is speculation at Turner that Zucker has his eyes on a bigger job, possibly running Turner when Kent retires.

For that to happen, he must deliver on improving primetime ratings, one of his priorities. CNN’s ratings have been sliding for a while, with the original cable news network falling behind first Fox News Channel and then MSNBC in primetime viewership.

For a while, ad revenue held up. But now, after hitting 20-year lows in primetime ratings earlier this year, the domestic network’s performance is affecting CNN’s revenues and profits, creating issues for Jeff Bewkes, CEO of Turner parent Time Warner, who has had to address plans for turning around CNN on recent conference calls with analysts.

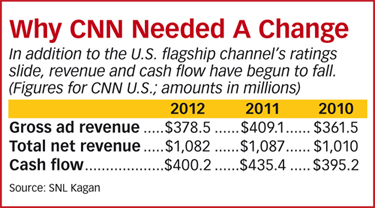

CNN will finsh 2012 with domestic gross ad revenue of $378.5 million, down 7% from 2011 despite the big spending associated with an election year, according to figures compiled by research company SNL Kagan. CNN’s ad total is also down from its peak of $427.7 million in 2008, the prior presidential election year.

The decline in ad sales more than offset increases in affiliate revenue, leaving CNN’s total net revenues for 2012 at $1.082 billion, down a bit from 2011. Its cash flow was down 9% to $400.2 million in 2012, according to SNL Kagan.

Fox News’ ad revenue climbed 12% for 2012 to $838.8 million, and its cash flow jumped 8% to $956.5 million, according to Kagan. At MSNBC, ad revenue rose 8% to $277 million, helping to hike cash flow 4% to $204 million.

“They are in trouble,” Kagan analyst Derek Baine said of CNN, adding that things could be much worse. “They still have a strong brand name with advertisers, and many of their core customers have stuck with them despite the ratings problems.”

Gary Carr, executive director of national broadcast at media buyer TargetCast tcm, said: “CNN is still attractive and still gets bought. Ratings are lower, so they don’t get the same unit costs.” Carr said CNN used to get a premium rate. And when news broke, the network would over-deliver and try to take back units. “They’re much easier to work with now.”

Carr said CNN is still a great news organization that he tunes in when news breaks. Hiring Zucker is a big deal, he added, because as a former producer, this job puts him “back in his wheelhouse.”

Kagan’s ad revenue figures do not include digital, but multiplatform sales have become a big part of CNN’s business. During a conference call announcing his new job at CNN, Zucker noted that as a competitor and a consumer, he was envious of CNN’s digital assets: “They were there first with online and mobile and had a huge advantage that has been borne out in its continued success.” Zucker said he wanted to leverage CNN’s digital success and integrate with its other platforms, turning users of CNN online and mobile into television viewers as well.

Advertising isn’t CNN’s only source of revenue, and Bewkes has told analysts Turner will be pushing for big subscriber fee increases over the next few years. To do that, CNN will need to improve its programming performance.

On the conference call, Kent said that while ratings are an important currency, they’re not the only thing to pay-TV operators. CNN is must-have programming when news breaks, but the network also needs to do the kind of programming that develops a pocket of hardcore fans who will watch the channel more often, he said, adding, “The most important thing is to be essential every day to someone.”

At NBCU, Zucker ran a very large organization with cable networks, movie studios and theme parks. Despite presiding over the decline of NBC’s primetime schedule, he’s qualified for a bigger job at Turner and Time Warner.

People familiar with the company speculated that Zucker’s arrival at Time Warner could upend Kent’s succession plans, which have had David Levy as the top candidate. Levy oversees revenue generation as president of ad sales, distribution and sports.

Whether Zucker has already been promised the job, or whether he’ll have to earn it, is not clear. But given Turner’s culture, and the long tenure of many of the company’s top executives, the big news could mean change is in the air.

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.