AT&T Doesn’t Want Amazon to ‘Disaggregate’ HBO Max into Prime Channels, Analyst Says

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

AT&T’s next CEO, John Stankey, released a media-technology bombshell earlier this week, when he announced that his company’s new subscription streaming service, HBO Max, would likely launch May 27 without app support for the world’s top OTT device ecosystem, Amazon Fire TV.

“I’m pleased to say we’re going to be in virtually all app stores [with] maybe one exception. It looks like we may not be in the Amazon Fire app store when all of this is said and done,” Stankey said.

Visit Next TV to read more stories like this one.

LightShed Partners analyst Richard Greenfield said in a blog post targeted to investors Thursday that the impasse between AT&T and Amazon likely centers around the way HBO Max will be distributed within Amazon’s Prime Channels, the tech giant’s pioneering aggregated marketplace for SVOD services.

Also read: AT&T’s Stankey: HBO Max Probably Won't Launch with Amazon Fire TV Support

Notably, AT&T’s legacy SVOD service, HBO Now, has been a lynchpin for Prime Channels since the aggregated platform launched in 2015.

“We believe it all comes down to the legacy HBO Now service, which will continue to exist for some period of time,” Greenfield wrote.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

The decision by the erstwhile Time Warner Inc. to allow Amazon to “dis-aggregate” HBO Now into Prime Channels, resell the programming and handle all portions of the customer relationship, spurred the growth of a “channels” movement, Greenfield contends.

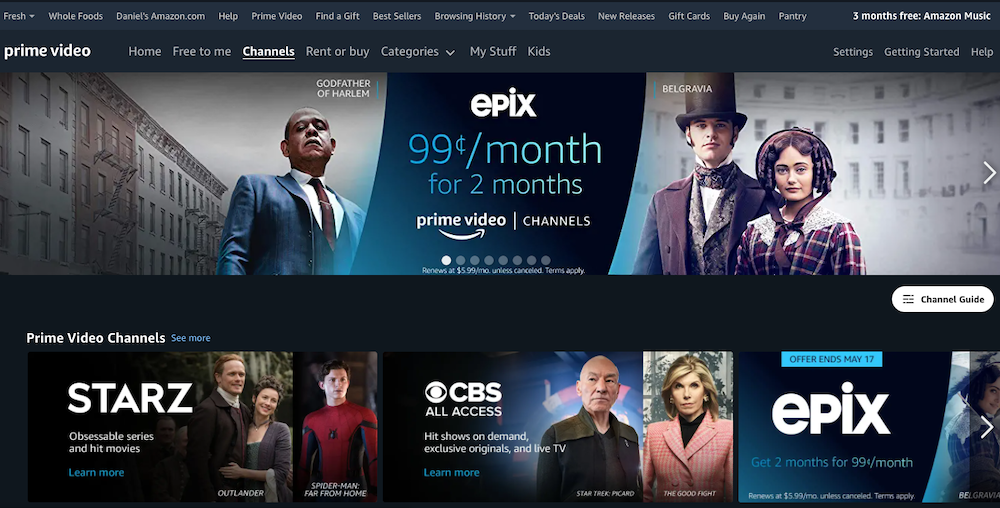

“HBO was quickly joined by Showtime, Starz, CBS All-Access and an array of smaller legacy media owned streaming apps who all embraced channels stores. As Amazon became the primary driver of SVOD subscribers for its channel partners (taking a meaningful share of the subscription economics), Roku Channels and Apple TV+ Channels followed with similar strategies,” the analyst said.

According to a report published in late 2018 by BMO analysts Daniel Salmon and William Lowden (detailed here by Variety), Amazon takes as much as 70% off the top of subscription revenue from its Prime Channels SVOD partners, who in turn, access as many as 45% of their subscribers through Prime Channels. The analysts estimated at the time that Amazon was taking in annual revenue of around $1.7 billion through Channels.

Netflix and Hulu, however, never allowed their content to be disaggregated into third-party “channels” apps, Greenfield noted. And notably, neither did Amazon Prime Video.

Why go to the trouble and expense of building a direct-to-consumer platform, only to cede the customer relationship—and a big portion of the profits—to a third party like Amazon or Apple, which in turn, is directly competing with you in the SVOD arena? Greenfield and LightShed wondered in a previous investor missive published last year.

The Walt Disney Company probably was thinking the same thing when it too reported a late-inning impasse with Amazon in the run-up to the successful launch of Disney Plus last November.

Also read: Disney Plus Still Lacks an Amazon Fire TV App a Week Away from Launch

Ultimately, Disney managed to gain Amazon Fire TV app support, but it refused, like Netflix and Hulu, to let Amazon process and resell Disney Plus through Prime Channels. (But as Greenfield noted, it does allow Apple+ TV Channels to include Disney Plus programming in its app. But once users select Disney Plus programming, they’re booted out of the Apple TV app and sent to Disney Plus.)

As Greenfield sees it, AT&T and Amazon are probably arguing about similar things, with the dynamics complicated by the legacy HBO Now streaming service.

“A new subscriber to HBO Max or an existing HBO Now subscriber who is automatically upgraded to HBO Max at launch, via the Amazon Prime channel store would only be able to watch legacy HBO content via the Prime Channel platform and would need to download the HBO Max app separately to watch content that is exclusive to HBO Max (catalog such as Friends and The Big Bang Theory to original series and movies). We believe Amazon looks at that consumer experience as subpar and overly complicated. We agree.”

AT&T and its WarnerMedia division have already announced HBO Max distribution deals with Hulu, Charter Communications and Google, the latter of which controls the increasingly critical Android TV OTT device ecosystem, as well as virtual pay TV service YouTube TV.

For its part, Amazon Fire TV is the world’s most proliferate OTT device ecosystem, announcing the surpassing of 40 million active users globally back in January.

In the U.S., Fire TV ranks second to Roku, which also has around 40 million active users.

While Stankey said most OTT platforms are locked up outside Amazon Fire TV, it’s notable that the conglomerate hasn’t specifically touted a partnership with Roku yet.

In fact, after Stankey's comments, Roku issued this statement: "As the No. 1 streaming platform in the U.S. with over 40 million active accounts that rely upon Roku to access their favorite programs and to discover new content, we are focused on entering into win-win distribution agreements with all new OTT services as part of their launch strategies. While we don't typically comment on specific deal terms or negotiations, the fact is that in this instance while we believe that HBOMax would benefit greatly from distribution on Roku at launch, we do not currently have an agreement in place."

Stay tuned. A lot will happen before HBO Max launches on May 27.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!