FreedomPop Uncorks Its Own Low-Cost Mobile Product Line

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

FreedomPop, a startup that sells “free” mobile voice and data services to cost-conscious consumers and claims to have held discussions with U.S. cable operators, has booted up its own brand of Android-powered products that carry sub-$100 price points.

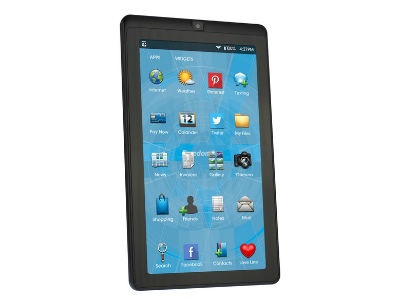

In a move that complements the company's distribution of refurbished Sprint devices and aims to fill the gap on low-cost Android mobile gear, the initial FreedomPop-branded product to ship is the Liberty (pictured), a 7-inch, 4-Gigabyte, Android-based WiFi-only phablet that sells for $89. The company notes that the Liberty is larger and less expensive than Apple’s first phablet product, the iPhone 6 Plus, which sports a 5.5-inch screen, and the Samsung Galaxy Note and its 5.7-inch screen. FreedomPop made the Liberty WiFi only to keep costs down, but said customers can tap into cellular by pairing it with $49 FreedomPop hotspot that supports 500 megabytes of free data per month.

FreedomPop will follow next month with the Frenzy, a $99 phablet that’s the same size as the Liberty, but adds LTE capabilities.

In the coming months, FreedomPop, which rides Sprint’s wireless network, will also introduce an $89 LTE Android phone, expanding on a higher-end lineup that already includes the Samsung Galaxy Note 2 and Note 3.

FreedomPop said all devices come with its free text and voice service – up to 200 voice minutes and 500 texts per month before tiered pricing plans apply.

In another cost-cutting move, all of these new FreedomPop-branded devices will not support a 3G fallback. But LTE availability is “now good enough that you’ll get ubiquitous coverage in most major markets,” said Stephen Stokols, FreedomPop’s CEO, noting that the company adds software that auto-connects users to WiFi when they are in the presence of a hotspot.

“The idea is to be ahead of the curve on LTE-only [products],” he said, estimating that FreedomPop has an 18-month lead on other carriers that are considering LTE-only offerings.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

FreedomPop, founded in 2011, doesn’t disclose specific customer figures, but “it’s in the several hundreds of thousands, and growing pretty fast,” Stokols said. FreedomPop is on a trajectory to break the 1 million customer market sometime in 2015, he added.

Stokols told FierceWireless last month that FreedomPop has conducted M&A talks with a publicly traded telecom company that isn’t among the Tier 1 U.S. wireless carriers (Verizon Wireless, AT&T, Sprint and T-Mobile US), but that the company’s preference is to build toward an IPO.

Cable Talks

U.S. cable operators don’t have access to their own cellular networks, but many have been aggressively deploying metro WiFi networks, possibly setting the stage for so-called “WiFi-first” wireless voice services that use cellular as a fallback.

Stokols said FreedomPop has held some discussions with cable operators, but notes that MSOs are interested in pursuing strategies that are disruptive and can scale up rapidly. But many MSOs are concerned that moving into wireless too aggressively will be a drag on their ARPUs, he said.

“There’s board-level sensitivity around that,” Stokols said. “But 12 months from now, I’d be shocked if a cable operator doesn’t do a WiFi First service.”