For Broadcast Nets,Cable Path Is Twisty

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

RELATED: How Aereo Would(n't) Work in an Alliance With MVPDs

Chase Carey, president/COO of News Corp., last week set the television world abuzz with talk about turning Fox from a broadcast network to a cable channel.

At one time or another, though, the owner of each of the Big Four nets has looked longingly at cable, with its two streams of revenue, higher profit margins and freedom from FCC programming oversight.

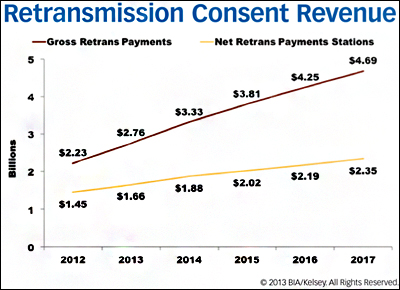

The catalyst for contemplating a conversion now is Aereo, the Barry Diller-backed streaming service that threatens millions in hard-won retransmission payments that help keep big-ticket sports on the airwaves. The broadcasters dragged Aereo into court, but so far it has withstood legal challenges. But, as one veteran TV executive says, “this isn’t about Aereo. This is about the potential precedent that could be set by an adverse ruling on Aereo” and the dominoes it could start to tip over.

Speaking at the annual NAB Show in Las Vegas on April 8, Carey said he wants Aereo—and any cable operator who might emulate or buy its technology for delivering broadcast signals to broadband customers without paying the network—to know Fox won’t sit by idly and revert back to being dinosaurs in the TV jungle. Carey was quickly backed up by other network chiefs, including Haim Saban, who controls Univision (and who might have a wider range of buyers available if broadcast regulations didn’t apply).

Converting Fox, or any of the other broadcasters, to a cable net would not be easy. “The challenge is not whether it can be done. It’s how long would it take to happen. It’s not easy or quick,” warns Wall Street analyst Richard Greenfield, who believes that as long as Aereo is legal, “it significantly changes the leverage imbalance that has dominated retrans negotiations” that now favor broadcast.

Long before Carey threatened to play the cable card in Vegas, Fox studied the model in 2008- 09. (Little-known fact: before News Corp. got control of DirecTV, DirecTV boxes contained TV antennas. But outfitting boxes with antennas is an expensive proposition.) A decade ago, NBC’s Bob Wright and Disney’s Bob Iger flirted with the cable conversion idea in public when they needed a way to get pesky affiliates back in line.

Fox’s plan, as developed about four years ago, would have moved the network to cable “with” its affiliates, making the change even more complicated.The idea was to run locally originated programming, including news, network and syndicated fare, over cable. The WB set up similar “virtual stations” in markets where it couldn’t get broadcast affiliates.

A drastic change from broadcast to cable has several pros and cons:

The Pros:

Even the threat of a move creates leverage in retrans negotiations.

Fox would be free from regulations over decency, obscenity and obligations to do lower-rated, familyfriendly programming.

It could cut costs at the stations. Running a transmitter can cost a half-million dollars per year. Instead, Fox could reap a short-term windfall by selling spectrum.

The Cons:

Lower ratings-10% to 15%-and lower ad revenu, according to Sanford C. Bernstein analyst Todd Juenger, who figures the loss at about $200 million. If MSOs get avails in network programming as part of the shift, that could increase competition for local ad dollars.

A converting network, Juenger says,would lose retrans and reverse-comp revenue (though it could more than make it up from subscriber fees).

New costs, to secure programming over cable rather than broadcast throughout the entire day. Moving some sports to cable might create problems with the public and the government. But one key supplier, the NFL, indicated some support for Fox, saying in a statement: “We are committed to our partnership with Fox.”

And there is still more fallout. By broaching the possibility of abandoning broadcasting, Carey might have opened a can of worms by indicating to Washington that Fox doesn’t need the valuable spectrum it’s been fighting to hold on to for so long. “This is a Pandora’s box,” one TV executive said. He noted that suddenly the networks, stations, programmers and distributors would have to renegotiate their relationships. Even if those hurdles are cleared, there’s still Washington. “Anytime you get government involved, it’s a three-sided sword: the public, election concerns and politics,” the exec said. —with Melissa Grego

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.