For Broadcast Nets, Cable Path Is Twisty

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

RELATED: HowAereo Would(n't)Work in an Alliance With MVPDs

Chase Carey, president/COO of News Corp., last week set the

television world abuzz with talk about turning Fox from a broadcast network to

a cable channel.

At one time or another, though, the owner of each of the Big

Four nets has looked longingly at cable, with its two streams of revenue,

higher profit margins and freedom from FCC programming oversight.

The catalyst for contemplating a conversion now is Aereo,

the Barry Diller-backed streaming service that threatens millions in hard-won

retransmission payments that help keep big-ticket sports on the airwaves. The

broadcasters dragged Aereo into court, but so far it has withstood legal

challenges. But, as one veteran TV executive says, "this isn't about Aereo.

This is about the potential precedent that could be set by an adverse ruling on

Aereo" and the dominoes it could start to tip over.

Speaking at the annual NAB Show in Las Vegas on April 8,

Carey said he wants Aereo-and any cable operator who might emulate or buy its

technology for delivering broadcast signals to broadband customers without

paying the network-to know Fox won't sit by idly and revert back to being

dinosaurs in the TV jungle. Carey was quickly backed up by other network

chiefs, including Haim Saban, who controls Univision (and who might have a

wider range of buyers available if broadcast regulations didn't apply

Converting Fox, or any of the other broadcasters, to a cable

net would not be easy. "The challenge is not whether it can be done. It's how

long would it take to happen. It's not easy or quick," warns Wall Street

analyst Richard Greenfield, who believes that as long as Aereo is legal, "it

significantly changes the leverage imbalance that has dominated retrans

negotiations" that now favor broadcast.

Long before Carey threatened to play the cable card in

Vegas, Fox studied the model in 2008- 09. (Little-known fact: before News Corp.

got control of DirecTV, DirecTV boxes contained TV antennas. But outfitting

boxes with antennas is an expensive proposition.) A decade ago, NBC's Bob

Wright and Disney's Bob Iger flirted with the cable conversion idea in public

when they needed a way to get pesky affiliates back in line.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Fox's plan, as developed about four years ago, would have

moved the network to cable "with" its affiliates, making the change even more

complicated. The idea was to run locally originated programming, including

news, network and syndicated fare, over cable. The WB set up similar "virtual stations"

in markets where it couldn't get broadcast affiliates.

A drastic change from broadcast to cable has several pros

and cons:

The Pros:

Even the threat of a move creates leverage in retrans

negotiations.

Fox would be free from regulations over decency, obscenity

and obligations to do lower-rated, family-friendly programming.

It could cut costs at the stations. Running a transmitter

can cost a half-million dollars per year. Instead, Fox could reap a short-term

windfall by selling spectrum.

The Cons:

Lower ratings-10% to 15%-and lower ad revenue, according to

Sanford C. Bernstein analyst Todd Juenger, who figures the loss at about $200

million. If MSOs get avails in network programming as part of the shift, that

could increase competition for local ad dollars.

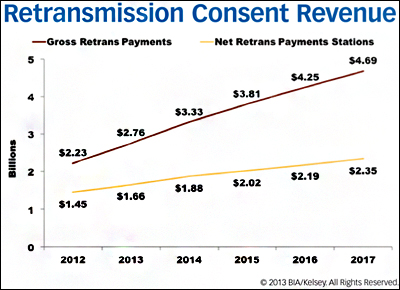

A converting network, Juenger says, would lose retrans and

reverse-comp revenue (though it could more than make it up from subscriber

fees).

New costs, to secure programming over cable rather than

broadcast throughout the entire day. Moving some sports to cable might create

problems with the public and the government. But one key supplier, the NFL,

indicated some support for Fox, saying in a statement: "We are committed to our

partnership with Fox."

And there is still more fallout. By broaching

the possibility of abandoning broadcasting, Carey might have opened a can of

worms by indicating to Washington that Fox doesn't need the valuable spectrum

it's been fighting to hold on to for so long. "This is a Pandora's box," one TV

executive said. He noted that suddenly the networks, stations, programmers and

distributors would have to renegotiate their relationships. Even if those

hurdles are cleared, there's still Washington. "Anytime you get government

involved, it's a three-sided sword: the public, election concerns and

politics," the exec said. -with Melissa Grego

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.