Analysts Say ‘14 Upfront Looks Like Last Year’s

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

RELATED: Ad Sales Chiefs Talk Data and Digital, But Want Dollars

The view from Wall Street is that Madison Avenue won’t be especially generous with Broadcast Row in the coming year… but it also won’t be much more generous to Silicon Valley.

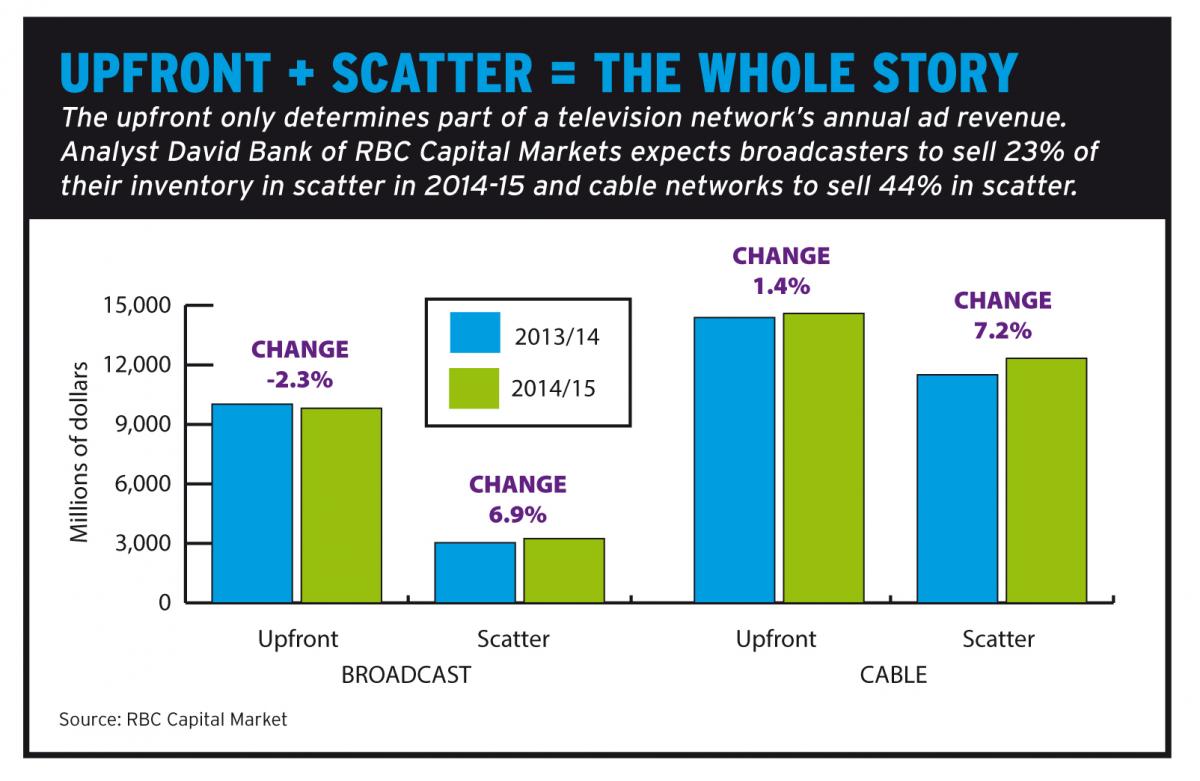

In a recent report, analyst Alexia Quadrani, managing director and media analyst, J.P. Morgan, said that buyers told her that broadcast upfront volumes are expected to be down 2%-3%, while cable volume should rise 5%. That’s an overall increase of 2%.

And David Bank, analyst with RBC Capital Markets, said in a report he expected volume to be flat to slightly down.

Bank added that he expects price increases on a cost-per-thousand-viewers (CPM) basis to be in the mid-single-digit range.

“Barring any major geopolitical or macroeconomic events, timing will look a lot like last year,” Bank said. “In other words, the process should wrap relatively quickly with no clear ‘winner’ on either side.”

Quadrani said that the cable upfront will be stratified, with the best networks expected to secure pricing and volume gains well above 5%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Live events, particularly sports, Quadrani added, command a 20% to 25% premium in CPM. “As audience fragmentation continues, advertisers are relying even more heavily on live sports events to achieve consistent reach,” she said buyers told her. That means the gap between sports CPMs and general entertainment prices could widen further, she added.

Bank believes the scatter market—where ads not reserved in the upfront are sold during the season—has been neither weak nor gangbusters. He said the networks have been pointing to scatter prices that are in the high single-digit to low double-digit range above upfront, while buyers say volume has been slow. “At the end of the day, we think both points of view fairly reflect the marketplace and the most honest answer to the ‘how is the marketplace’ question is steady, but not strong,” Bank said. And the second-quarter scatter market is often seen as a good indicator of the strength in the upfront.

Despite a ton of new original programming being shown during the NewFronts, the analysts don’t think this is the year the television upfronts are disrupted by digital video. “While viewership of video on digital platforms (including mobile) is growing rapidly, it still only accounts for about 6%-7% of total viewing,” Quadrani said.

“While advertisers appear to be more aggressively moving dollars to digital—which should be helped by further progress in measurement—we still see TV as dominant for some time and expect TV—especially cable—to continue to exhibit good growth this upfront season.”

She added that buyers noted digital video still has to be packaged and priced properly, and that online video prices will still need to come down to attract a greater share of cable TV dollars.

Similarly, Bank said, “we don’t believe online video is ready for primetime—pun intended— as a meaningful competitor to network TV impressions, and won’t be for quite some time.”

Buyers tell Bank that online video consumers tend to represent a very concentrated and somewhat limited subsection of consumers, so advertisers will tend to reach the same small group of consumers time and time again, with the identical message.

“This plays directly into the strength of TV, especially network TV, whose best attribute is reach,” he said. “Even if other issues— CPM parity, contextuality, spot loads, inventory scarcity, etc.—weren’t a factor, reach still would be.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.