Ad-Supported Streaming May Not Lead to the Subscriber Boom Netflix, Disney Are Hoping for, Kagan Says

Researcher says lower prices may just encourage current ad-free customers to switch to ad-supported tier

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With Netflix and Disney Plus just months away from launching ad-supported versions of their respective streaming services, Kagan, the media-research arm of S&P Global Market Intelligence, says that lower prices and more ads may just encourage current ad-free customers to switch to the more economical tiers.

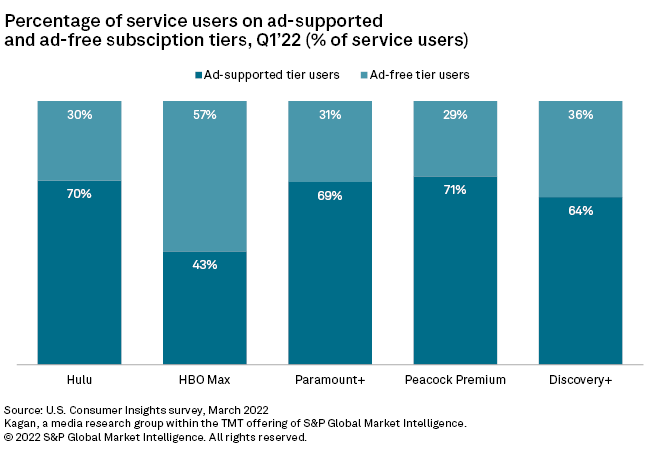

Kagan surveyed about 2,519 streaming service subscribers and found that 60% to 70% of customers of Hulu, Peacock Premium, Discovery Plus and Paramount Plus already subscribed to the ad-free tier. Only about 43% of HBO Max customers subscribe to the ad-supported tier, but that may be because it is only a few months old. HBO Max launched its ad-supported tier in June 2021.

According to Kagan, while about one-third of those ad-supported customers lived in households with less than $50,000 in annual income, 25% to 40% lived in homes where annual incomes were $100,000 or more.

“Given the popularity of ad-supported plans, operators such as Disney and Netflix that are launching ad-supported plans may not see a mass influx of new subscribers and could instead see a sizable number of existing subs switch to ad-supported offerings,” Kagan senior research analyst Seth Shafer wrote in the report.

Disney Plus is expected to launch its ad-supported version on December 8, and Netflix has said it plans to do the same before the end of the year. Netflix had its first ever quarterly streaming subscriber loss in Q1 (200,000 customers) and in Q2 lost about 1 million streaming customers. The belief is that as the number of streaming services grows, consumers are gravitating toward ad-supported tiers to keep tier monthly costs down. But in the Kagan report, Shafer wrote that it may just come down to each service being different.

“A case could be made that Netflix and Disney Plus are simply ‘different’ when it comes to ad viewing preferences — Netflix, due to the fact that it has been an ad-free haven for its entire existence and Disney Plus, due to some parents seeking to keep children from being exposed to ads on the service,” Shafer wrote. “While those factors could slightly reduce levels of ad-supported subscribers for Netflix and Disney Plus relative to other services, survey data suggests that a sizable number of new and existing subs for both Netflix and Disney+ will opt for ad-supported tiers.”

Kagan found that a large percentage of ad-supported users at other streaming services are also subscribers to Netflix and Disney Plus. According to the company, 82% of Hulu, 84% of HBO Max, 79% of Discovery Plus, 78% of Paramount Plus and 66% of Peacock Premium ad-supported subscribers also subscribe to Netflix. Between 42% and 64% of customers of those ad-supported services also subscribe to Disney Plus, according to Kagan.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

The researcher added there was little “crossover behavior” between ad-supported and ad-free tiers, meaning that when given the choice, ad-supported customers tend to stick with that tier with other services.

“Using Hulu and HBO Max as examples due to their larger respondent base sizes across multiple services, ad-supported viewers at those two services tended to select ad-supported tiers when they used other services,” Shafer wrote. “Ad-free viewers were also generally more likely to select ad-free tiers at other services but the tendency was less apparent when compared to ad-supported users opting for other ad-supported offerings.” ■

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.