Spectrum TV App Blackout on Roku: The Latest on This Next-gen Carriage Battle

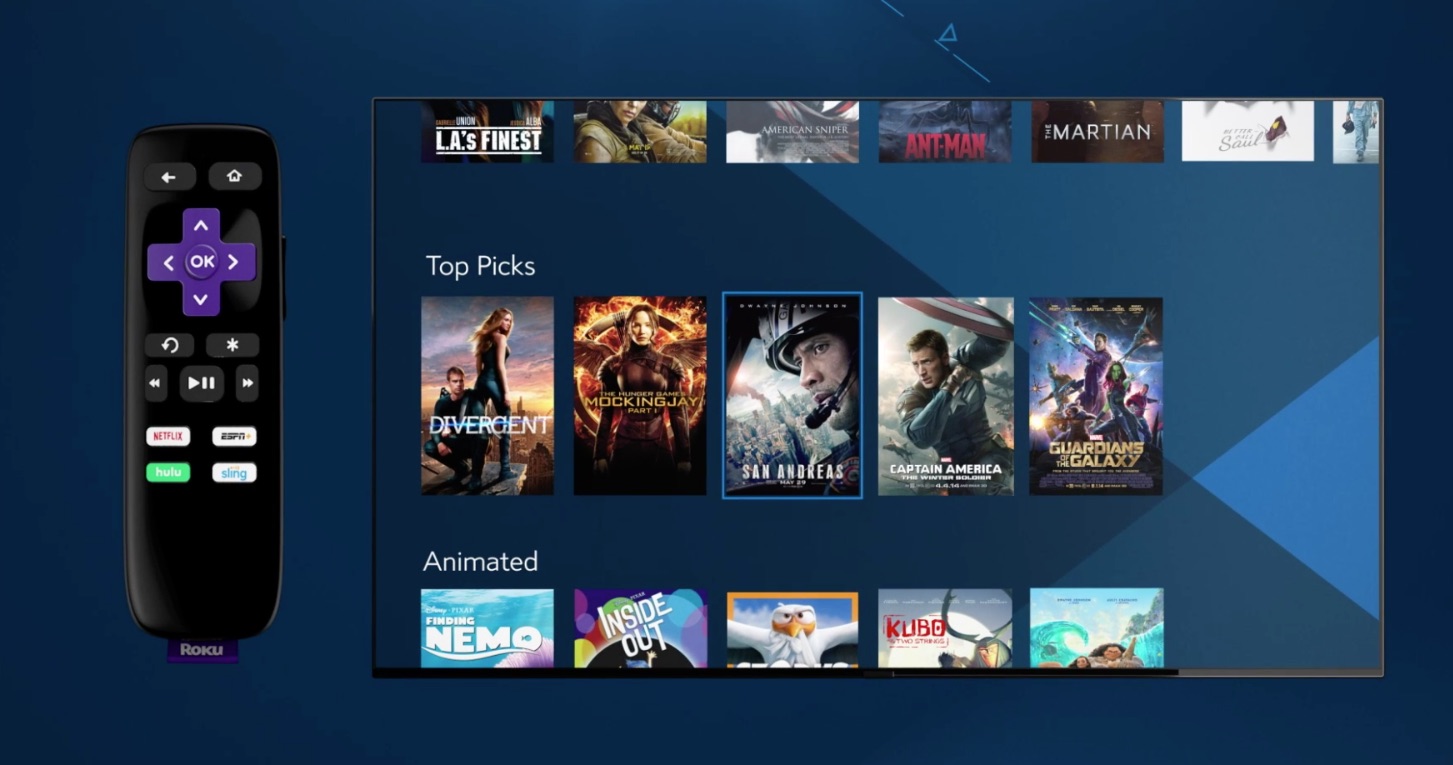

Charter's Spectrum TV app remains blacked out from Roku's Channel Store

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After a 10-month "blackout" that saw Charter's OTT app disappear from Roku's Channel Store, the Spectrum TV app is once again downloadable by the No. 1 connected TV platform.

“Charter Communications and Roku have reached a mutually beneficial agreement to renew distribution of the Spectrum TV App (STVA) on the Roku platform," a joint statement reads. "As a result of the renewal, the Spectrum TV App is now available for download from the Roku channel store. We are pleased to renew our partnership and offer this great streaming experience to our shared customers.”

Since mid-December, Roku users had been unable to download Charter Communications’ Spectrum TV app on their devices.

Those Roku-using, Charter-subscribing users who already had the Spectrum TV app downloaded on their Roku smart TV, streaming player or stick as of mid-December were unaffected ... unless they delete their app for some reason.

Some users appear to have fallen into a bit of a technology-related trap over the July 4th holiday weekend, after Charter tried to issue an update to the cadre of legacy Spectrum TV for Roku downloads, along with Spectrum TV app versions for other OTT device platforms, ranging from iOS to Samsung.

The attempt appears to have interjected a technology error that resulted in U.S.-based Charter subscribers getting the following error message across myriad types of devices, Roku included: “Spectrum TV is only available in the U.S. and its territories, ref code RLC-1002.”

The outage was soon resolved. But as first reported by TV technology blogger Phillip Swann, frustrated users in the interim turned to social platforms, including Roku's community forum, to discuss the problem.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Users reported attempts to fix the issue and regain Roku access to their Spectrum TV account by methods including reboot of their modem and streaming device, among other tricks.

As Swann noted, unfortunately, an unknown number of these Roku users unwittingly tried to fix the issue by deleting their Spectrum TV app, only to find out that a fresh download isn't available in the Roku Channel Store.

"DO NOT DELETE THE APP. IT ISN'T AVAILABLE ANYMORE IF YOU DO," stridently warned one Roku forum poster.

In June, a Charter rep told us there's nothing new to report in regard to the app support impasse that is keeping the cable operator's OTT users from accessing their service on the biggest connected TV device platform.

Roku execs, concerned with a much larger kerfuffle with Google that involves the tech giant's YouTube and YouTube TV apps, haven't mentioned Charter publicly in months.

The Spectrum TV app, which lets Charter customers tap into their TV subscriptions on select OTT and mobile devices, is often used by Charter cable TV subscribers for secondary TVs within homes, in lieu of additional pricey leased set-tops.

Those who have already downloaded the Spectrum TV app have been able to continue using Spectrum TV service on Roku. It's unclear if those apps are still receiving updates.

A message on the landing page for Spectrum TV’s Roku app still reads, “Despite our best efforts to reach an agreement, Roku has not accepted Spectrum's offer to continue our contract that allowed customers to access the Spectrum TV app on Roku devices.”

It's hard to tell just how many of Charter's 16.2 million Spectrum TV customers use the Spectrum TV app.

Anecdotally, however, angst about the app not being available on the No. 1 OTT platform is surfacing in product review forums.

"Very disappointed! The only reason I chose the tcl smart TV was so I would be able to use my cable provider Spectrum's app on it," wrote one verified Amazon product reviewer in mid-December, posting about her purchase of a 50-inch Roku-powered TCL smart TV.

Notably, in late April, a skirmish broke out between Roku and Google, with Roku removing download access to Google's YouTube TV virtual MVPD app. That conflict -- which has a much higher profile -- remains ongoing, as well.

A Not So Trivial Dispute?

While many of the typical end-of-year “Blackout Season”-related contract disputes between content companies and pay TV operators that emerged in December have been settled, this somewhat novel iteration of the age-old distribution conflict has quietly dragged on, and it doesn’t seem to have any end date.

Roku has famously been involved in a series of high-profile app support holdups recently—it didn’t support Comcast’s Peacock or AT&T’s HBO Max for months after those streaming services launched last year.

Those delays were caused by complex negotiations that involved such factors as ad revenue sharing, and how those services were accessed by consumers—meaning, whether Roku users tapped into, say, HBO Max directly, or through disaggregation via Roku Channels.

Perhaps a more relevant historical precedent was Roku's banishment of the AT&T TV app from its Channel Store from Jan. 1 through mid-May of last year. That was around the time when AT&T launched its IP-delivered linear pay TV service, AT&T TV. It was also around the time that the telecom's WarnerMedia division put SVOD service HBO Max on the launch pad.

In the case of the Spectrum TV app, it’s unclear as to what specifically the two sides are haggling about. A source with insight into the negotiations said the impasse has nothing to do with Charter’s cozier relationship with Apple. Notably, two years ago, Charter promoted its Spectrum TV service with Apple TV 4K giveaways, while also launching the Spectrum TV app on the platform.

It’s also unclear as to how much pressure Charter is under to have its app restored to the No. 1 connected TV device platform. Charter reported that it finished 2020 by adding 56,000 pay TV subscribers—an outlier performance, given the steep erosion of most linear pay TV platforms right now.

The Spectrum TV app is supported by iOS and Android, meaning it's usable on most mobile devices in the U.S. But outside of Apple TV, its only major connected TV device support comes from Samsung smart TVs and Xbox gaming consoles. So it's unclear as to how motivated at this point Charter is to enable its customers to tap into their pay TV experience through connected TV platforms.

Leasing secondary WorldBox set-tops generates revenue, of course, and having too many customers pass on the option cuts into average revenue per customer--which has been dropping of late the No. 2 U.S. cable operator. Its ARPU slipped 1.7% in the fourth quarter to $111.85.

There's also another possible factor to consider: Charter maybe wants to launch its own device platform, and it doesn't want to contribute to Roku taking over the business.

Charter Chairman and CEO Tom Rutledge said during the company's Q4 earnings call that the operator is considering the deployment of its own streaming device to its broadband-only customers. Notably, Charter had talks last year with Comcast about licensing its Xfinity Flex platform.

Certainly, for Comcast, there are advantages for having consumers access services like Peacock through Xfinity Flex, where data collection and advanced advertising can be far more controlled vs. a third-party platform like Roku.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!