Why ‘Re-Bundling Has To Happen’: Breaking Down the New ESPN, TNT Sports and Fox Sports Streaming JV

The Hulu-like JV makes sense with tier-1 pay TV distribution dwindling, league partners who’d rather be streaming, a multibillion-dollar NBA rights renewal pending, Amazon stalking … and YouTube TV pulling away

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Making perhaps the boldest alliance since NBCUniversal and the erstwhile News Corp. formed Hulu 16 years ago, Disney/ESPN, Warner Bros. Discovery and Fox Corp. on Tuesday announced the broad outlines for a new joint venture which will pool each of the media companies' linear sports channels into a virtual MVPD-like offering.

Also read: TV Giants Team Up for Sports Comeback vs. Streamers

As former Fox executive turned sports media consultant Patrick Crakes told us, “the devil is in the details” for a service that hasn't announced a management team, a consumer price point, or even a name yet.

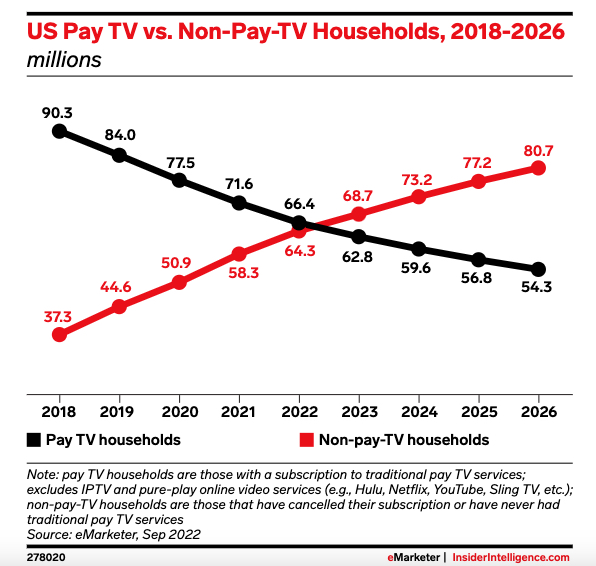

Crakes' immediate reaction to the news: Cord-cutting has whittled down the number of homes from which channels like ESPN, Fox Sports 1 and TNT can draw first-tier program licensing fees, the kind of fees needed in order to pay the NFL its $110 billion.

“Re-bundling has to happen if there’s any hope to meet T1 content costs in any cogent and effective way,” Crakes said to us via text.

“We need to learn more about this deal, but if distributors are in on it as well (thanks to the Charter-Disney deal) this could be a first step towards getting some scale, some pricing power and even consumer commitment for a product that enables some of the consumer friendly attributes of digital distribution,” the consultant added.

Meanwhile, in a shareholder letter titled “The Skinny Sports Bundle We have Been Waiting For,” MoffettNathanson noted the unique ability of Disney, WBD and Fox to pull this DTC product off.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

“What Disney, Fox and WBD have in common is that they have each thus far largely refrained from ‘cheating” the linear ecosystem — that is, leaking their best linear content to DTC,” the equity research firm said. “NBC and CBS’s NFL games are available for often discounted monthly fees through Peacock and Paramount Plus, but to date the only place to watch Monday Night Football or Fox’s Sunday NFL games has been on linear. WBD’s sports content recently became available to view through Max’s Bleacher Report Add-On. The delay to initially charge Max subscribers $9.99 for this sports tier this spring now can be viewed with a different understanding.

“With live feeds of most of the critical networks for a sports fan, this is in a sense a version of the ’skinny bundle‘ that kicks out all the cheaters that we have long been calling for.”

Here are five other things to consider about this exciting new JV:

The Current Pay TV Ecosystem Simply Can't Afford the NFL and NBA

The economics just for the NFL’s current TV deal, valued at over $110 billion, can't be rationalized by the state of the current pay TV ecosystem. There just aren't enough consumers left willing to pay $10 a month for ESPN in a cable bill.

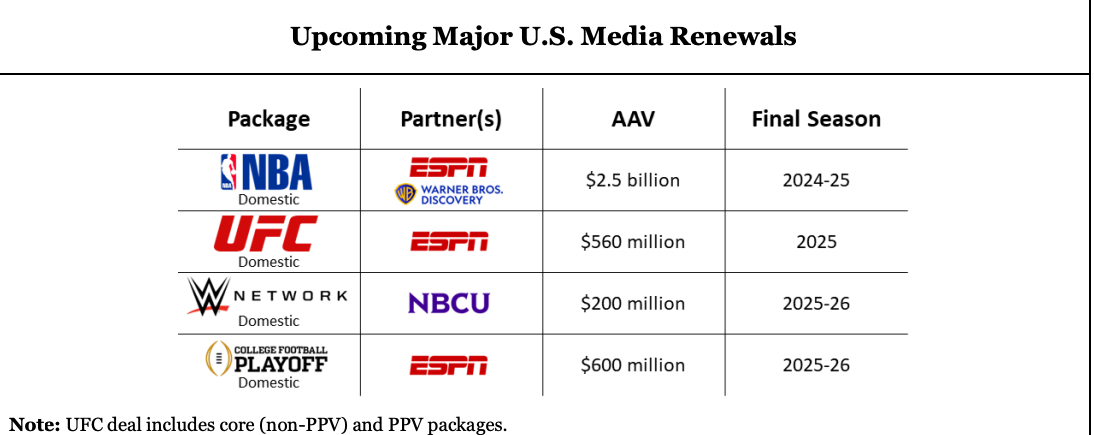

The infrastructure will be further taxed when the NBA demands compensation of around $75 billion for its next rights deal.

Connectivity-Focused Distributors, Namely Charter, Have Been Asking Specifically for This Kind of Service

Amid the tense run-up to what has been termed a “landmark” carriage renewal deal between Charter Communications and Disney, the cable company outlined a bleak, self-perpetuating scenario in which the best content continues to bleed from the pay TV ecosystem and into subscription streaming, with customers exiting right along with it.

In this presentation delivered last September as the carriage war started, Charter outlined a reformed relationship with programmers and distributors:

Step one: “Aggregate the ad-supported streaming apps from cable-network brands into packaged linear products at an affordable price point, creating the most compelling consumer proposition in the marketplace.”

Step two: “In parallel, [Charter will] help market programmer streaming apps to broadband subscribers utilizing the full complement of Charter’s sales and marketing distribution capability”

The result: “Compelling video product for consumers with the best value proposition and more consumer choice.”

The NBA Is Looking for (Again) $75 Billion in Its Next National TV Deal

The new JV will bundle linear channels ESPN, ESPN2, ESPNU, SEC Network, ACC Network, ESPNews ABC, Fox, FS1, FS2, BTN, TNT, TBS and truTV.

That locks up virtually all of the national live TV rights for the NBA, Major League Baseball and the NHL. A roll-up would, as Crakes noted, benefit consumers, who are often vastly confused as to where to watch the games amid the cross-purpose workings of competing media companies.

It also might benefit Disney/ESPN and Warner Bros. Discovery, which are in the next month set to start renewal negotiations with the National Basketball Association. The current national TV agreement expires after next season (which ends in April 2025), and the NBA is reportedly looking for as much as $75 billion combined in a new multi-year deal.

For Disney and WBD, having a unified distribution asset can't hurt leverage.

"In short, we do not expect an immediate impact on sports rights in the current iteration of this JV because ESPN, Fox and WBD are all expected to continue to independently bid on their own rights,” MoffettNathanson said in its Tuesday-evening letter. “However, especially given the nature of long-term sports rights, we must consider what this new sports JV could evolve into that could change the shape and leverage of future sports rights negotiations.”

League Partners Would Rather Be Streaming

About the only major sports league that the new JV doesn't control is NFL football, which has a far more diversified distribution portfolio, extending out to non-JV entities including Comcast, Paramount and Amazon.

The NFL has voiced its contentment for the results it has received through its $1 billion distribution pact with Amazon Prime Video for Thursday Night Football, a platform that delivers the league its youngest TV audience by far.

The NFL has simultaneously stated its pleasure with distribution of NFL Sunday Ticket on YouTube TV.

Clearly, the NFL wants to stream. And its a good bet the NBA, as well as the JV's other league partners, also want to.

YouTube TV and Google Are Pulling Away

On Tuesday morning, hours before the big JV announcement, YouTube CEO Neal Mohan told the world that his company’s seven-year-old virtual MVPD, YouTube TV, has amassed more than 8 million subscribers.

That’s up from YouTube's last disclosure of 5 million customers made just about 18 months ago.

As all (or most) of the aforementioned Disney, WBD and Fox sports networks are distributed by YouTube TV, that's not terrible news for those companies.

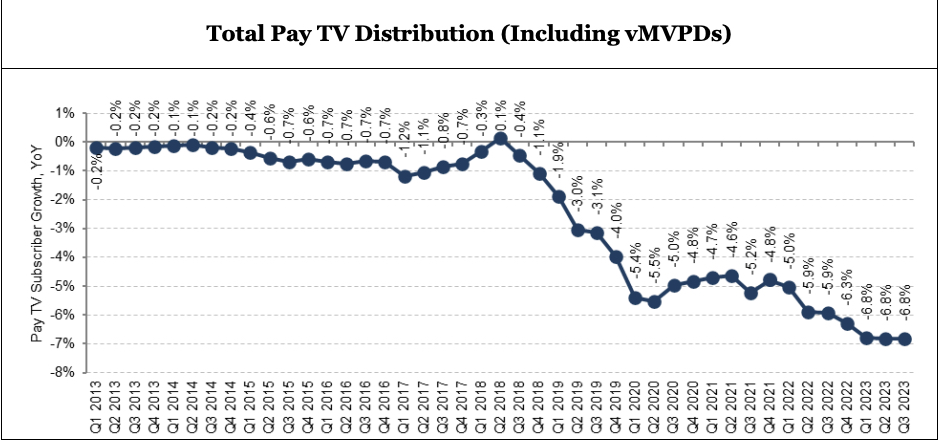

As MoffettNathanson noted in this Thursday-morning graphic, YouTube TV's rapid growth is keeping the rate of linear pay TV's cratering kind of flat:

Another way to look at it: Comcast lost more than 2 million subscribers in 2023, while Charter bled more than 1 million. So someday soon — not this year, but within the decade — Google will be the biggest seller of linear pay TV bundles … that is, if not for a “re-bundling.”

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!