What to Know Ahead of Disney’s Upfront

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With the ink still fresh on its purchase contract for 21st Century Fox assets, Disney’s Upfronts presentation next week will include the previously Fox-owned networks FX and National Geographic in addition to its longstanding flagship networks. It remains to be seen how advertising and viewership will shift across this newly expanded empire, but as Disney execs and talent prepare to take the stage, we examined past trends for four of the conglomerate’s key cable networks using insights from TV ad measurement and attribution company iSpot, and Inscape, the TV data company with glass-level insights from a panel of more than 10 million smart TVs. The data below covers Jan. 1 through May 5.

FX

- According to iSpot, top spending brands for FX include The General, GEICO, Carvana, T-Mobile and LifeLock.

- Also per iSpot, some of the programming delivering the highest ad-impression counts include syndicated shows How I Met Your Mother and Mike & Molly, plus the movies Guardians of the Galaxy, Captain America: The Winter Soldier and Taken 3.

- According to Inscape, other networks that FX viewers are likely to watch include FXM, Paramount Network (formerly Spike TV), Syfy, Starz and AMC.

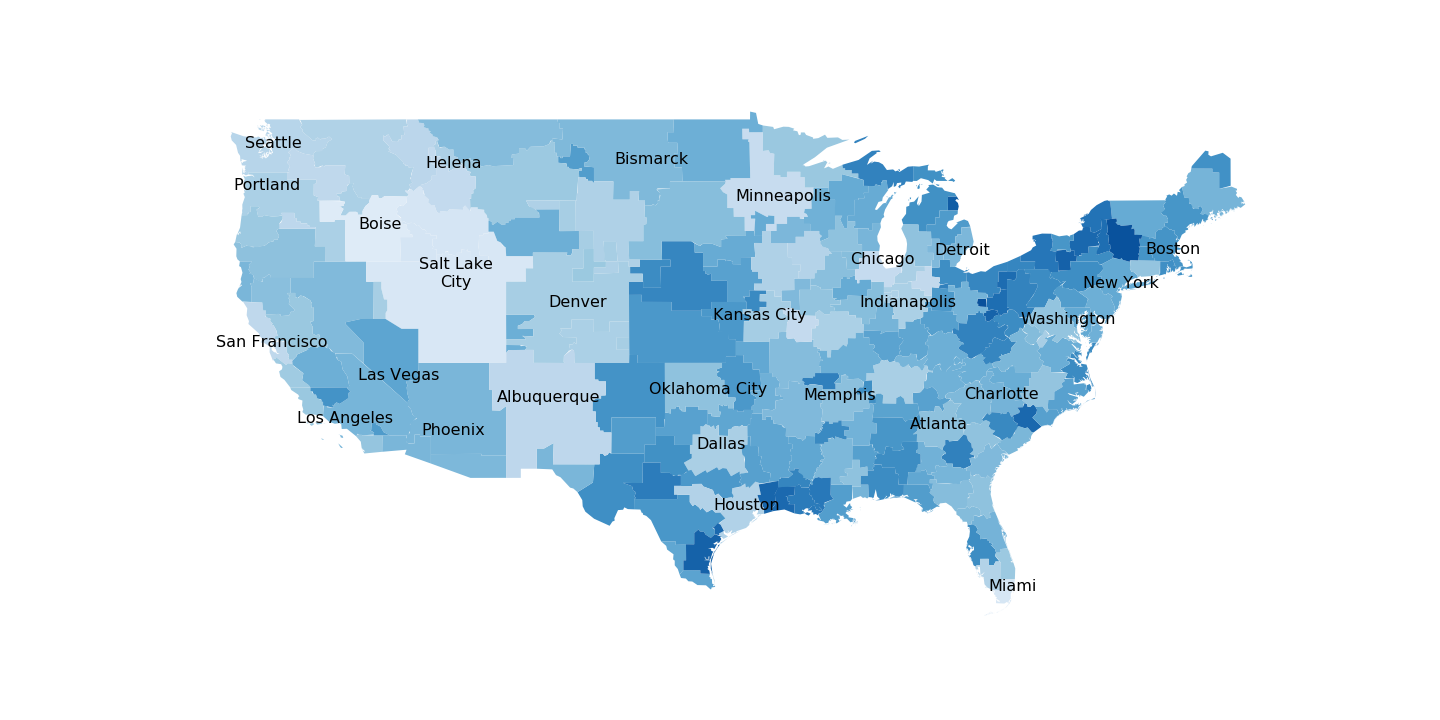

- When it comes to audience location, Inscape’s analytics reveals high viewership in parts of the Northeast (especially the Albany-Schenectady-Troy DMA), the Midwest and parts of Texas including the Corpus Christi DMA.

National Geographic

- GEICO, Liberty Mutual, Lexus, Little Caesars Pizza and Subaru are among the top-spending brands for National Geographic, per iSpot.

- Life Below Zero, Locked Up Abroad, Wicked Tuna, Alaska State Troopers and Drugs, Inc. are some of the programs generating high ad-impression counts, according to iSpot.

- Other networks that National Geographic viewers are likely to watch include Science Channel, American Heroes Channel, Smithsonian, National Geographic Wild and The Discovery Channel.

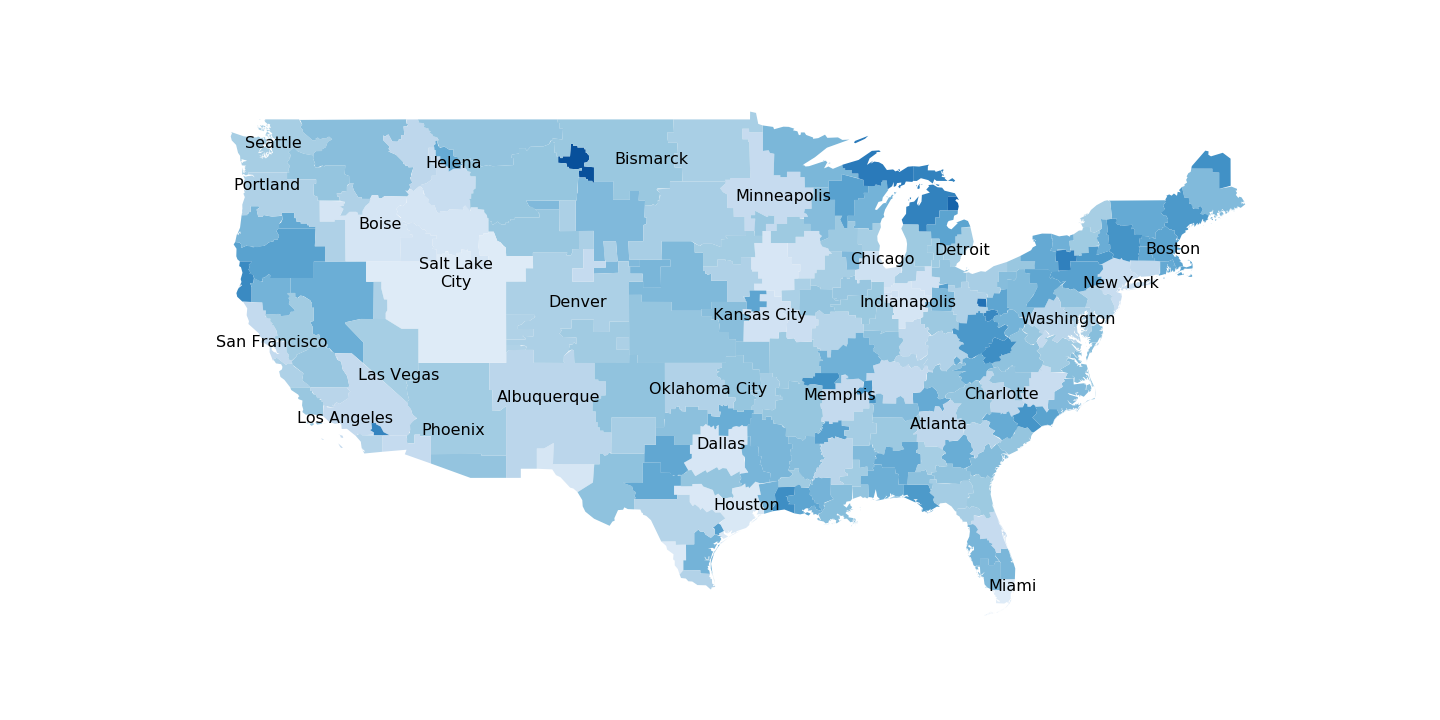

- The audience location heatmap from Inscape shows some key viewership hotspots including Glendive (Montana), Los Angeles and a few of the northern Michigan DMAs.

Freeform

- Top-spending brands so far in 2019 include State Farm, Olive Garden, Verizon, Taco Bell and Universal Pictures, according to iSpot.

- Some of the programs delivering high ad-impression counts include The Middle, Reba and The 700 Club, plus the movies Shrek and The Goonies.

- According to Inscape, these viewers are most likely to watch other networks such as UP, CMT, Fusion, MTVLIVE and Fuse.

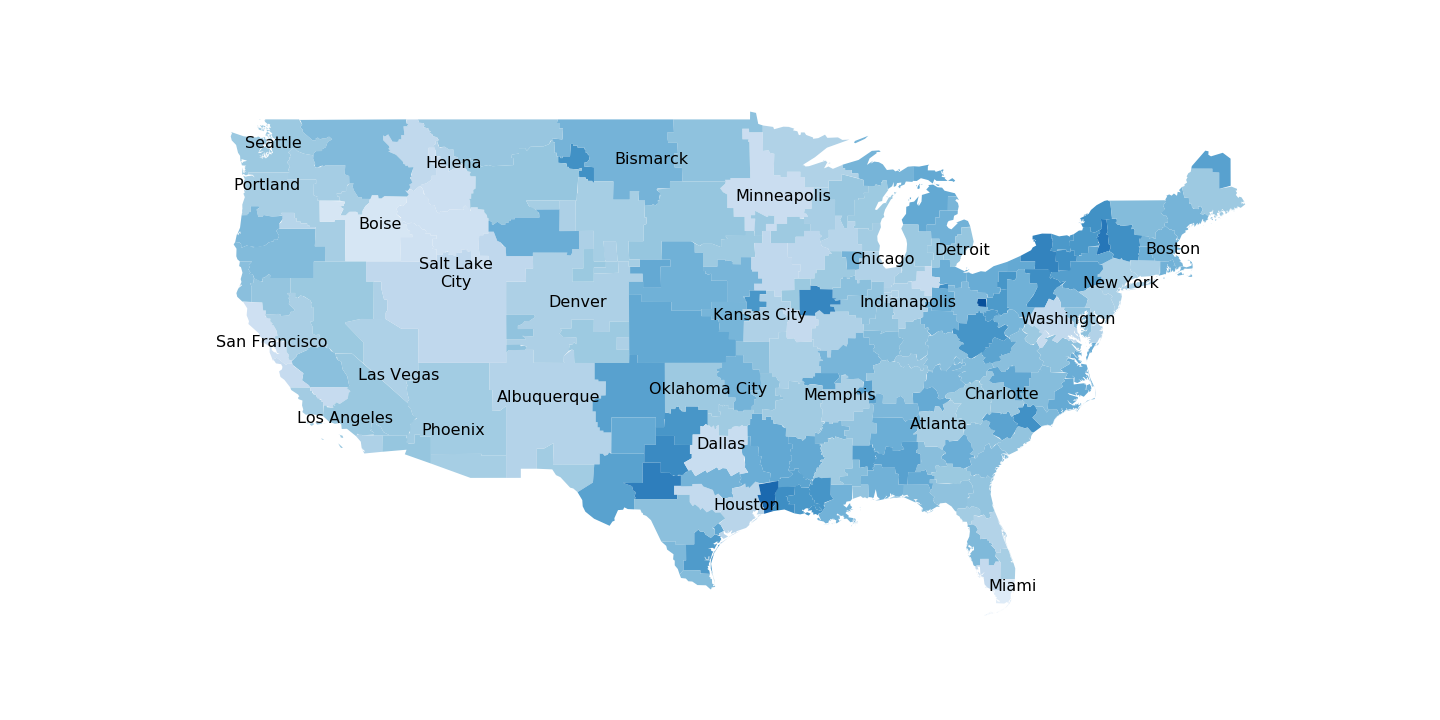

- Here’s the viewership heatmap from Inscape:

ESPN

- Per iSpot, AT&T Wireless, State Farm, Taco Bell, Allstate and Capital One (the credit card) are some of the brands that have spent the most on ESPN this year.

- SportsCenter, College Basketball, NBA Basketball, First Take and Get Up are some of the programs with high ad-impression counts, according to iSpot.

- Other networks that viewers are likely to watch, per Inscape, include ESPN2, ESPNEWS, ESPN University, NBA TV and Pac-12 Network.

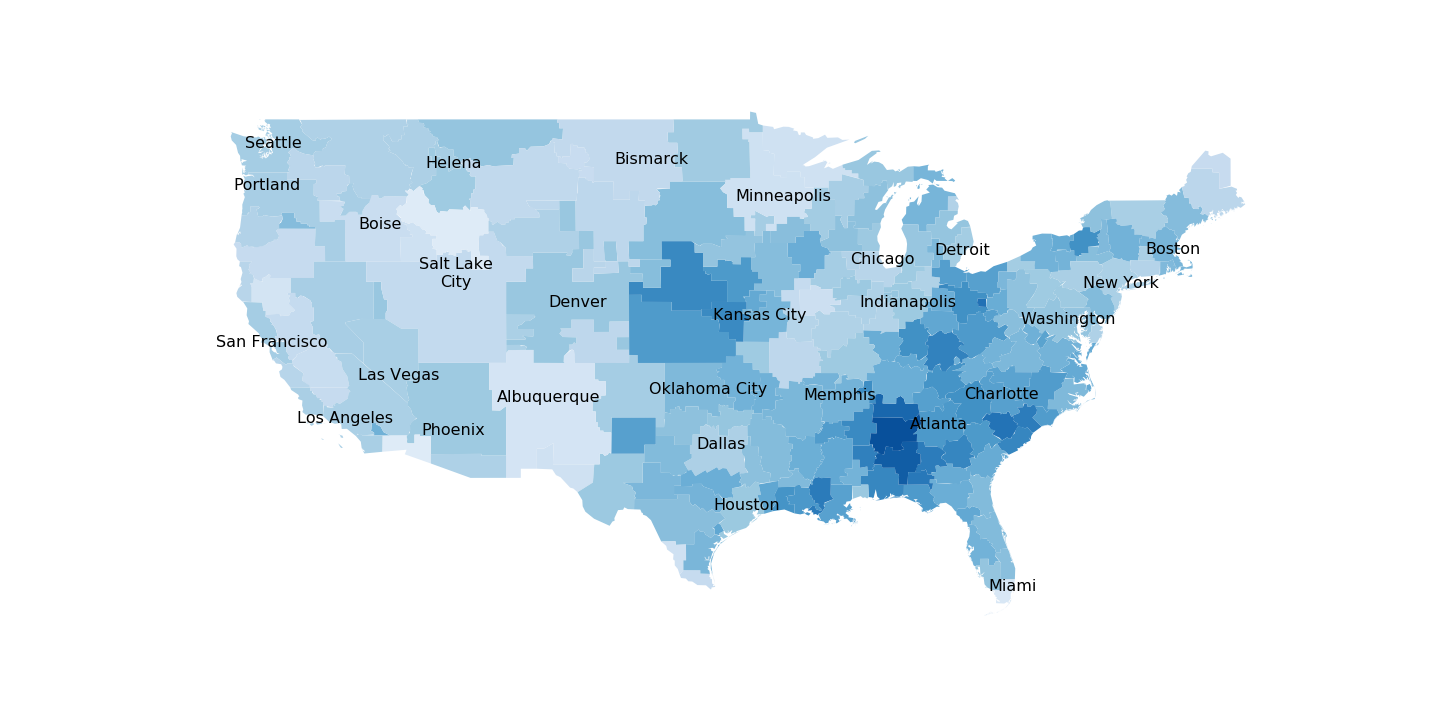

- Inscape’s audience location heatmap shows hotspots around Alabama, Nebraska and Kansas in particular.

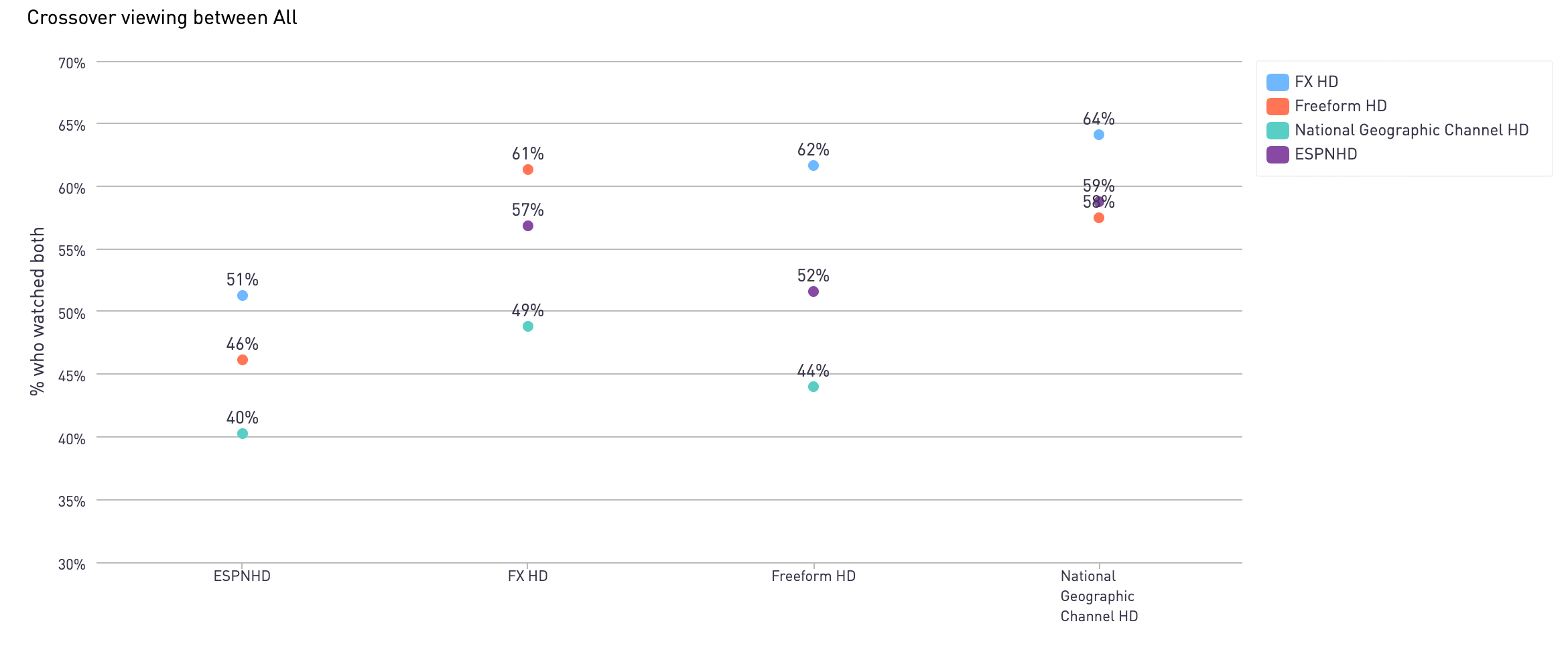

We also looked at viewership crossover from the networks above using data from Inscape. A note about methodology: You have to do more than just flip past a station with your remote to count as a “crossover viewer” in Inscape’s system. For the data below, the minimum viewing threshold is 2 minutes.

At the high end: 64% of National Geographic viewers have also tuned into FX, although only 49% of FX watchers have checked out National Geographic. Of the Freeform fans, 62% have watched FX, 52% have tuned into ESPN and 44% have checked out National Geographic. On the low end, only 40% of ESPN viewers also watched National Geographic.

The smarter way to stay on top of broadcasting and cable industry. Sign up below