TV Advertising Seen Dropping 7% in 2020

GroupM predicts another 12% dive in 2021

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Television advertising spending in the U.S. is expected to fall 7% to $61.07 billion in 2020 and another 12% next year, according to a new forecast from GroupM.

The huge media buyer sees national TV dropping by 11% this year, but growing at 6% in 2011.

GroupM includes streaming outlets and offshoots like Roku and Hulu in its national TV figures. That streaming TV will do better than traditional TV, losing 3% in 2020 and gaining 15% in 2021.

In its report, the agency notes that cord-cutting reducing pay TV viewing and ad-free streaming services grabbing viewers “could fuel inflationary conditions.”

Including about $8 billion in political advertising, local TV should be up 1% in 2020. But core local TV advertising will be down 34% because of weakness in local retail and auto spending. Without an election in 2021, local TV spending will plunge by 40%.

Related: Magna Forecasts 13.2% Drop in 2020 National Ad Revenue

“A potentially important assumption behind our forecasts relates to the return of professional sports. As of the writing of this document, some leagues have developed plans to resume play; however, whether schedules will proceed as intended remains to be seen,” GroupM said. “While some incremental advertising spending could certainly follow from the resumption of play, the specific impact on spending is probably limited because much of what would end up in sports inventory would end up elsewhere if sports did not resume.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Over the longer term, GroupM sees television spending bouncing back and forth between election and non-election years, finishing basically flat at $61.3 billion in 2024.

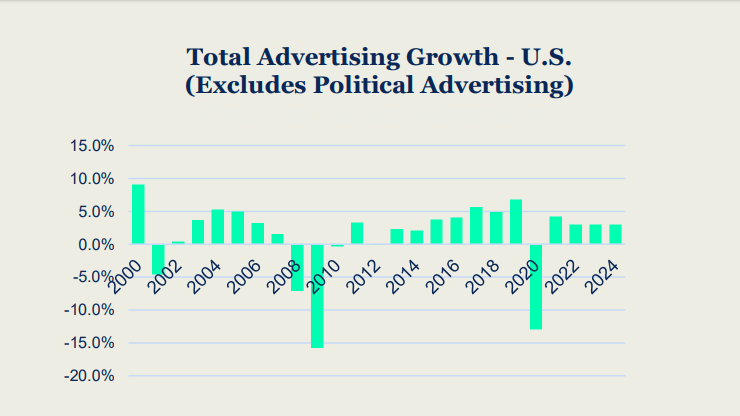

GroupM said all U.S. advertising spending will decline by 13% during 2020, with a 4% rebound in 2021.

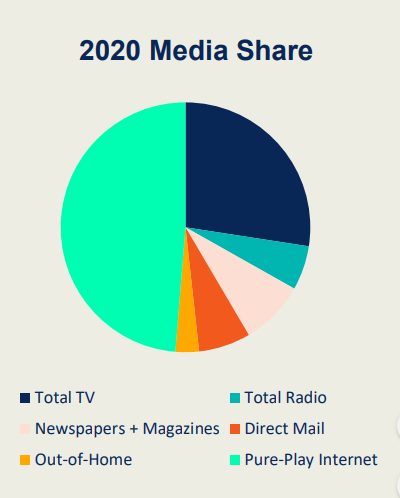

Digital advertising will edge down 3% in 2020--flat including political advertising. It should grow by 12% in 2021. GroupM figures that pure-play internet media properties will have a 49% share of the total ad market in 2020 and 54% in 2021.

“Economic activity is presumed to be somewhat normal after 2022, although the scale of decline and the actions taken at the present time will all have implications on the specific pace at which the economy expands, let alone when we return back to even just 2019 levels,” the report said. “This is, of course, a key assumption on its own: the absence of much of a safety net for many people who will be severely impacted by the ongoing cataclysms represent risks to a broader economic recovery.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.