Top 14 Pay TV Operators Shed Nearly 8% of Their Subscribers in 2022 -- Leichtman Q4 Cord-Cutting Report

That's up from a pace of only around 5% in 2021

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The fact that the U.S. pay TV business is shrinking fast is hardly news anymore, but the rate at which it is eroding is certainly worth keeping up with.

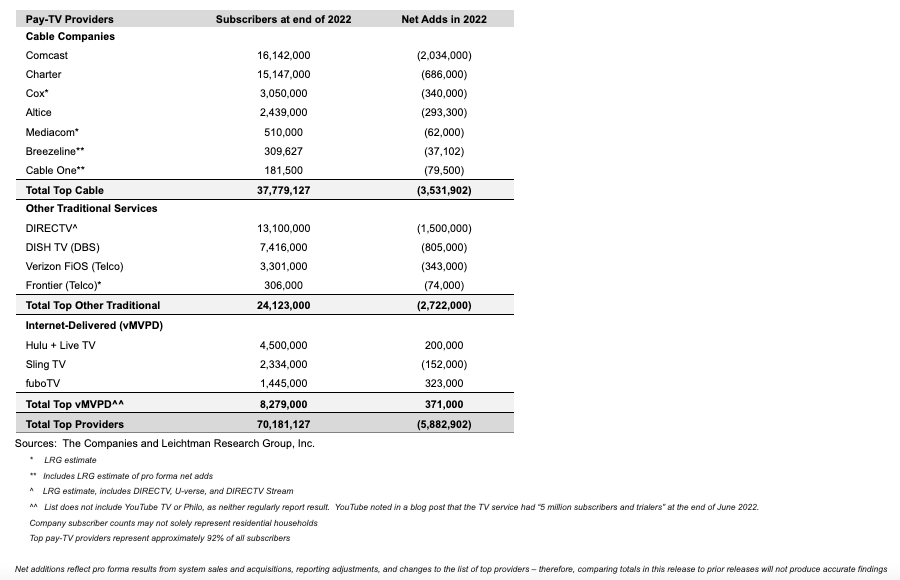

Leichtman Research Group (LRG) reported Friday that the top 14 pay TV operators in the U.S., minus Google, collectively lost nearly 5.9 million customers in 2022, finishing the year with just 70.2 million subscribers.

That's a year-over-year attrition rate of nearly 8%. In 2021, LRG pegged overall shrinkage at just over 5% for the same companies.

The loss leader was once again Comcast, which lost 11.2% of its linear video subscribers in 2022 to finish the year with just over 16.1 million.

If the current rate of loss holds or accelerates, Comcast will fall behind Charter Communications and become the No. 2 U.S. pay TV operator by the end of 2023. Seriously -- Comcast shed over 2 million TV customers last year. Consider that Comcast's home city of Philadelphia only has a population of around 1.6 million citizens.

Meanwhile, the fastest growing pay TV operator in LRG's chart Friday is FuboTV, which added 323,000 customers last year. As Next TV wrote earlier this week, FuboTV believes it will be cash-flow positive by 2025, but it keeps having to sell its own increasingly devalued stock to keep the lights on. It just raised another $68.1 million doing this in Q4.

Notable: LRG includes estimates for DirecTV platforms, since AT&T spun them off to private equity and they no longer disclose subscriber counts in quarterly earnings reports.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Also, Google/Alphabet rarely break out data for the top virtual MVPD, YouTubeTV, and LRG doesn't hazard an estimate for that platform.

Nielsen's latest market share snapshot of overall U.S. TV viewing for January reveals that YouTube consumption grew by nearly 3 points in one year. Since Nielsen is measuring "glass" consumption and not mobile devices, the streaming portion of the pie is connected TV viewing. This makes us wonder if that spike is being caused by a significant uptick in specifically YouTube TV engagement and customers.

Then again, if numbers were way, way up, Alphabet would probably break them out.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!