Redbox: Everything You Need to Know About the DVD Kiosk Company's SPAC-Fueled Plan to Migrate 40 Million 'Late Adopters' to the Streaming Age

Redbox seeks to transition its value-conscious kiosk users into a multi-pronged OTT business

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After a brutal 2020, in which a pandemic slowdown in the major studio movie release pipeline further eroded its 18-year-old DVD and Blu-ray kiosk rental business, Redbox is pitching investors on an ambitious plan to transition its still-loyal base of around 40 million customers into a vital, multi-platform niche within the competitive OTT business.

Outlining its strategy in a virtual July 14 meeting, Redbox provided further details on its initial public offering through a special purpose acquisition company (SPAC), Seaport Global Acquisition Corp., which will value Redbox at around $693 million and leave the company with around $209 million in cash when the deal closes later in the third quarter.

Private equity firm Apollo Global Management, which purchased the DVD rental business from Outerwall in 2016 and took it private, will roll 100% of its Redbox equity into the IPO, receiving 59% of shares of the publicly traded RDBX on the Nasdaq on a pro forma basis.

Selling the deal at Wednesday's meeting with equity analysts was Redbox CEO Galen Smith, who transitioned into the lead exec role after serving as chief financial officer of Outerwall during the 2016 Apollo purchase of the company.

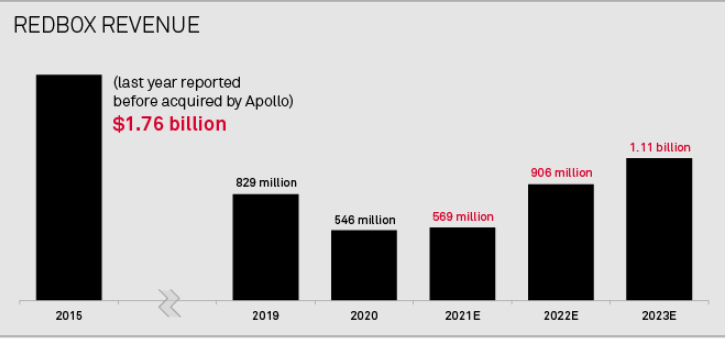

You'd think that a physical media-based kiosk business, already in decline when the pandemic sent revenue tumbling 34% in 2020 to $546 million, might not have much of a narrative. But the SPAC route releases Redbox from some of the liability associated with forward-looking statements, which gives Smith and his management team a little room to dream.

They believe they can double Redbox revenue to more than $1.1 billion by 2023, competing with the likes of Amazon and Roku, and building on an established brand and customer base--advantages that much-better-funded "streaming wars" startups like Quibi lacked.

And sure, a user base of around 40 million doesn't equate to the 200 million-plus subscriber scale of Netflix, or the 100 million-plus scale of Disney Plus. But it's in the same streaming customer ballpark as ViacomCBS and the newly minted Warner Bros. Discovery.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

So why not?

"We also have from our 18-plus-year history this incredibly deep set of customer data," Smith told equity analysts. "We know what our consumers love to watch. We know what actors they love. We know where they shop. We know when they shop. We know a lot about our consumers, and how they interact both at retail, as well as with our various services. And that gives us an opportunity to provide this incredibly customized and personalized experience to them."

Redbox still operates around 40,000 disc-rental kiosks across the outlets of nearly 150 U.S. retail partners. It over-indexes in lower population density markets with lower costs of living (see the graphic from the company presentation below).

It's an impressive brick-and-mortar footprint, bigger in sheer U.S. outlet numbers than McDonalds and Starbucks combined.

Notably, 71% of the Redbox kiosk customer base of around 40 million users describes itself as "bargain hunters," willing to drive down the street to rent a disc for $2 vs. paying six bucks for the same movie on a digital transactional service.

A bulk of Redbox kiosks are located in chains including Walmart, Dollar General and Dollar Tree. These are customers who think more than twice about paying $14.99 a month for Netflix or HBO Max.

Redbox's loyalty program touts 39 million members, who trade all sorts of personal data for discounts at kiosks. Redbox also touts an email roster of around 46 million potential digital customers.

Also notable: 70% of regular Redbox customers can be described as "late adopters."

"While it seems like Netflix might be ubiquitous, and everybody is streaming, the reality is that not everybody has made that full shift to digital," said Jason Kwong, the former WarnerMedia, Netflix and FullScreen executive who serves as chief strategy and digital officer for Redbox. "Now some folks are subscribing to Netflix, but not everybody has really cut the cord and fully moved over. Especially as it relates to the late adopters, which gives again, Redbox that opportunity, because that's the customer that we address."

Redbox is already in the streaming business.

The company says the Redbox app has been downloaded 43 million times, achieving an impressive 4.8 user rating from Apple App Store customers.

In the living room, the Redbox app is supported by Roku, Android TV, Xbox game consoles, as well as Samsung, LG and Vizio native smart TV operating systems. It's also supported by iOS and Android in the mobile device world. PlayStation support is coming. About the only notable place you can't get the Redbox app is on Amazon Fire TV.

The app started simply as a mechanism for customers to find and reserve the physical discs they seek at the closest available kiosks. But Redbox has been adding components to the app over time.

Three years ago, Redbox added a transactional video-on-demand option for its movie renters, allowing them to spend around $5.99 for the convenience of not having to drive, ride or walk to a kiosk. "TVOD" revenue grew to around $35 million in 2020, offsetting some of the blood loss for the kiosk biz.

Last year, Redbox added an AVOD service, Redbox Free On Demand, which features around 2,000 movie and TV show titles. Just this week, Redbox announced deals to license movies from Shout! Factory, Legendary Television, Magnolia Pictures and Relativity Media.

Just prior to the AVOD platform, it also launched Redbox Free Live TV, a collection of more than 100 linear channels, including Crackle, Popcornflix, Tastemade, Unsolved Mysteries, Cheddar News, Divorce Court and Pac-12 Network.

These ad-supported streaming efforts are being monetized by a programmatic sales acumen that Kwong concedes is still in the early developmental stages.

"Getting any attention from a lot of programmatic players gets tough until you actually reach a certain volume," he said.

And Redbox's internal advanced advertising team remains small. Most of the ad sales efforts are carried out by an outside vendor, Screenvision. The hope is to build out these advanced advertising resources with the bounty of the SPAC transaction.

"We also expect to continue building as part of this transaction, more of our internal direct sales as well," Kwong said.

Redbox's ad-supported streaming audience is growing. It counts over 1 million active monthly users, with engagement hours growing 960% year over year in June.

Away from the ad biz, Redbox is branching out into the "channels" gambit, as well, offering wholesale aggregation of subscription streaming services including HBO Max, Discovery Plus, Paramount Plus, Starz and Showtime. Just like Amazon, Apple and Roku do, Redbox shares in any subscription bounty sold on its platform, and it controls customer billing and other data-laden aspects of the overall customer relationship.

And then there's Redbox Entertainment, the company's movie acquisition arm, formed several years ago to even out "gaps" in the major-studio release schedule that might harm the kiosk business.

The division has released 21 titles to date, not just within the release window chain of its own platforms, but across the digital spectrum of theatrical exhibition, as well as TVOD, SVOD and AVOD competitors. Notable releases have included the poorly reviewed biopic Capone, starring Tom Hardy, as well as crime drama Running With the Devil, starring Nicolas Cage and Laurence Fishburne.

Redbox executives have visions of this division possibly overseeing the production of original shows for various Redbox platforms in the future.

"The beautiful thing about this digital transformation is we're already along the path," Smith said. "This is not something that's all on the come, it's something that's already underway, and we're going to continue to leverage our legacy kiosk business to continue to have it to grow as we go forward."

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!