Originals Only Part of the Streaming Story

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Original series help subscription video-on-demand services differentiate themselves in the market and lure in customers. But licensed programming still drives the most traffic in the U.S. for Netflix and Hulu, according to a March 2017 study from 7Park Data.

Granted, the picture might change during months in which new original series premiere on these OTT services, but more than 80% of TV streams in Q1 2017 were of licensed, non-original shows, 7Park Data found in its latest Streaming Intelligence report. Its findings were based on a proprietary mapping process paired with standard metadata that relies on numbers culled from more than 1 million active OTT users that collectively stream more than 1 million hours of content each day.

“Licensed TV is watched during windows when viewers are waiting for their favorite originals to return,” 7Park Data said. “Licensed TV is watched during that post-binge ‘cool down’ and watched in the run-up to a new season on broadcast.”

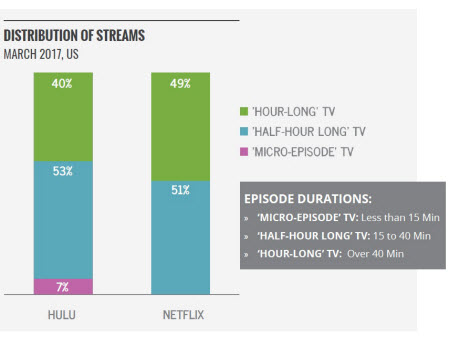

In addition to classics and cult programming, SVOD subs also gravitate to “micro-episode” series that are shorter-form (15 minutes or less), and therefore require a smaller time commitment.

For Hulu, it’s become a secret weapon of sorts, as the most popular micro-episode titles were Adventure Time, Steven Universe, Regular Show and Aqua Teen Hunger Force. According to the study, 7% of all TV streams on Hulu are for episodes of 15 minutes or less, up 19% from the prior year.

By comparison, micro-episode viewing on Netflix is miniscule, presenting a “rare weak point for the service (and an opportunity as well),” 7Park Data said.

The popularity of TV genres also differ between Hulu and Netflix subs.

The family genre was tops on Hulu, up 2.9%, versus a year ago, while horror led the way on Netflix, up 17.1%, aided by shows such as Supernatural, The Vampire Diaries and original new series Santa Clarita Diet.

By comparison, mysteries (-43.9%) on Hulu, and family (-39.2%) on Netflix were the genres that were falling behind the curve for the respective services.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.