‘Netflix Is Intelligently Driving Adoption of Ad Tier’ With Price Hikes, Analyst Says

‘Netflix needs to attract meaningfully more ad-supported subscribers to make their advertising business more than a rounding error,’ Michael Nathanson said

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Netflix stock has surged over 16% since it revealed Wednesday that the company added 8.76 million subscribers globally in the third quarter, while its revenue surged 8% to $8.5 billion.

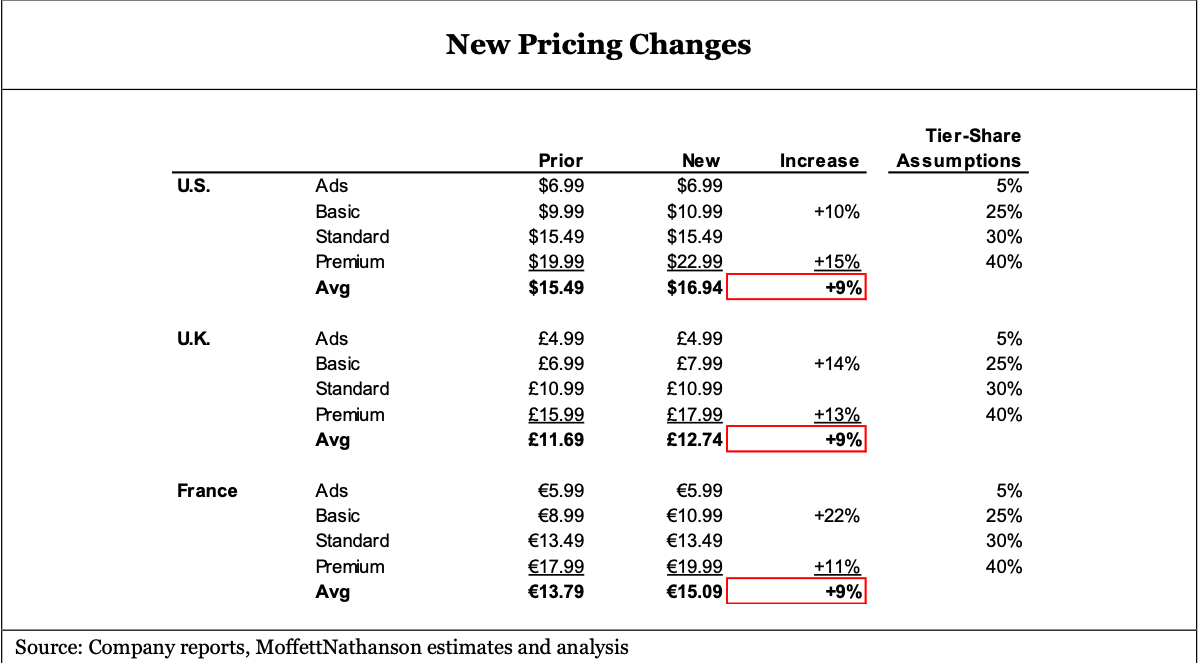

But amid all the bullish news to emerge from Netflix’s Q3 report, equity analyst Michael Nathanson said “the biggest surprise is the immediate and substantial price hikes in three of Netflix’s largest revenue markets.”

By raising the price of the ad-free basic tier, “Netflix is further incentivizing new and existing members to sign up for its materially lower priced ad-supported plan,” the analyst explained in a note to investors Thursday morning.

Currently, with its ad tier accounting for 5% or less of its total subscriber bases in the U.S., U.K. and France, Netflix needs to drive members to that category in order to make it economically feasible.

“Put simply, Netflix needs to attract meaningfully more ad-supported subscribers to make their advertising business more than a rounding error,” Nathanson wrote.

Raising the price of the 4K-capable premium tier in the same regions, meanwhile, drives up average revenue per member (ARM) “among households that are either price-inelastic and/or advertising adverse.”

With the price increases, Nathanson's firm, MoffettNathanson, is raising Q4 revenue projections for Netflix by 2.4% and full 2024 revenue forecasts by 3.5%.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!