Media Rights, Sponsorship Will Fuel Sports Growth to $68B in 2017: PwC

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

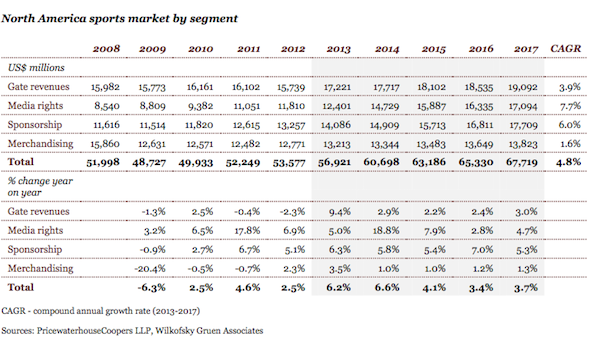

Led by growth in the valuations for media rights and sponsorship dollars, the North American sports market will advance at a compound annual rate of nearly 5% through 2017, according to the latest research from PricewaterhouseCoopers.

PwC’s Sports Outlook projects that the North American sports market will expand across four sectors to $67.7 billion in 2017, marking a compound annual growth rate of 4.8% from $53.6 billion in 2012.

Although gate receipts will remain the largest of the four segments over the period, increasing at a CAGR of 3.9% from an estimated $15.7 billion in 2012 to $19.1 billion, both media rights and sponsorship growth will outstrip the historic category leader over that span.

Media rights are forecast to increase at a CAGR of 7.7% from some $11.8 billion in 2012 to $17.1 billion in 2017, as a number of new deals come into play during the five-year outlook. Although PwC doesn’t specify in its report, new long-term Major League Baseball and National Football League contracts with major rights bumps kick off in 2014.

On the sponsorship front, PwC predicts a 6% CAGR that will lift the sector's estimated total of $13.3 billion in 2012 to $17.7 billion in 2017, driven by new inventory and category rights resulting from fresh in-venue spaces and media platforms, as well as the continued relaxation of prior category restrictions.

As for merchandise, licensed sales will edge up at a CAGR of 1.6% from $12.8 billion to $13.8 billion in 2018. New league supplier deals and team rebranding efforts will provide a bit of a lift from sluggish economic conditions that are otherwise expected to curtail consumers’ spending interest.

Adam Jones, director, PwC Sports Advisory Services, said that historically “gate revenue has been the lead source for sports and their teams, but over the next five years media and sponsorship revenue growth will outpace” that traditional driver’s growth levels.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Jones said gate revenue increases are slowing for a number of reasons, noting that the interest in “high-demand teams” has been sated from high ticket pricing and sell-out perspectives, while”pressures are being exerted on certain other sectors.” That, he said, was not only a function of the cost of tickets, but time considerations of getting to and from the stadium and arenas, as well as the experiences therein, compared with how fans can enjoy the competitions from the comfort of their homes.

“The leagues and teams have begun working on this through the installation of better infrastructure via video boards and wireless connections,” he said, adding that the parties are working on developing customized apps and offerings to enhance fans in-stadium experiences.

As to media, hikes in rights prices will jump 5% to $12.4 billion in 2013, before surging 18.8% to $14.7 billion in 2014. PwC projects those totals to grow 7.9% to $15.9 billion the following year, 2.8% to $16.3 billion in 2016 and 4.7% to nearly $17.1 billion in 2017. The National Basketball Association's current national contracts with TNT and ESPN/ABC expires after the 2015-16 season.

“Fundamental ratings for the telecasts will remain strong,” said Jones. “Live sports provide a value for advertisers to reach audiences that are not nearly as susceptible to competing on-demand consumption trends.”

National deal aside, PwC said new contracts and/or renewals by regional sports networks will also result in sector expansion.

National networks and RSNs alike will benefit from the “further rollout of new platforms and devices that will drive even more valuations to those rights,” said Jones.

He said there also be gains tied to social media metrics that are part of some current deals, but not others, and “means to monetize them will grow importance in the years ahead. The broadening of audiences tied to other platforms are becoming increasingly key factors.”

Sponsorship represents the second-fastest-growing sports segment, according to PwC, improving 6.3% this year to surpass the $14 billion threshold. Projected increases of 5.8% in 2014, 5.4% in 2015, 7% in 2016, and 5.3% the following year will combine to lift sponsorship funds to $17.7 billion in 2017, according to PwC. Akin to media rights runoffs, sponsorship's upside emanates in large part from the expiration of old deals that are replaced by new pacts at higher rates.

PwC traditionally produces an annual sports outlook with a global view. However, given emerging trends with rights and sponsorships, the company elected to focus on North America this year, according to Jones.