Looking for Elevated Sales

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Some buyers may have groused about long lines at elevators during last year’s NATPE, but distributors reported brisk sales to Latin America—and they are predicting even better results at the 2012 confab this week.

Healthy Latin American economies, doubledigit growth in TV advertising, buoyant pay TV markets, strong demand for formats and the launch of new streaming video services by Netflix and others are among the key factors executives cite for the generally bullish prognosis.

NATPE president and CEO Rick Feldman stresses that the move to Miami in 2011 was designed to “revitalize the market,” not make it “more Latin-focused.” That decision helped boost attendance from Latin America and Europe and bump up overall attendance by about 1,000 people, to around 5,000.

“Moving to Miami was a smart move that recognized that NATPE had become a Latin-focused market and that Miami is the unofficial capital for doing business in Latin America,” notes Keith LeGoy, president, international distribution, Sony Pictures Television.

This year, organizers are also moving to correct the biggest complaint about last year’s move—the long lines at the elevators. “I hope they will sort out the problems with the elevators,” says Elie Wahba, senior VP of Latin America and the Caribbean at Twentieth Century Fox Television Distribution. “If they can, it will strengthen the market. If not, it will kill it.”

To ensure that doesn’t happen, organizers are spreading out the distributors through the Fontainebleau hotel complex this year. “Last year, in an attempt to make the buyer’s job easier we put all the distributors in suites in one tower and were assured the elevators could handle the traffic,” Feldman says. “This year we will use all four towers instead of one.”

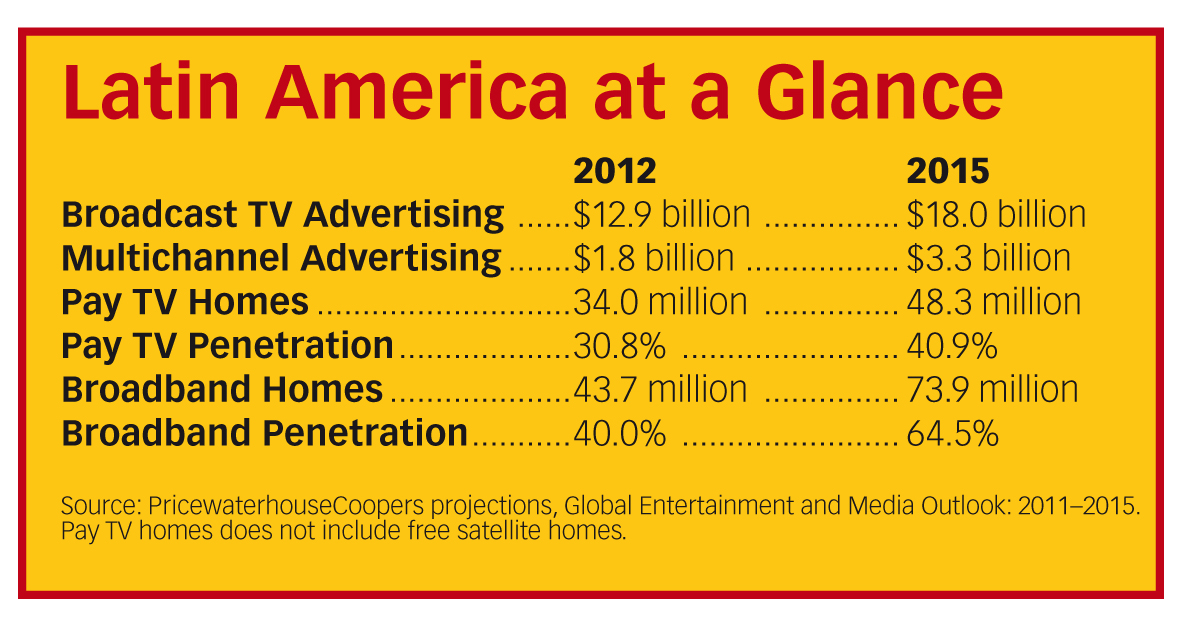

While Latin economies tanked in the early 2000s after the dotcom bubble burst, they have survived the recent global financial crisis much better than Europe and North America, thanks in part to strong commodity prices. PricewaterhouseCoopers is predicting nominal GDP growth of around 12% in 2012 and a similar 12% pop in TV advertising for the six largest countries in the region.

Not surprisingly, that has translated into a very strong program sales market. “Our sales are higher and are increasing year to year,” says Wahba, adding that Brazil has been particularly buoyant. “Movies are still very strong, though piracy is a problem. And while U.S. TV series are harder to sell to broadcasters, they do very well with satellite and cable channels.”

Strong broadcast markets are also boosting the region’s production of telenovelas. Marcel Vinay, director of international sales at TV Azteca, estimates Latin American producers create about 100 telenovelas a year.

All that production has created increased competition for prime broadcast slots in Latin America at a time when the success of Latin novelas around the globe has encouraged a spike in soap production from countries like South Korea and Turkey.

Despite the increased competition, Vinay says that he expects their sales to grow in 2012 and that they are planning to double their production in 2012 to about 900 hours of novelas, thanks to a new HD facility that will go online in the first quarter of 2012.

Pan-American Traffic

Many of these telenovelas also make their way into the rapidly growing U.S. Hispanic market, where a B&C survey of the business last fall found that more than 90 Hispanic-targeted networks have been launched.

The two biggest broadcasters, Univision and Telemundo, acquire, coproduce or commission a significant amount of programming from Latin American producers. And other Latin broadcasters have launched their own U.S. Hispanic channels.

Mexico’s TV Azteca, for example, supplies all the programming for its U.S. Azteca America channel and is looking to launch one or two additional Hispanic channels in the U.S. this year, Vinay reports.

The healthy broadcast market and the thriving local production business has also boosted demand for both scripted and unscripted formats. LeGoy at Sony says that their expanding local production business has produced non-scripted formats like Who Wants to Be a Millionaire in Spanish and Portuguese, original Spanish-language series that have been sold in both Latin America and to U.S. Hispanic broadcasters and Spanish-language remakes of U.S. network programs for Latin broadcasters.

Following the success of ABC’s Ugly Betty, which was based on a huge international Colombian hit telenovela, Latin distributors are also looking to bring their formats to both English- and Spanish-language U.S. channels. “Ugly Betty opened doors that were closed before,” says Jorge Granier, managing director of RCTV International.

After RCTV’s popular broadcast channel in Venezuela was shut down by Hugo Chavez, its international distribution arm is now focusing on sales, coproductions and format deals, Granier says. During NATPE, he will be pitching ideas to both broadcast and cable outlets in the U.S.

Streaming to Miami

Broadband penetration is low—around 40% for the six largest countries in Latin America versus 74% in the U.S. in 2011, according to PricewaterhouseCoopers. But Netflix and others are launching Spanish-language services for Latin America or the U.S. Hispanic market, and a number of distributors are expecting an uptick on those sales at this year NATPE.

RCTV International, for example, has sold programs to both Hulu Latino Spanish-language service streaming video service and Netflix’s Latin American service, which acquired around 1,500 hours. To further capitalize on that market, RCTV is now investing heavily to digitize its library.

Pay TV penetration in Latin America is also still relatively low by U.S., standards but it too is growing, with PricewaterhouseCoopers is predicting 9.6% per year growth between 2011 and 2015 in the region’s six largest countries.

That growth is particularly important for the sales of U.S. TV series, which generally are unable to get prime time slots on the broadcast channels. But their success airing in English with Spanish subtitles in the more affluent cable and satellite homes has sparked increased interest among broadcasters, some studios argue.

“Middle-class pay TV subscribers are clearly an important demographic for broadcasters,” and they are now looking more closely at ways to try U.S. series in prime slots, says LeGoy.

E-mail comments to gpwin@oregoncoast.com

The smarter way to stay on top of broadcasting and cable industry. Sign up below