iSpot.TV Sees Benchmarks as Basis For Ad Guarantees

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The talk about buying television advertising based on its effectiveness is starting to turn into action.

Real-time measurement company iSpot.TV, after measuring the results of ad campaigns, has issued benchmarks for 17 different ad categories that let advertisers know how much of a lift their campaigns should produce and make TV networks comfortable guaranteeing that their ads will result in positive outcomes.

“Our view is that you’ve got to have scale, consistency and predictability, much like in the primary currency in the GRP [gross ratings point],” iSpot CEO Sean Muller said. “We’re basically launching the equivalent of that for outcomes.”

With the benchmarks in place, “we’re going to see outcome currency sort of heat up a lot more in 2020,” Muller said.

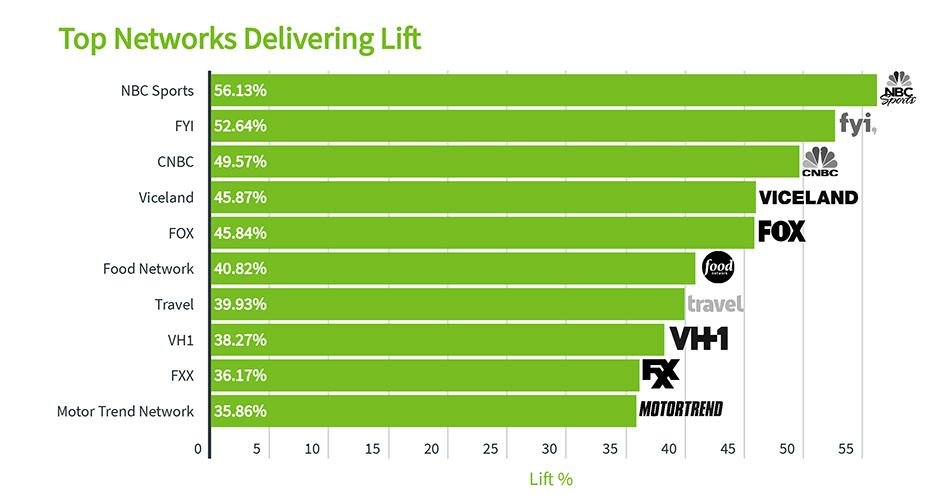

iSpot’s figures show big differences in results from category to category and from network to network. For example, when it comes to the auto category in the third quarter, people who saw commercials on NBCSN were 56.13% more likely to go to a website where they could research or configure vehicles than those who didn’t see the ads (see chart). Among broadcasters Fox was the top performer, providing a 45.84% lift. The average lift for the category was 27.68%.

Muller said the big differences in lift among networks were because of the relevance of the commercials to the audience. “Where you have relevant audiences, you also have receptive audiences, but you get that to different degrees,” Muller said.

Many networks are already looking to sell ads based on targeted audiences, an approach those networks claim will make ad campaign more effective. “If you’re coming out and saying that your audience targets are good and are going to deliver outcomes, why not just guarantee that?” Muller asked. “You might get even higher CPMs, if you’re going to guarantee it, and even more interest.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Networks should be more comfortable making guarantees if iSpot’s benchmarks give them and their clients a better idea of what to expect. If iSpot has found that campaigns in a category on that network results in lifts between 18% and 30%, they could agree on a guarantee of a 20% lift.

“They’re not going to stick their necks out too much,” Muller observed. But even if they’re a bit on the safe side, advertisers benefit. “What we found is that where the networks have done this, they’re vested in making sure to target and optimize the campaigns,” he said. “So far, they’ve been blowing these numbers out of the water just by putting a little attention to it.”

“There have been lots of individual one-off studies done so far, but nothing as structured as what iSpot has, said Howard Shimmel, president of Janus Strategy & Insights. “ It’s a big step towards networks being able to develop guarantees that can be used in selling with the necessary level of precision required.”

Shimmel, former chief research officer at Turner, said it was important to consider other variables that might impact the ROI or attribution of a campaign — creative, context, engagement. Some variables can be addressed in forward-looking planning and be used predictively, he said.

NBCUniversal and Fox have said they’re using iSpot data to gauge the effectiveness of campaigns, but Muller declined to say which media companies have been making guarantees based on lift metrics. iSpot gets viewing data from millions of smart TV sets and creates its own logs of which commercials air and who sees them. Originally, iSpot measured the effectiveness of ads based on website visits, but now it also gets information from a number of different providers on store visits, point-of-sale data, consumer goods purchases and box-office sales.

One of iSpot’s clients is a large movie studio that bought a targeted campaign to launch one of its theatrical releases earlier this year.

“Their question for us was, was the audience-targeted campaign worth the premium that they paid for it,” Muller said. “We used the lift metrics and the conversion analytics to measure the incrementality they got from their audience-targeted buy, and compared that to the nontargeted portion of their buys. It turned out that the targeted buy had a 59% higher ROI, even though the CPM was higher on it.”

iSpot is also looking at how frequency affects lift. While incremental reach does top out after a viewer sees an ad a certain number of times, the bigger concern is frequency being too low. “If you’re driving a frequency that’s too low that can impact” the incremental lift,” Muller said.

Next on the agenda is measuring lift for over-the-top viewing. “We actually have quite a bit of scale in OTT, but we’re not yet ready to publish benchmarks,” Muller said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.