How Ready Is Charter To Let Disney and ESPN Walk? It Plans To Funnel Blacked-Out ‘Monday Night Football’ Fans to Fubo and YouTube TV

Why this mega-blackout feels different — Charter seems more interested in protecting its core broadband ‘connectivity relationships’ than renewing its $2.2 billion deal with Disney

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Before he got distracted by his current fight for survival in the retail wireless business, Dish Network chairman Charlie Ergen spent a lot of time chest-thumping in the pay TV carriage wars, telling the programming community that when he blacked out a channel he was prepared to walk away for good.

And in recent years, Dish made good on some of Ergen’s threats, notably tossing regional sports network Bally Sports to the curb in 2019. If you’ve observed the recent wide-ranging collateral damage caused by the subsequent bankruptcy of the Sinclair Broadcast Group subsidiary that manages Bally Sports, then you understand how fateful and impactful Ergen’s decision was.

Major League Baseball, the National Basketball Association and the National Hockey League are all currently scrambling to figure out ways to make money from local TV sports amid Bally Sports’s floundering.

So how broad-reaching will the impact be if Charter Communications, which has around twice as many pay TV subscribers as Dish (14.7 million vs. 6.9 million), decides not to try to bring back the biggest sports channel of them all, ESPN?

Well … double it. And add 30.

There is no precedent for what Charter now seems prepared to do. But in the early hours of Friday morning, less than 12 hours after it took down ESPN, ABC and the rest of the Disney cable TV universe in a carriage dispute, Charter held a conference call, during which it made it clear that this isn’t blackout business as usual.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

“Charter seems genuinely willing to walk away from Disney, and even the entire linear video model, if necessary,” MoffettNathanson principal and senior analyst Craig Moffett wrote shortly after the cable company’s virtual meeting.

Observed Moffett: “They even titled their ‘impromptu’ conference call this morning: The Future of Multichannel Video: Moving Forward, Or Moving On.“

Sure, Charter’s morning presentation included typical rhetorical phrases like “drawing a line in the sand” against skyrocketing program licensing costs.

But consider Charter’s actions. Beyond the immediate disruption to college football broadcasts — a big Utah-Florida game on ESPN was the first contest to get blacked out — the first NFL action on ESPN to be impacted by the Charter blackout will be the highly anticipated season-opening Monday Night Football contest between the Buffalo Bills and New York Jets on September 11.

Besides being Aaron Rodgers’s first game as a Jet, this is a matchup that features two Charter franchise markets.

What’s truly interesting: According to Moffett, Charter is setting up a QR code that takes its pay TV customers directly to signup pages for virtual pay TV services Fubo and YouTube TV, which do carry ESPN.

(Not surprisingly, Disney is trying to drive pay TV refugees to Hulu + Live TV, which it controls.)

Charter’s single-click destination will also help Spectrum video customers who choose these vMVPD options to downgrade their Charter service.

“Forcing customers to pay for Disney content they opted out of, or don’t view and pay even higher rates, would negatively impact our connectivity relationships,” Charter said in its Friday morning presentation.

Indeed, Charter no longer sees video as a means of profitability but rather a tool to drive its core internet connectivity business. And at this point, it seems less concerned about preserving its remaining pay TV bathwater than the “baby” of mobile and wireline broadband connectivity.

As for Disney, which is openly planning its migration of ESPN to direct-to-consumer streaming, it faces a pricey multibillion-dollar renewal negotiation with the National Basketball Association with the possibility that its affiliate budget could suddenly come in about $2.2 billion lighter.

“Programmers are caught in a self-imposed dilemma as they have moved content to their DTC products for short-term profit maximization and their management teams are not incentivized to drive business for the long term,” Charter’s presentation added.

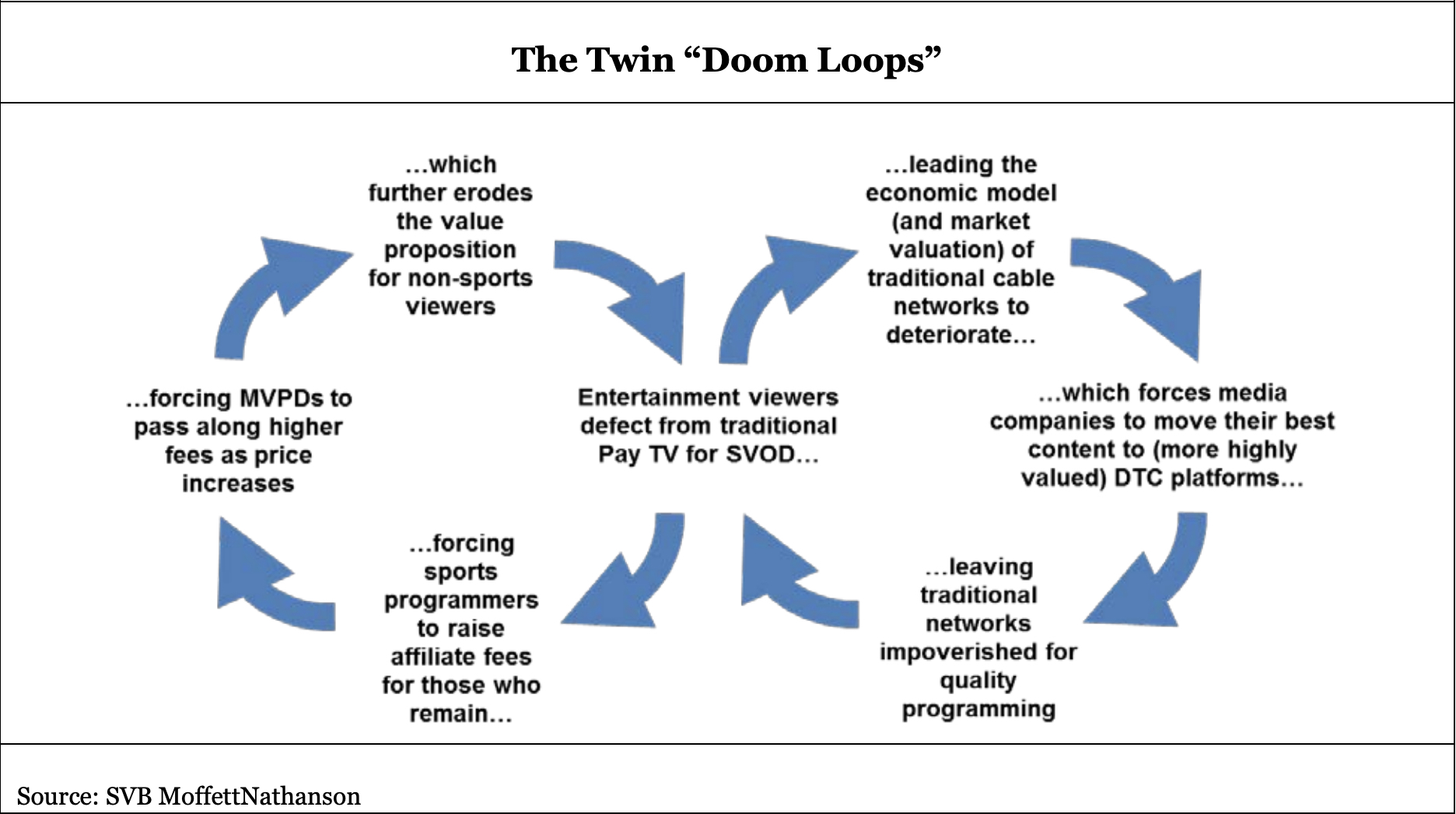

Moffett has already put a name on the virtuous cycles degrading the pay TV business: “doom loops.”

For its part, Charter seems to understand the “doom loop” sequence quite well, and it's more concerned about it leaking into connectivity, which is itself challenged by disruptive technologies liked T-Mobile's fixed wireless service.

Here at Next TV headquarters in mid-city Los Angeles, this weekend exchange on Nextdoor validates Charter's concern.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!