HBO Max Still Hasn't Recovered From Its Pullout From Amazon Channels (Chart of the Day)

Lower-than-expected base of streaming subscribers may explain why Warner Bros. Discovery wants to reverse course on pricey exit from wholesale HBO Max distribution

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With Netflix and Disney hard at work developing less expensive subscription tiers that are partially supported by advertising, research firms are working overtime to size up the opportunity.

On Monday, Next TV wrote about a Whip Media survey indicating consumer satisfaction with partially supported SVOD tiers vs. commercial-free plans. And on Tuesday, we're doing even more navel-gazing, looking at a research report from Antenna that analyzes customer signups for ad-supported tiers vs. commercial-free tiers.

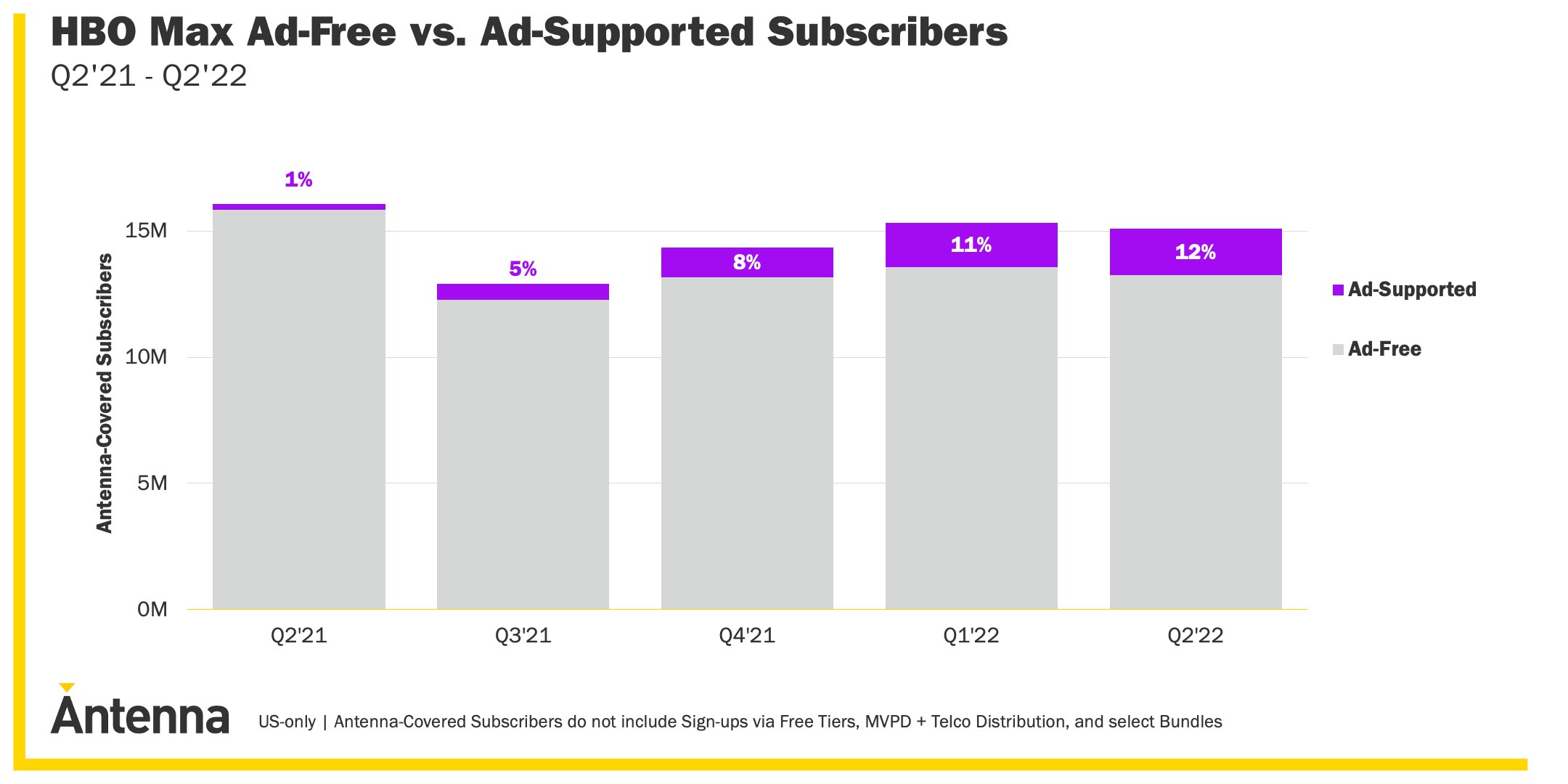

First, to us, the most interesting thing about Antenna's U.S.-based survey: The research company pegs the total U.S. base of HBO Max users at 15.1 million, with 12% (1.9 million) subscribing to the discounted $9.99-a-month iteration with limited commercials.

Also read: HBO Max Survives Un-Kneecapped ... for Now

By comparison, Netflix has nearly 75 million users in the U.S. and Canada. The data is intriguing at a time when parent company Warner Bros. Discovery is in process of combining HBO Max and Discovery Plus, and making key decisions, including what tech stack to use.

Another key observation not related to Antenna's core research premise: HBO Max lost a ton of subscribers, as it conceded it did, a year ago, when it pulled HBO out of Amazon Prime Video Channels. HBO Max still hasn't reached the subscriber level it was at when it made that fateful exit ... which is notably being reversed by WBD.

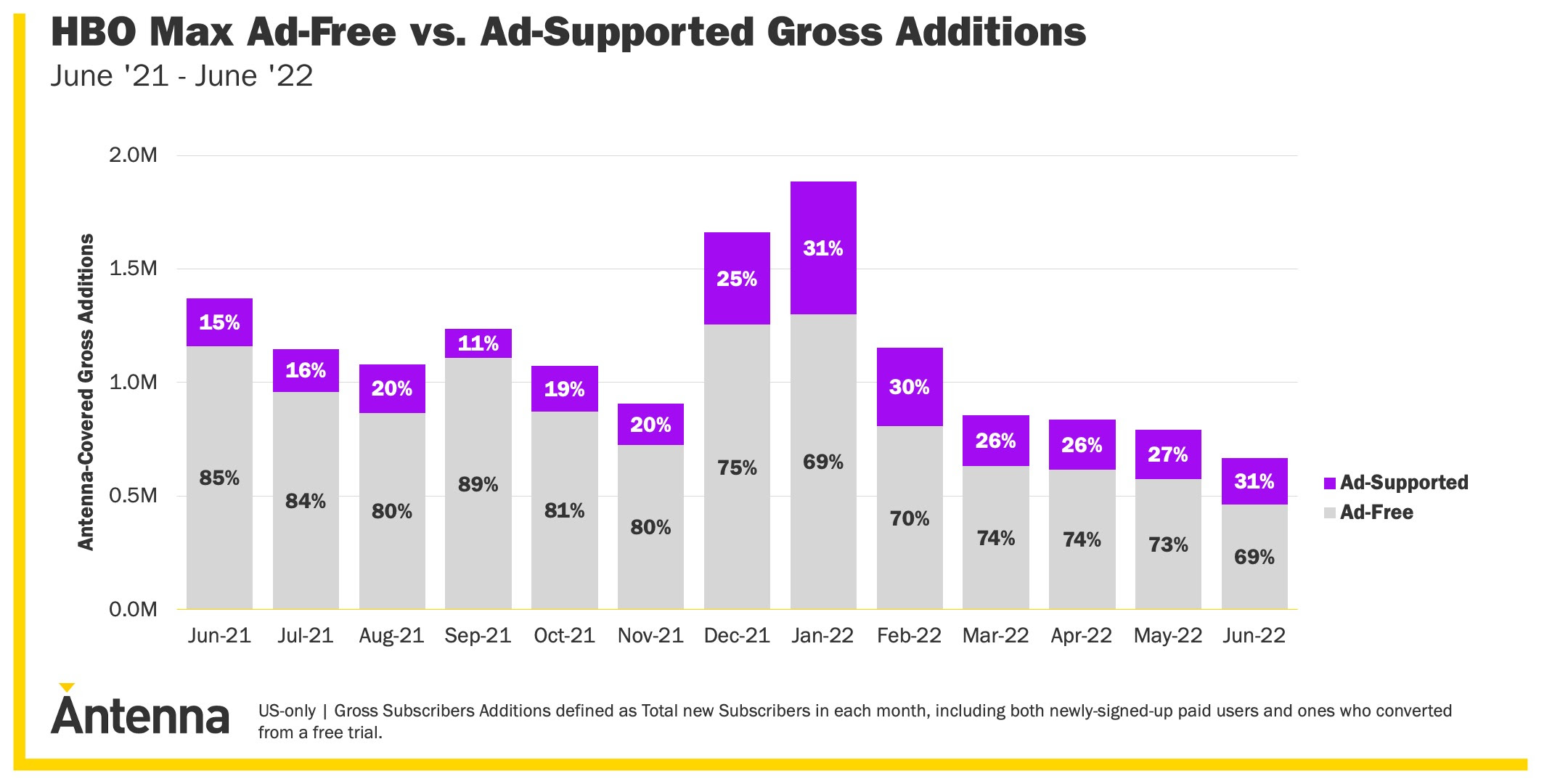

Back to the core topic of Antenna's latest research, HBO Max's $9.99-a-month tier with ads only accounted for an average of around 18% of subscriber additions last year, when only subscribers to the premium $14.99-a-month tier could access Warner Bros. 2021 theatrical slate titles released "day-and-date" on subscription streaming.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

With Warner removing that day-and-date enticement for its 2022 slate, the percentage of HBO Max customer additions choosing the cheaper ad-supported iteration has shot way up -- it was 31% for June.

"This is an important detail, as Netflix reportedly renegotiates a portion of its programming deals with studios to allow for ads to be shown," Antenna notes in its report.

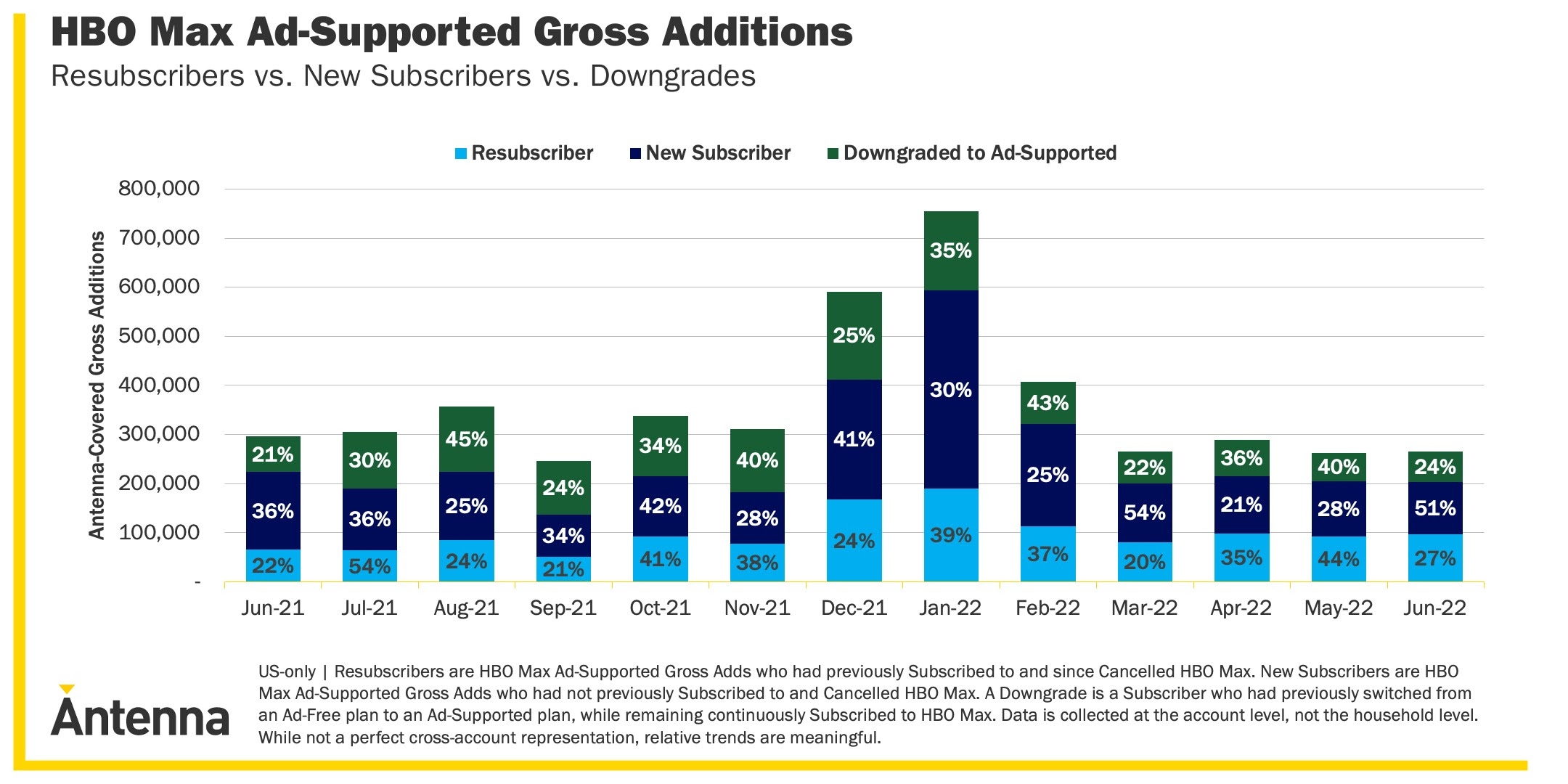

Meanwhile, based on Antenna's survey, it's hard to tell how many of HBO Max's ad-supported customers are downgrading service. In May, for example, 40% of customer adds for the cheaper tier came from subscribers downgrading from the $14.99-a-month premium tier. But that figure was only 24% in June.

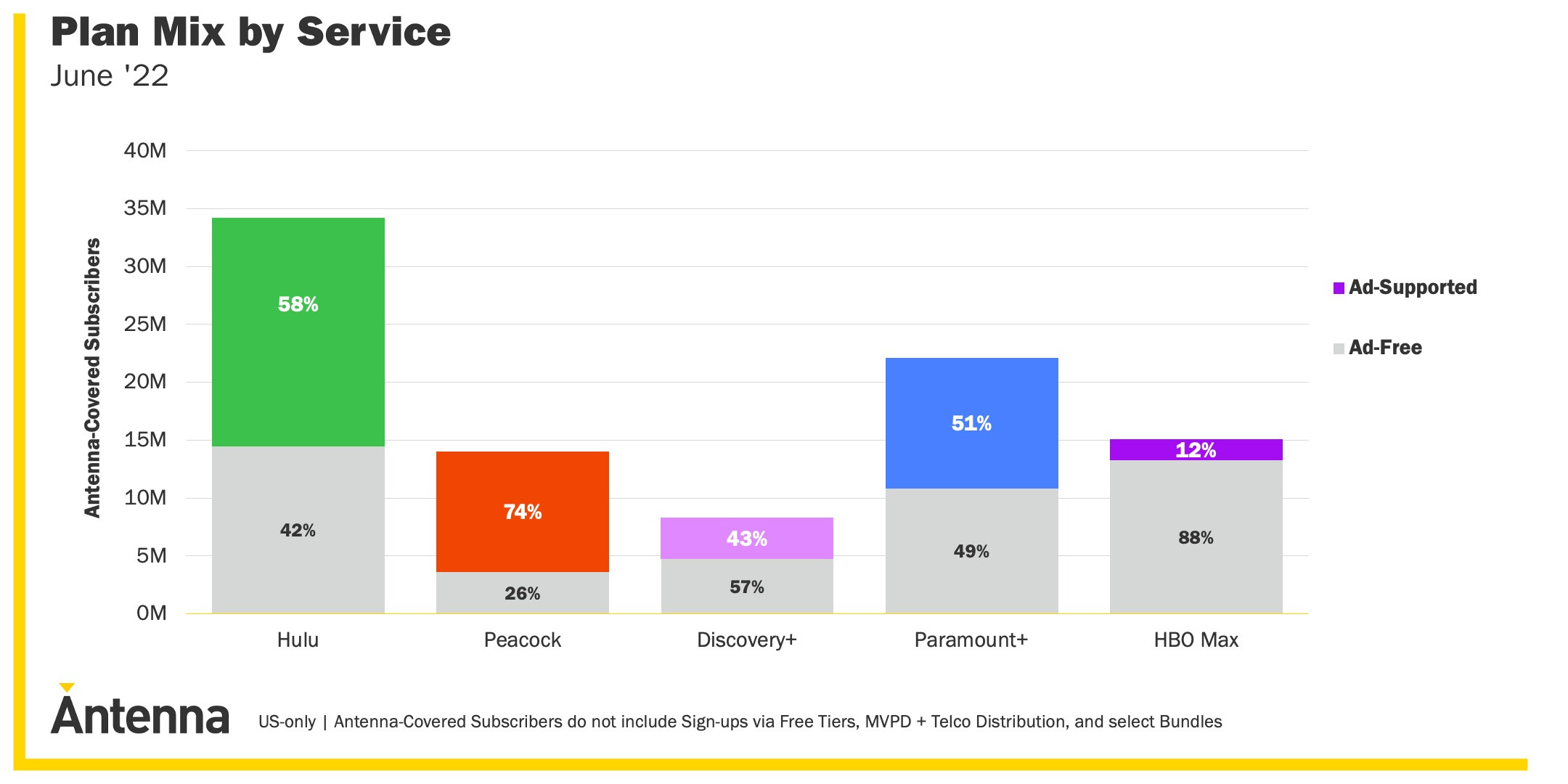

Finally, this last graphic shows the relative breakdown of ad-supported vs. commercial-free subscribers for the major hybrid subscription streaming services.

Paramount Plus has the most evenly split customer base, while Peacock's subscriber ranks are primarily ad-supported.

Antenna expects Netflix and Disney to skew more in line with HBO Max.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!