Footing the Bill

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

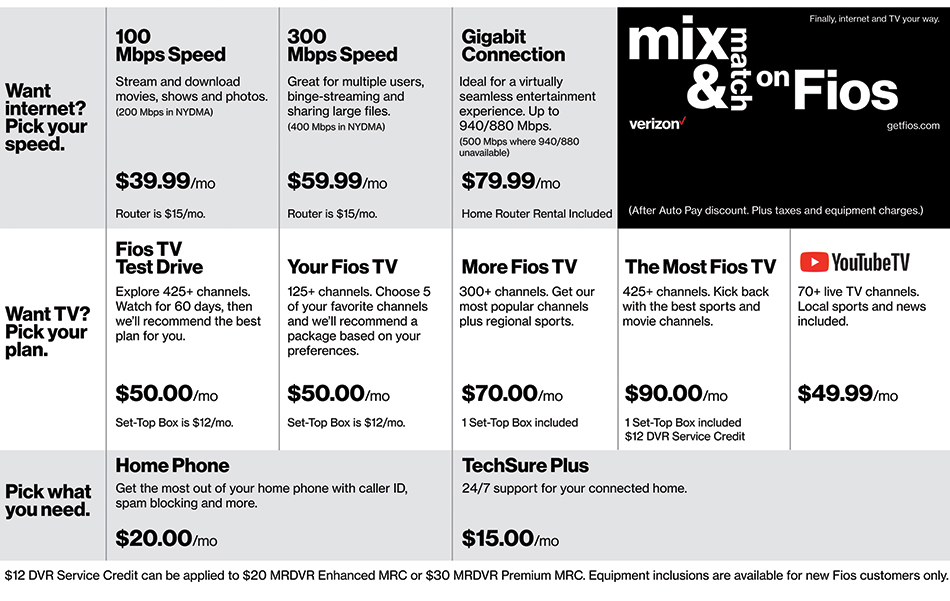

As the pay TV business moves through its latest evolution, the product emphasis is primarily on speed and choice. But as subscription TV service gets more complicated — Verizon Communications’s Fios Mix & Match offering is the latest step toward the Holy Grail of a la carte programming — so, too, do the more mundane aspects of the business, like how to collect payment for the myriad content opportunities presented to consumers.

There is a handful of vendors that have controlled cable billing since the industry began, with CSG Systems, Amdocs and NEC’s Netcracker being among the largest. But as offerings continue to grow, so does the danger of confusing the customer. And for just about any industry, billing confusion and questions are usually at the top of the list when it comes to poor customer satisfaction.

On the surface, billing seems to be relatively straightforward: You order a package and you pay for it. But with telecom companies, there is a slew of hidden charges, fees, promotional offers and pricing that can puff up a monthly bill almost beyond recognition. And with the future expected to be rife with choice, that also means there are more opportunities to disrupt the relationship.

Top Reason for Customer Calls

“It's pretty much common knowledge that questions about billing are one of the top reasons for subscribers contacting their operator,” said Dr. Charles Patti, Cox chair in customer experience and senior fellow at The Cable Center in Denver.

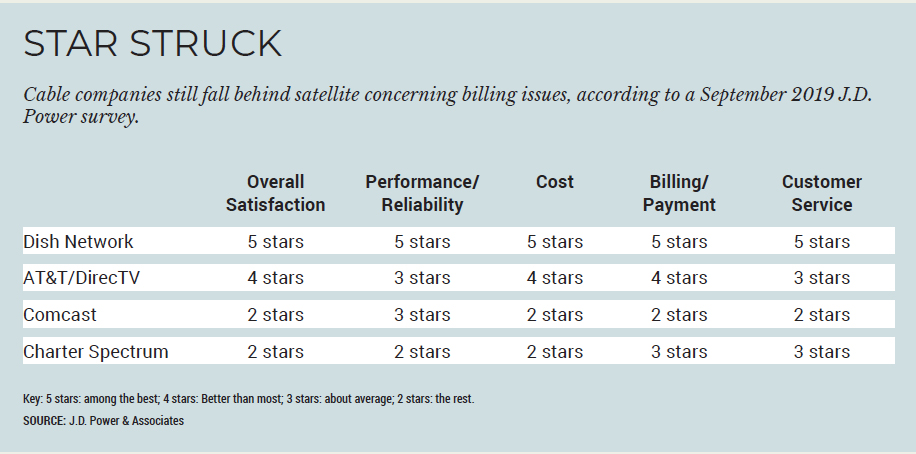

In a September 2019 ranking of television service providers by J.D. Power, companies with a high number of billing complaints ranked low on the customer loyalty scale. Per J.D. Power, nearly 40% of television and internet customers who had a high bill complaint said they didn’t achieve a resolution. Additionally, 52% of internet subscribers who had a high bill complaint said they would switch carriers.

Cable did a lot better in the J.D. Power rankings as an internet provider than as a video distributor. Comcast was No. 1 in the North Central region among internet providers, No. 2 (behind AT&T) in the North Central and the South and No. 3 (behind AT&T and Cable One) in the West. But it ranked fifth in the East, third in the South, North Central and West regions as a television provider.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Part of that has to do with customer perceptions and the higher cost of cable video service (because of higher programming costs), as well as past federal fines for charging customers for services and equipment they didn’t authorize.

“Taking every opportunity to demonstrate transparency is a customer-focused outlook that improves the overall customer experience,” Ian Greenblatt, J.D. Power managing director and practice leader, technology, media and telecom intelligence, said in a press release announcing the rankings last year.

About 65% of North American pay TV subscribers run on CSG platforms, and the company counts Comcast, Charter Communications and most of the other large cable operators as customers, as well as about 20 direct-to-consumer platforms in the over-the-top space.

Billing questions are still at the top of customer complaints, said CSG head of global product management Chad Dunavant, and operators are making changes, especially around the concept of prorating. That can be the culprit when a customer calls to complain that they signed up for a $99 service, yet their first bill was much higher, he said.

Operators are either removing prorates and providing service for no cost during the time that the billing dates differ, or aligning the dates programmatically as part of the order process.

“Customers are more comfortable with the subscription model due to new entrants and are OK having service through the date of their service," Dunavant said. “Moreover, operators are starting to play around with base packages that have a recurring billing relationship and then ala carte services that are sold directly through a credit card with a separate billing relationship. All of these models are things the billing systems can support, and areas CSG has invested in to ensure our operator customers can meet the demands of the market.”

One thing CSG is doing to simplify the process is a product it calls the “video bill,” where it sends out a personalized interactive video tutorial of what a customer’s first bill looks like.

“We send out emails when you order; we send out emails when your statement processes; we send out emails when your second statement processes,” Dunavant said. “There are all of these interactions to try to make it easier for consumers to understand. As a la carte rolls out and is adopted, those techniques will become even more important.”

Comcast began implementing the video bill in 2015, spokesperson Katie Lubenow said. Customers can access it through the MyAccount app, by saying “explain my bill” into their X1 Voice Remote or through the Xfinity Assistant, an always-on virtual assistant that customers can access online or via the Xfinity mobile app.

Charter has a similar customer video on its website that breaks down billing statements. Elsewhere on its website, it explains the vagaries of franchise fees, sales taxes and other charges.

In 2018, Comcast redesigned its billing statements, with the help of customer feedback, to make them easier to read and understand. Bills broke out one-time and recurring charges and highlighted changes in service.

“We believe in a clear, transparent billing experience for our customers,” Lubenow said, adding that the changes have resulted in reduced calls about billing problems.

That could get a little more difficult as the video business evolves into a more a la carte model.

“We’ve definitely seen the industry evolve from just something that was basic pay television to cable television that included a lot more bundling and cross-promotional discounts into a multi-line-of-business universe,” Dunavant said. About six years ago, he said, CSG began offering an OTT billing product, and the move toward direct-to-consumer distribution actually simplifies the billing process.

“On the OTT front specifically, it’s less complex,” Dunavant said. “Typically with OTT, you’re dealing directly with a content provider or a studio, not an aggregator, so the plans are much simpler. And the way you think about billing is simpler, because in most cases they are just doing credit card-only. You’re looking at a line item that might show up on a credit card for $9.99 per month and it shows a content distributor on that line item. It’s pretty simple, versus these large-scale bundles that have multiple line items and franchise taxes and everything else that goes with it.”

While the Fios Mix & Match offering is seen by some as the next step toward a la carte, Sanford Bernstein media analyst Peter Supino wrote in a note to clients that the offering is more “evolution, not revolution.”

“With ‘custom’ video bundles, the marginal video customer gets what he/she wants (to not buy things that they won't watch), while Verizon optimizes its per subscriber video costs,” Supino wrote. “This additional margin opportunity funds Verizon's elimination of video's infamous add-on service fees (but NOT set-top box rentals charges).”

The Experience in Canada

A la carte, to some, is an inevitability, and CSG is already traveling down that road. Among its customers are Canadian operators that have been offering a la carte programming to customers since 2016 as part of a government mandate.

So far, a la carte hasn’t been a challenge on the billing side, Dunavant said, because not that many Canadian customers are taking advantage of it. Those who do are only selecting a few channels.

“We haven’t seen a huge uptake yet,” Dunavant said.

But in a scenario where customers are selecting hundreds of a la carte channels, it gets a lot trickier.

“That becomes complex, because now every single channel has a price,” Dunavant said. “And how do you display that to a call center agent or how do you display that to a customer?

“One of the things we’ve done within our applications is to put in search functions and put in toggles that allow you to group channels together and make it easier to find and identify the channels that you need,” he continued. “The other part of the challenge is how does that get displayed on a bill.

“Imagine a situation where somebody picked 100 a la carte channels. Now you have 100 line items on a bill for each a la carte channel,” Dunavant said. “When you’re doing a statement run and are trying to keep your costs down, that becomes costly.”