Disney Jumps to No. 1 in DTC Subscription Scale ... At a Huge Cost (Charts of the Day)

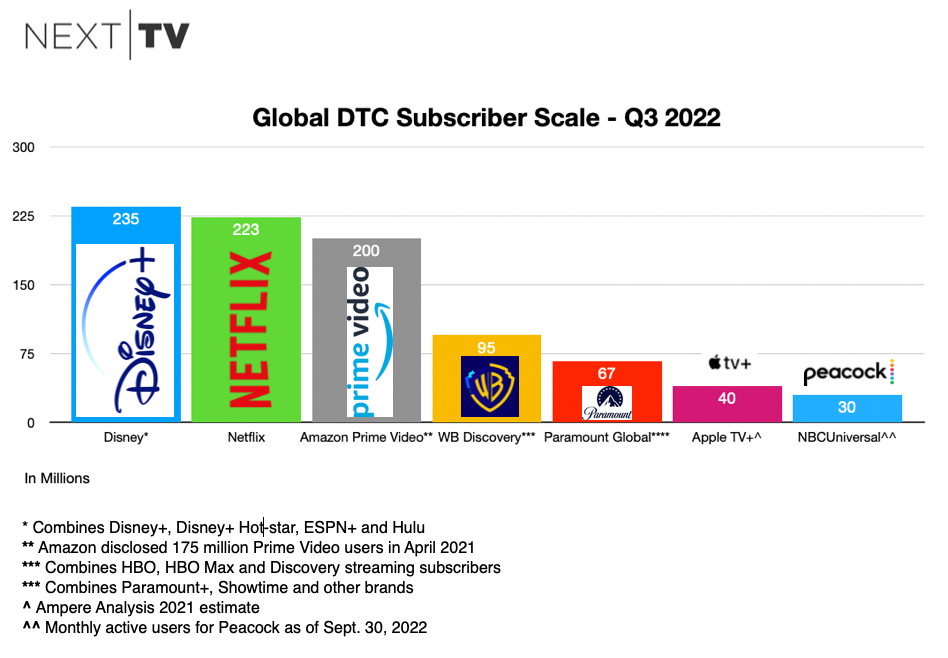

Disney zoomed past Netflix in Q3 with 235 million global subscriptions, but DTC losses reached almost $1.4 billion. Here's a snapshot of how the Streaming Wars are going with the third quarter in the books

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

“I believe that the grand experiment of chasing subscribers at any cost is over,” declared Warner Bros. Discovery CEO David Zaslav during his company's third-quarter earnings call last week.

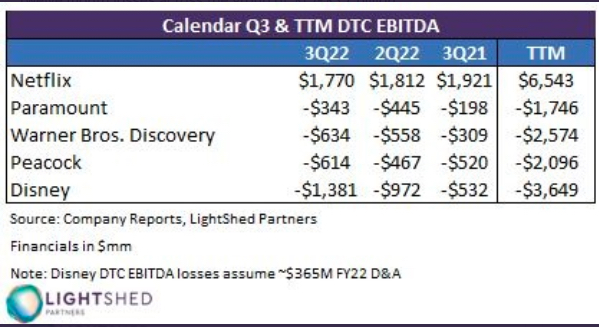

While Zaslav has staunchly expressed his intention not to have too many more quarters like Q3, during which WBD experienced EBITDA losses of $634 million on direct-to-consumer platforms, this chart from LightShed Partners shows that heavy spending on the so-called Streaming Wars continues.

And at least one of WBD's media-conglomerate competitors is perhaps more determined -- and better positioned -- to get to the other side of the proverbial garden hose of internet disruption.

The Walt Disney Company added a whopping 14.6 million DTC customers globally in Q3, but saw its DTC losses widen to $1.474 billion from $630 million.

With Disney's stock price tumbling more than 12% since it revealed its steep streaming losses Tuesday, Wall Street, at least in the here and now, isn't pleased with the conglomerate's ambitious platform growth strategy, which calls for it to spend $30 billion on content this year.

But with demo ratings off well into the double digit percentages year-over-year for the vast majority of ABC's returning shows, distribution for ESPN imperiled by recently accelerated pay TV cord-cutting, and the global box office pacing to come in far below its last pre-pandemic annual frame (2019), Disney seems determined to take the pain and get to the other side -- that happy place where the right scale and ARPU equals a profitable next-generation media business.

As the chart below shows, Disney seems to be on the way in terms of sheer scale. It's now working on its subscription pricing and advertising models.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

“By realigning our costs and realizing the benefits of price increases and our Disney Plus ad-supported tier coming December 8, we believe we will be on the path to achieve a profitable streaming business that will drive continued growth and generate shareholder value long into the future,” CEO Bob Chapek told investors Tuesday.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!