Warner Bros. Discovery Bumps Up Combined DTC Rollup to Spring, Plans FAST Launch, Expands 'Synergy' Cuts to $3.5 Billion

But heavily indebted media company misses revenue target in Q3 with $9.82 billion in sales ... and the stock drops again

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

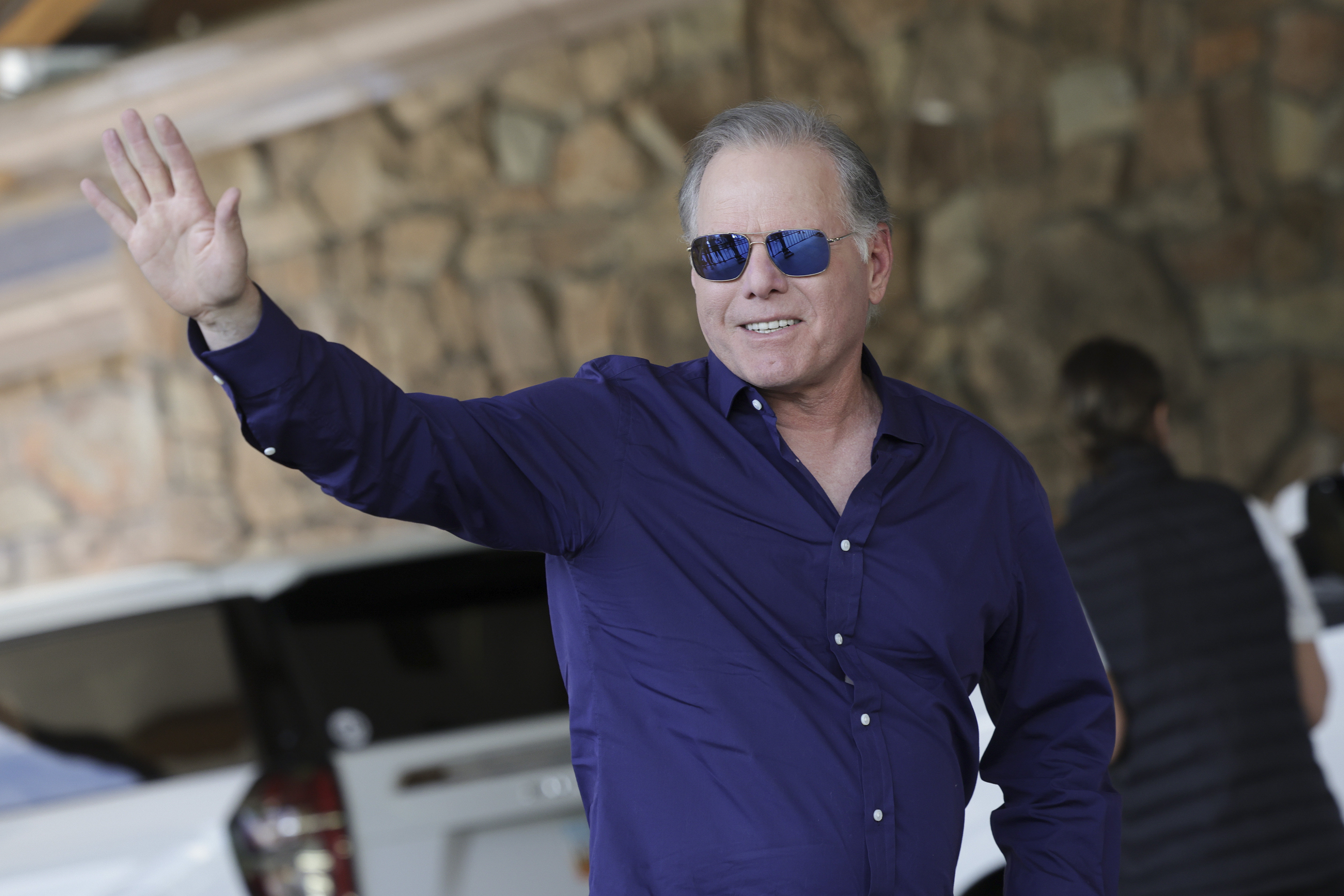

Its stock price halved since April, his company heavily in debt and facing "cyclical headwinds and secular challenges," and revenue significantly off from consensus projections, Warner Bros. Discovery CEO David Zaslav tried his best to spin some happy news for investors, while ginning up more blame for his predecessors, Thursday during WBD's Q3 earnings call.

For starters, Warner is now bumping up the launch of its combined HBO Max and Discovery Plus subscription streaming services from the summer to the spring. The two services jointly added 2.8 million customers in the third quarter, upping WBD's combined direct-to-consumer scale to 94.9 million paid users -- a scale still vastly smaller than the 220 million-plus paid DTC users enjoyed by Netflix and Disney.

Also read: David Zaslav and the Great 'Course Correction’: Why Is He Betting on the Past? (Bloom)

WBD will also launch a free ad-supported streaming platform next year, to compliment its fully paid as-yet-unnamed combined SVOD service, as well as the ad-light version.

Zaslav said an AVOD platform will be the best way to monetize the bowels of Warner's deep library, which he feels was utilized inefficiently on HBO Max ... under the predecessor regime led by AT&T and former Warner CEO Jason Kilar.

"They're not watching old series like Dynasty on Max," he said.

Zaslav pledged that by 2025, streaming will generate $1 billion in EBITDA.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

And Warner will continue to cut away, increasing its earlier $3 billion synergy target to $3.5 billion. Zaslav touted an "opportunity" to look inside each WBD operating unit and see "what's working" ... and ditch what is not.

"We haven't been reimagined and restructured as a company in a decade in a half," Zaslav said, failing to mention a painful re-org that occurred under Kilar in 2020.

About Those Headwinds...

Warner generated $9.82 billion in revenue in the third quarter, off from the $10.36 billion anticipated by consensus forecasts.

The company, formed in April after AT&T spun off its WarnerMedia division and merged it with Discovery in a deal valued at $43 billion, reported a net loss of $2.3 billion in Q3, with $1.92 billion of pre-tax amortization from acquisition-related intangible assets and $1.52 billion million tied to pre-tax restructuring and other charges.

WBD reported $50.4 billion of gross debt with only $2.5 billion in cash on hand.

The company's stock price, which has been halved since the merger closed, dropped another 5.6% in day trading and almost another 5% in after-hours trading Thursday.

"We are managing through some cyclical headwinds and secular challenges," Zaslav told equity analysts, spending much of the call on the defensive.

First, the CEO dismissed the notion that he and his team, which mostly come from the Discovery side of the corporate marriage, are going to butcher HBO and HBO Max -- the crown-jewell asset of the Warner empire, the sacred home to The Sopranos, Game of Thrones and now, third-quarter ratings sensation House of the Dragon -- and fill it with Discovery reality shows.

"We did not get rid of one show that is helping us," Zaslav said, speaking of a recent purge that included Batgirl, a $90 million direct-to-streaming movie, already completed, that was killed outright and made into a tax write-off. "What we have to do is spend our money on what has the best chance of succeeding."

To that end, don't expect a lot of innovative new IP.

"There hasn't been a new Superman movie in 15 years. There hasn't been a new Harry Potter movie in 13 years. What are the movies that have brands that are understood and loved everywhere else in the world? Zaslav noted, adding, "It’s no longer about how much, but about how good."

Except when it isn't

He said that Warner liked the audience performance of a recent "experiment" in which "B+" quality Magnolia Network reality shows, including Fixer Upper: The Castle, were moved onto HBO Max.

The success proved that lifestyle-themed reality shows -- a staple Discovery Plus product -- will blend well on a combined DTC service, Zaslav said.

Zaslav also took time to defend CNN chief Chris Licht, who continues his own painful restructuring at Warner's CNN cable news outlet. He praised the newly launched CNN This Morning, even though it debuted to a disappointing 380,000 viewer average.

"No one knows morning television like Chris Licht," Zaslav said.

He also took time to sooth investor fears about upcoming renewal negotiations with the NBA, noting that Warner still has three seasons left on its rights contract ... and that it's already secured important complimentary assets, including Charles Barkley and the rest of the key talent on TNT's acclaimed and well-watched NBA Tonight.

"We're going to be disciplined," Zaslav said regarding the negotiations, during which the NBA is expected to seek big increases over the current $1 billion per season.

Deficiencies, Deficiencies ...

Still, as he has since he took over Warner six months ago, Zaslav stridently tried to manifest the tone of a leader burdened with having to clean up a huge mess led by his predecessors ... all the while discounting for the fact that they had to lead their own newly merged media conglomerate through a pandemic and launch a major streaming service at the same time.

For instance, the deeply flawed HBO Max app experience was eviscerated by consumers and technologists early on. But a rebuilding of the app under Kilar's watch solved all -- or certainly the vast majority of -- the UX problems.

Still, on numerous occasions Thursday, Zaslav mentioned "deficiencies" with the technology. For example, he stated that the HBO Max app didn't drop you into a new suggested program after you finished what you're watching until his team recently came along and fixed it.

You're welcome.

And once again, Zaslav hammered away at the "streaming first" approach Kilar adopted during the pandemic, noting that, "direct-to-consumer movies don’t work." (And they worked in shuttered theaters?)

Continuing his assault, Zaslav condemned the previous regime's painful decision to pull out of the Amazon Prime Video Channels marketplace ... while justifying his own decision to reverse that move.

"We can't have only one fishing boat out there," he said, noting his own personal relationship with Amazon CEO Andy Jassy. Amazon is "an important company with broad reach," Zaslav said.

For his part, while mentioning AT&T, erstwhile corporate predecessor Time Warner Inc., and several associated executives by name -- but notably, not Kilar -- Zaslav did concede that, "It's easy to play Monday morning quarterback." ■

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!