DirecTV Now Brings Uncertain Future

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With the much-anticipated launch of over-the-top service DirecTV Now expected by the end of the month, AT&T believes it has created the pay TV delivery pipe of the future. But for AT&T’s principal video business — satellite-TV leader DirecTV — the new offering might be just another siphon for its dwindling customer base.

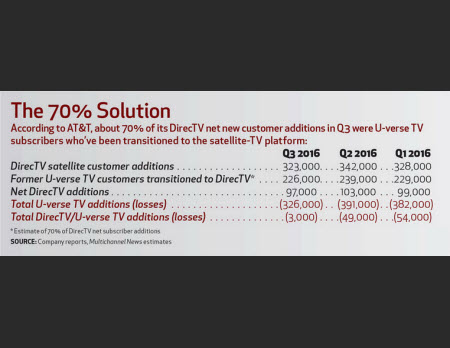

DirecTV has already seen customer growth wane after merging with AT&T. The telco has crowed that DirecTV has added about 1.2 million subscribers since the $48.5 billion acquisition closed in July of 2015, but the numbers are a bit misleading. Most of those DirecTV additions are former AT&T U-verse TV customers who have migrated to the DirecTV satellite platform.

In the third quarter, AT&T said DirecTV added about 323,000 net new subscribers, about the same as the 342,000 added in the second quarter and the 328,000 added in the first quarter — but 70% of the third-quarter DirecTV additions formerly subscribed to Uverse. Backing out those former U-verse customers, DirecTV added just 97,000 net new customers in the period.’

INTRAMURAL SKIRMISH?

Now AT&T is getting ready to unleash yet another competitor in the video market, DirecTV Now. While details have been sketchy, AT&T has revealed that DirecTV Now will have more than 100 live, streaming and on-demand channels and will be priced at $35 per month. The service has landed deals with The Walt Disney Co., Time Warner’s Turner Broadcasting System, A+E Networks, Viacom, NBCUniversal and Discovery Communications, though it still lacks 21st Century Fox and CBS programming.

Early indications are the initial package will include popular channels such as ESPN, Nickelodeon, Cartoon Network and TNT. But there is no clarity yet as to which channels would be included in the $35 entry package — and some concern that DirecTV Now’s appeal to cost-conscious pay- TV subscribers will draw from DirecTV’s base.

DirecTV Now is targeted at the 13 million to 14 million non-video broadband subscribers across the country, but is likely to take a fair share of existing pay TV customers, too.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak said swapping U-verse TV customers for DirecTV customers makes sense for AT&T because U-verse TV customers have higher programming costs — about $17 more per month per customer, he estimated. When DirecTV said it would price DirecTV Now at $35 per month, cable investors headed for the exits, fearful the OTT service would severely cut into the overall pay TV base. But that might miss the bigger point.

“By far the most at risk was AT&T itself,” Wlodarczak said. “And swapping consumers with a material margin [DirecTV] to a product with no margin [DirecTV Now], even if it lowers wireless churn or enhances wireless growth, makes no sense. That would encourage AT&T to back off if they cannibalized DirecTV.”

AT&T began migrating U-verse TV customers to DirecTV almost immediately after closing on the DirecTV acquisition. Since the fourth quarter of 2015, U-verse has shed 1.34 million TV customers, while DirecTV has added 1.21 million net new customers.

Wlodarczak believes the U-verse TV conversion will “continue to mask declines in overall satellite for a while. When that effect is over, you are likely to see pretty significant declines in satellite-TV additions in the U.S.” Cable companies, helped by broadband as part of the bundle, will be recapturing share and, to a lesser extent, virtual or digital MVPDs will also encroach on DirecTV and Dish Network, he said.

DIRECTV SUBS: BIG TV WATCHERS

Telsey Advisory Group media analyst Tom Eagan, though, is “not a big believer that we’ll see DirecTV subscribers en masse migrating to DirecTV Now. DirecTV customers are the households that watch the most channels. I don’t think the streaming service is capable of fulfilling that.”

Dish Network’s Sling TV is a test case of how an OTT service might help to erode a satellite sister offering. Dish does not break out Sling TV customers from overall subscribers, but analysts have said they think the OTT service has more than 900,000 subscribers. Some likely came from Dish, and there are analysts who think the Dish drain has had a big impact. Dish CEO Charlie Ergen said in 2015 there was “no question” that after the launch of Sling TV would eat into Dish Network’s satellite base.

In the third quarter, MoffettNathanson principal and senior analyst Craig Moffett estimated Dish Network lost about 320,000 customers while Sling gained about 204,000 subscribers. Over the past four quarters, Moffett estimates Sling has added 517,000 customers while Dish has lost 949,000.