Cox, Verizon Top J.D. Power Business Phone Study

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Verizon Communications and Cox Communications rung up top honors for J.D. Power’s latest U.S. Business Wireline Satisfaction Study, as both topped the list among large, mid-sized and small (and very small) business customers.

The study, based on responses from 4,220 business customers in May, defines “very small businesses” as those with between one and 19 employees, “small/medium businesses” as those with 20 to 499 employees, and “large enterprise businesses” as those with more than 500 employees.

Satisfaction is measured and weighted across six areas: performance and reliability (27%); cost of service (18%); sales representatives and account executives (19%); billing (14%); communications (15%); and customer service (12%).

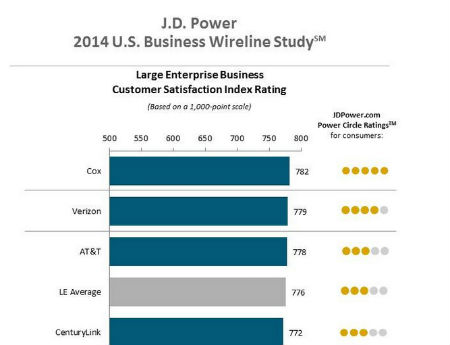

Cox lead the large enterprise business category with an index rating of 782, followed by Verizon (779), AT&T (778), CenturyLink Communications (772), Comcast (766) and Time Warner Cable (758). The index average for the category was 776.

Verizon, which an index rating of 759, topped the small/medium category, followed by Cox’s (753), as they were the only two to finish ahead of the SMB index average of 734. AT&T, with 730, was next, followed by Comcast (728), TWC (717), CenturyLink (710), and Charter Communications (700).

Verizon (727) and Cox (710) were also the only providers to beat the 696 index average for very small businesses. They were trailed by Charter (694), CenturyLink (689), AT&T and Comcast (both at 688), and TWC (681).

J.D. Power said overall customer satisfaction averages 700 on a 1,000-point scale in 2014.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Among other findings, J.D. Power said the industry average for short- and long-term outages have dropped sharply since 2011. The average number of short data outages (lasting less than five minutes) experienced by customers over the last six months dropped by more than 28% -- to 3.4 incidents in 2014, from 4.7 in 2011. The average number of extended outages (more than five minutes in length) has dropped by more than 16% -- to 1.6 incidents in 2014 versus 1.9 in 2011.

For carriers, keeping those numbers down is imperative, as J.D. Power found that business customers who take voice services and experience two or more lengthy outages, 31% said they are likely to switch providers in the next year, while just 11% that experienced no outages indicated that they will switch.

Overall, nearly 16% of business customers indicated the likelihood to switch to a new provider, J.D. Power said, noting that SMBs have the highest churn potential (20%) and very small businesses (15%) the lowest.

Reasons cited for switching are led by better pricing (73%), new features or service plans (30%), favorable pricing options (29%), and better/more reliable service performance (28%).