Comcast Sparks an Old-School Bidding War

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With its decision to go public with its heretofore unmentioned desire for 21st Century Fox assets currently betrothed to the The Walt Disney Co., Comcast appears to be gearing up for an epic battle that hearkens back to the old media mogul days, when oversized personalities like Sumner Redstone, Barry Diller and John Malone duked it out for control of media properties.

In a statement spurred in part by public filings by Disney and Fox for their upcoming shareholders meetings, Comcast said it was “considering, and is in advanced stages of preparing, an offer for the businesses that Fox has agreed to sell to Disney.”

With that, Comcast took off the gloves, making it clear that it was not only preparing for battle, it was more than ready. It closed its terse statement by stating while no decision had been made “at this point, the work to finance the all-cash offer and make the key regulatory filings is well advanced.”

In other words: Bring it on.

Throwback Move

The media landscape is littered with tales of bare-knuckle brawls between entertainment titans. And the current love triangle that is Comcast-Disney- Fox has jogged some memories back to 1994, when three epic media personalities — Paramount Communications chief Martin Davis, Viacom chairman Sumner Redstone and QVC chief Barry Diller — battled publicly over the movie studio.

Diller, who had worked at Paramount earlier in his career, had been rumored to be interested in making a deal for the studio, but had pulled back at the last minute, according to a 1994 article in Vanity Fair. In that piece, Diller had lunch with Davis at Paramount’s private dining room in Manhattan, deflecting the Paramount CEO’s fears that he was considering a bid for the studio. Two months later, Paramount announced a deal with Viacom, valued at about $8.2 billion. Shortly after, backed by then Tele-Communications Inc. chairman John Malone, Diller launched a hostile bid for the studio for $9.5 billion.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

What followed was a five-month bloody battle between the moguls involving lawsuits, poison pills and a lot of finger-pointing. In the end, Viacom emerged the victor with a $10 billion bid. It is unlikely that Comcast will get off that cheaply this time.

MoffettNathanson senior media analyst Michael Nathanson has estimated that Comcast would likely bid about $10 billion more than Disney for the Fox assets. That, he said in a note to clients, is something Disney can easily match.

Nathanson estimated that Disney’s current offer for the Fox assets is valued at about $68 billion, $54 billion in equity and $14 billion in assumed debt. Assuming that Comcast would offer about the same as it did before — it was rejected in the early rounds of bidding because of potential regulatory concerns and the Murdoch family’s distaste for Comcast stock — its cash bid would be valued at about $78 billion in total ($64 billion in equity and $14 billion in assumed debt), according to Nathanson. “We would expect Disney to match that higher bid with $10 billion in cash added in to its existing deal,” Nathanson wrote.

Nathanson has said Iger is determined to win the Fox assets, and believes the Disney chief has “never backed down from making the right long-term strategic moves for his company because of price.”

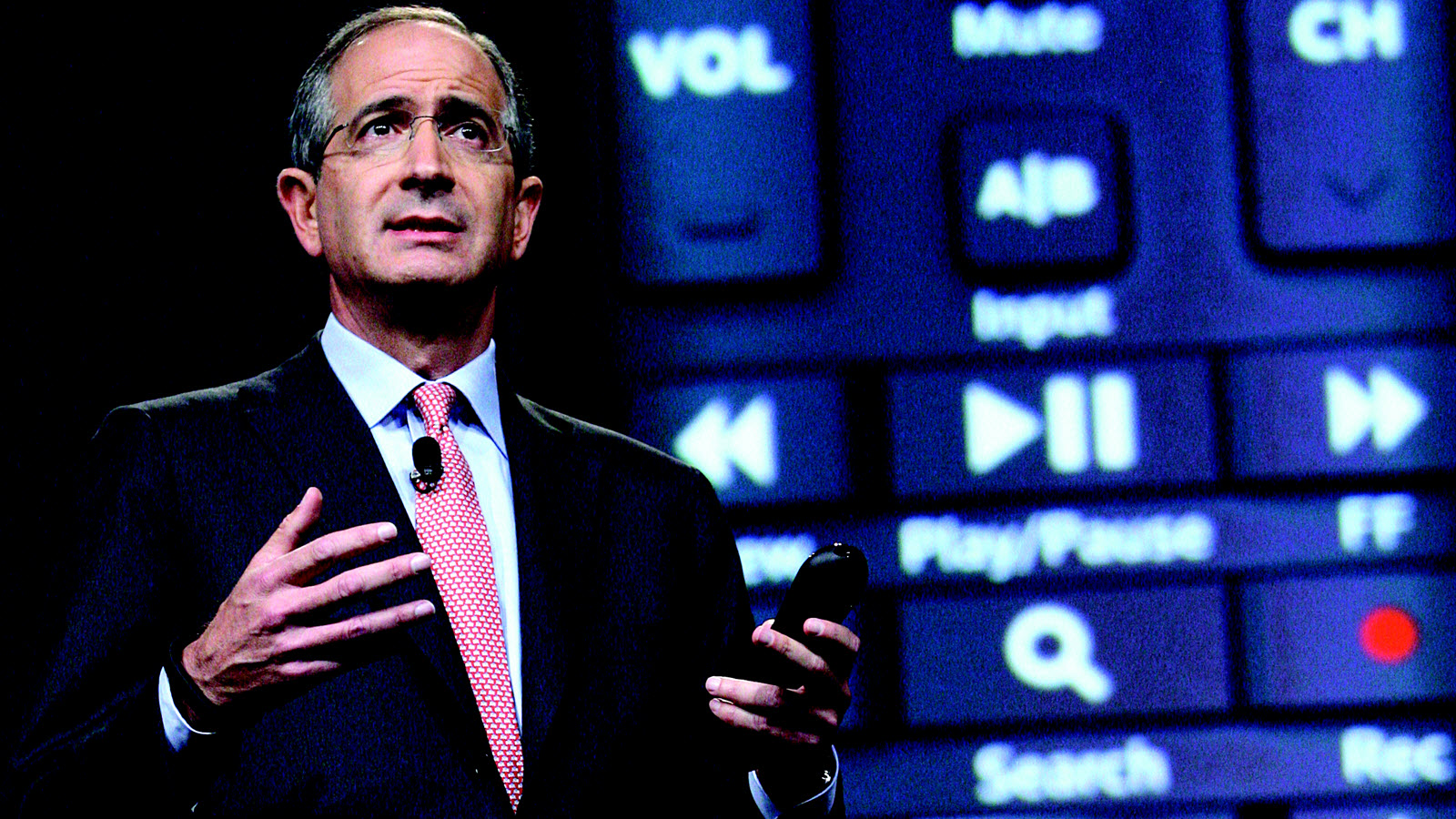

Comcast CEO Brian Roberts, the veteran of many mega-deals ranging from industry-defining acquisitions like AT&T Broadband in 2001 and NBCUniversal in 2011 to smaller content buys like DreamWorks Animation, is no stranger to asset battles. But he has preferred to take the high road in most of his transactional endeavors. At the same time, Comcast investors appeared spooked by the company’s interest in Fox, with some interpreting it as an indication that the cable company has lost faith in its U.S. distribution business.

Although Comcast has denied that — even as it made a $31 billion formal offer for U.K. satellite company Sky, of which Fox owns a 39% stake — shares in the cable firm have plunged about 20% this year. The public admission of its interest in Fox hasn’t helped either, as Comcast shares were down about 3% since it made the announcement.

That decline has come just as Netflix, once thought of as the cable killer, has risen. Last week, Netflix’s market capitalization briefly touched $153 billion, passing Disney ($152.2 billion) and Comcast ($145.5 billion) for the first time, before settling for a tie with the Mouse House, closing May 24 with a market cap of about $152 billion. Fueling those gains has been an 82% surge in Netflix’s share price since December.

Disney’s Big War Chest

Disney, which has low leverage — about 1.2 times forward-looking cash flow — and $9 billion in free cash flow, can afford a bidding war with Comcast. Nathanson estimated borrowing the additional $10 billion needed to compete with the Comcast bid would increase its leverage ratio to about 1.6 times at the end of 2020, not a major concern for ratings agencies.

Comcast, on the other hand, would see its debt balloon to $164 billion in a Fox deal, according to Moody’s Investors Service. In a note, it said a Fox bid, estimated at about $60 billion for the equity, would drive Comcast’s overall leverage past 4.3 times cash flow, endangering its investment-grade debt rating.

Moody’s placed Comcast’s A3 debt ratings on review for possible downgrade last week, adding that a Fox bid would make it the second highest leveraged media company behind AT&T-Time Warner. Earlier, Moody’s had warned that Comcast’s willingness to increase its debt load that much represents a big departure from past practices and stated commitments and creates “significant doubts for the future.”

But both companies see Fox as an integral part of that future and are expected to bid hard and high. Sanford Bernstein analyst Todd Juenger in a report earlier this month said Disney and Comcast believe the business has evolved to a point where there will be only a few global scale players and Fox is “the seminal defining point,” in determining who they will be.

“And therefore, we think both Comcast and Disney are likely to pay a high price,” Juenger wrote.