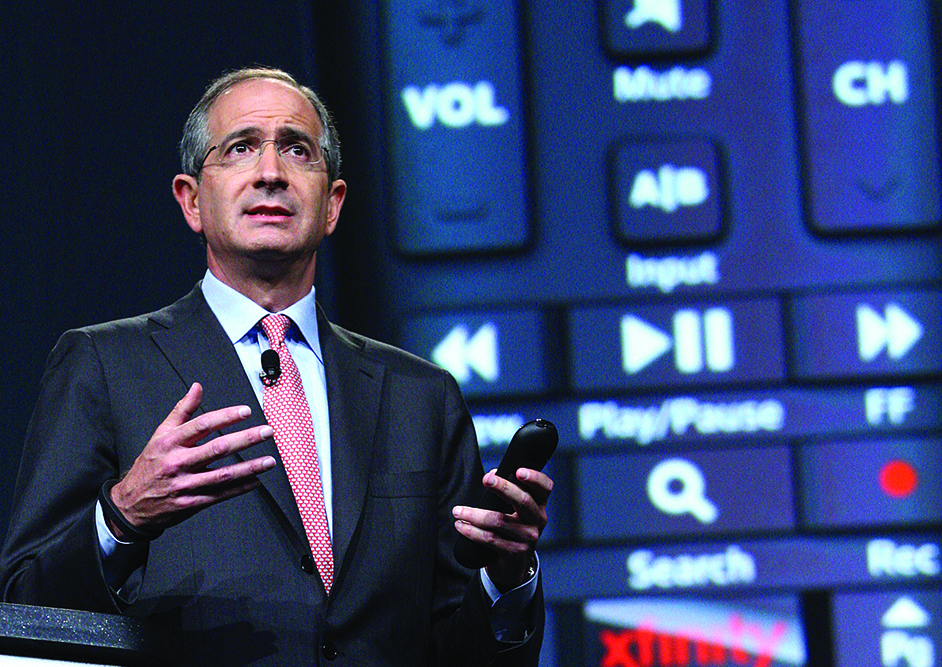

Comcast Chief Brian Roberts Sees Little Threat from Fixed Wireless

Exec spoke at Morgan Stanley Technology, Media & Telecom Conference in San Francisco

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Comcast chairman and CEO Brian Roberts told an industry audience Monday (March 8) that despite slowdowns in broadband growth, he sees little threat to the business from new competitors like fixed wireless, adding that rural expansion, offering a competitive product and bundling with mobile should help subscriber additions continue to rise.

Speaking at the Morgan Stanley Technology, Media & Telecom Conference in San Francisco, Roberts said he sees four areas where the company can boost broadband growth: expanding its footprint, competing more aggressively, bundling with other products like wireless and growing its business services reach.

Comcast has been expanding its reach to about 1 million more homes per year within its footprint through edge-out programs. This year he expects that expansion to be even greater, given government initiatives to build out unserved and underserved rural areas.

“Where it's been uneconomic previously, it will be economic in the future for us to extend our broadband,” Roberts said. “And we're going to compete aggressively to do that.”

Roberts didn’t seem too concerned with competitive technologies like fixed wireless, because he believes cable broadband is still a better quality product and aggressively priced.

As far as fixed wireless, Roberts said only time will tell, but at the moment “it’s an inferior product” to cable broadband, likening it to digital subscriber line service from the telcos in the past.

Also: T-Mobile, Verizon Fixed Wireless Subscriber Additions Could Double by 2023, Analyst Says

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Today we can say, we don't feel much impact from that,” Roberts said of fixed wireless, adding that it reminds him of earlier days when telcos touted digital subscriber line service as a replacement for cable broadband. “We don't take it for granted, but we've seen lower-price, lower-speed offerings before, and in the long run I don't know how viable the technology holds up.”

Also: Analyst Says Telcos Better Positioned to Chip Away at Cable’s Broadband Lead

Roberts believes that maintaining its leadership in offering the highest speeds and the best quality will continue to drive broadband growth for the industry. Comcast, he said, was the first company to offer 1.2 Gigabits per second high-speed internet service, and now it’s available throughout its entire footprint. And customers continue to want speed. He noted that two years ago, only 28% of Comcast’s broadband customers took 300 Megabits per second service. Today, 55% of its customers take that speed.

Also: Verizon Recasts Jim Carrey as the Cable Guy for Super Bowl Fixed Wireless Ad

“So, we've doubled the amount of our customers getting that speed in getting ready for any kind of potential competition,” Roberts said, adding that Comcast’s moves to deploy DOCSIS 4.0 technology, which promises speeds of up to 10 Gbps, show where it believes the path is leading.

Adding to the potential growth runway is wireless, which Comcast has said in the past could be an attractive bundle with broadband. Xfinity Mobile has grown to 4 million lines since its 2017 launch, representing about 2 million customers. Comcast has about 32 million broadband customers — and a broadband subscription is needed for wireless service — so the growth runway is long.

“So, we're just getting started and I hope that as we go forward, you'll see really a combined offering between our broadband and our wireless products,” Roberts said.

Roberts also touted Comcast’s streaming service Peacock, which has about 24.5 million subscribers, putting it near the bottom of big-time streaming services like Disney Plus, HBO Max and Paramount Plus.

Also: Comcast to Double Programming Spending to $3 billion

While Peacock’s previous model had been more geared to revenue generated through advertising, a more hybrid subscription-ad revenue model appears to be the current path.

“The take rate led us to say that the sweet spot, as we think of it as a business, will be to go with the dual revenue stream,” Roberts said. “That's no stranger to Comcast. That's what powered the company for 50 years.” ■

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.