CMTS/Edge QAM Revenues Take Another Dip

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Global cable modem termination system and edge QAM revenues melted by 4% in the second quarter as lower-cost downstream and QAM channel shipments dominated the product mix, Infonetics Research said in a report released Thursday.

Revenues in the category reached $313 million in the second quarter. That followed a tough first quarter in which CMTS/edge QAM revenues reached $327 million, down 25% versus the year-ago quarter.

Jeff Heynen, the principal analyst for broadband access and pay TV at Infonetics, said port pricing declined about 15% in the quarter even as MSOs added capacity for DOCSIS 3.0, multiscreen video, and over-the-top video.

Port pricing is taking a hit as MSOs turn up downstream licenses on already-deployed hardware. This pay-as-you-go approach allows vendors to ship gear with capacity that can be turned up later, but those future, software-based upgrades carry smaller sales margins and affect the average selling price, Heynen explained.

Software license turn-ups were particularly evident in North America, where CMTS and edge QAM revenues dipped 27%.

And deployments of high-density CMTSs and edge QAMs that will evolve to become Converged Cable Access Platform (CCAP) products won’t offer much relief. Pricing will continue to erode as channel volumes soar, Heynen said.

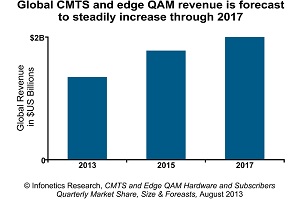

These factors have led Heynen to cut his 2017 revenue forecast for CMTS/edge QAM revenues by about 15%.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

For the quarter, Cisco Systems retained its CMTS crown with 51% of the market, followed by Arris (42%, which factors in its purchase of Motorola Home), and Casa Systems, which ended the quarter with 8% of the market, up from 6% in the first quarter.

Cisco was also tops in edge QAMs, with 32% market share, closely followed by Harmonic and Arris/Motorola. All three vendors were within three points of each other, Heynen said.